“Stars Are Slowly Aligning For Gold” – Frisby – Gold ends March with a third-quarterly gain, a feat not seen since 2011 – Impressive gains seen despite tightening of monetary policy from Federal Reserve – Frisby – gold is set to break through technical resistance of ,360 – Gold’s safe haven role back in focus with Trump trade wars and increasing geopolitical tensions – Now is opportune time for investors to buy gold, ahead of next quarter Bullion’s wrapping up a third quarterly gain, a feat not seen since 2011, and exchange-traded fund holdings are near the highest in a half-decade. Haven demand may also get a boost with foreign-policy hawks in the ascendant in Washington. Spot bullion was steady at ,324.23

Topics:

Jan Skoyles considers the following as important: Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

“Stars Are Slowly Aligning For Gold” – Frisby

– Gold ends March with a third-quarterly gain, a feat not seen since 2011

– Impressive gains seen despite tightening of monetary policy from Federal Reserve

– Frisby – gold is set to break through technical resistance of $1,360

– Gold’s safe haven role back in focus with Trump trade wars and increasing geopolitical tensions

– Now is opportune time for investors to buy gold, ahead of next quarter

The following has been taken from Dominic Frisby’s MoneyWeek column. Desire for gold”, said the US stockmarket legend, Gerald Loeb, “is the most universal and deeply rooted commercial instinct of the human race”. Well, over the last seven years that universal and deeply rooted commercial instinct has been AWOL. The general public just hasn’t been interested. And rightly so. Gold has done little; the action has been elsewhere. But nothing lasts forever, so today we ask – is it time to be desiring gold again? Gold’s big problem for the last five yearsGold’s all-time peak came in 2011 during one of several Greek crises: $1,920 per ounce was the high. It then spent a year or so not far off those lofty levels, re-testing $1,800 several times. In 2013, however, it gave up the ghost and one of the most vicious bear markets ever to befall humanity began in the companies that mined, or claimed to be mining, gold, as well as in the metal itself. This ended in late 2015/early 2016 for no apparent reason, beyond the facile observation that things had “gone too far”. You were able to buy miners that previously had been valued in the billions with a fiver borrowed off a bloke round the corner. We had an electric start to 2016. But since the summer of that year, things have gone to sleep again rather. The mining companies (royalty companies aside) have resumed their bearish trend, especially at the junior end of the scale. |

Gold Spot, Q1 2011 - 2018 |

| Listen on SoundCloud , Blubrry & iTunes. Watch on YouTube below | |

|

Meanwhile, the metal itself has been eclipsed by just about every asset class there is, be that US stocks, emerging markets, oil, (some) base metals, battery metals and, of course, cryptocurrencies. Of late, rather unannounced, gold has been creeping back up. But there’s been a problem. Gold ran into this problem yesterday. It ran into it in February; in January; last September; several times over the summer of 2016; and way back in March 2014. That problem is $1,360 (or thereabouts). It’s like Gandalf standing on The Bridge of Khazad-dûm, declaring to the Balrog: “You shall not pass”. As soon as it gets there or thereabouts, gold does what it’s told and gold retreats. As we say in the technical analysis game, there is a lot of resistance at $1,360. Here’s a chart of gold over the last five years. (By the way, you may notice I’m trying out some new charting software this week – thanks to the guys at Sharescope – and I haven’t quite got on top of it yet, but I’m getting there.) The two red lines mark the $1,355 to $1,370 area. You can see that, with every attempt since 2014, gold has come down off this level like a balrog in flames. What is promising about the most recent price action is the fact that the retreat has not been so pronounced. Whereas in 2014 or 2016 the attempts at this level met with sell-offs of $200 or more, the 2017 retreat was “only” $100 or so, but the 2018 pull-backs have been more like $50 and much shorter-lived. Higher lows, in other words. There have now been four re-tests of the zone in 2018 alone. “The more times a level is tested, the less likely it is to hold”, you will have heard me say many times on these pages. I can’t help thinking that $1,360’s resolve at gold’s Bridge of Khazad-dûm is weakening. And once we’re through that, I can’t help thinking there should be fairly safe passage through to the mid- to high $1,400s – albeit with a couple of wobbles along the way. |

Gold Resistance, Mar 2013 - 2018 |

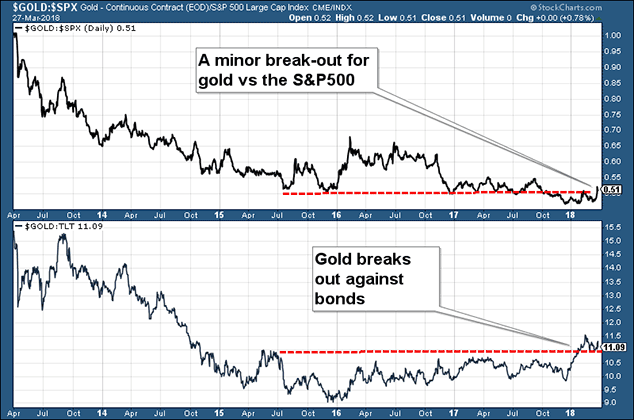

Here’s another good omen for goldThe astute among you might point to the fact that gold’s strength has been as much about US dollar weakness as anything. Against sterling for example, which has been strong, gold is flat, indeed it’s down a few percent compared to where it was after the Brexit vote. This is true, but then I see your sterling, and raise it bonds and stocks. It’s early days, so don’t reach for the champagne just yet. But we are starting to see gold outperform both stocks and bonds. It’s been a long time since we have been able to say that – early 2016 aside. If you measure bonds by the iShares Barclays 20+ Treasury Bond exchange-traded fund, (NYSE: TLT), then gold has actually broken out to three-year highs. Against stocks, the story is less convincing. But over the past couple of weeks, gold has outshone the major stock indices, especially the FTSE 100, which has been awful. The chart below shows gold vs the S&P 500 (in other words, the gold price divided by the index level of the S&P 500 – when the line is going up, gold is outperforming) and against the bond ETF, TLT (again, when the line is going up, gold is outperforming bonds). |

Gold Daily, Apr 2013 - Mar 2018 |

These are small victories, but given what the goldbug has been through these last seven years, any victory is a victory.

Outperformance is what will attract the capital, so outperformance is what you want to see.

But given the current volatility of stockmarkets – and there was another bout yesterday – money is likely to flow to gold. My outlook for stocks is choppiness; that should benefit gold.

I’ve been saying it for a while – the stars are slowly aligning for gold. If gold can catch a bid, then silver and the miners should all catch a bid too. At the moment, gold has been outperforming the miners and silver, or their performance has been roughly equal. In a proper bull market you will see silver and miners lead. Maybe it is they that must lead us across the aforementioned bridge.

I’m sure there are many MoneyWeek readers who have owned gold since the 00s, riding out both the bull and the bear market. I can’t help thinking the next five years are going to be better than the last five.

Tags: Daily Market Update,Featured,newsletter