Swiss Franc . FX Rates The US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated. There is more focus on positive developments elsewhere, especially in Europe. The CDU victory in the weekend election in the largest German state of North Rhine-Westphalia offers further evidence that Merkel will most likely be reelected Chancellor for the fourth time later this year. The political risk that was so evident in Europe at the start of the year continues to unwind. News that French President Macron is considering naming a prime minister from the center-right Republican Party is a supportive and suggestive gesture ahead of next month’s parliament election. Sterling remains firm. Many still have their sights on the .3000-.3055 area. This week’s data is expected to show firmer prices (CPI) and a recovery in the retail sale after March weakness. Meanwhile, the latest polls show the Tories with a commanding lead ahead of the June election. FX Daily Rates, May 15 - Click to enlarge The dollar ran into resistance in the JPY114.35 area last week.

Topics:

Marc Chandler considers the following as important: $CNY, CAD, China Fixed Asset Investment, China Industrial Production, China Retail Sales, EUR, EUR/CHF, Featured, FX Daily, FX Trends, GBP, Italy, Italy Consumer Price Index, Japan Producer Price Index, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

Swiss Franc |

|

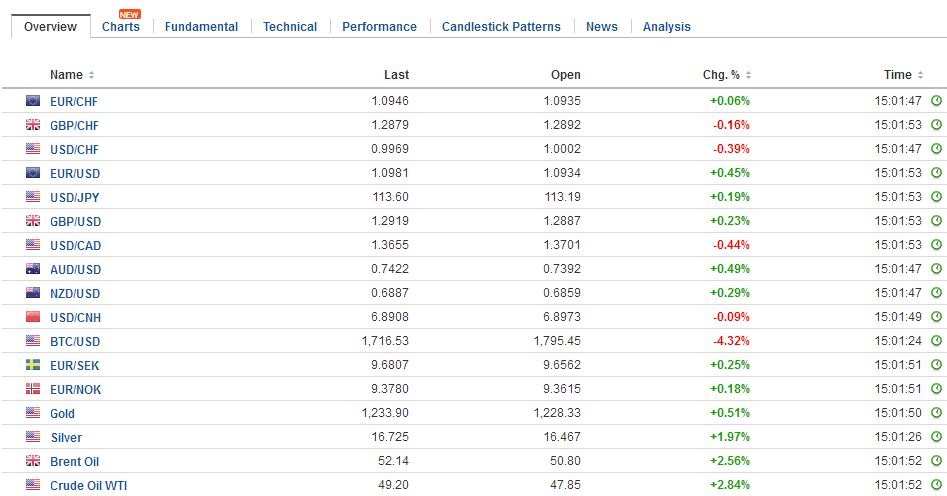

FX RatesThe US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated. There is more focus on positive developments elsewhere, especially in Europe. The CDU victory in the weekend election in the largest German state of North Rhine-Westphalia offers further evidence that Merkel will most likely be reelected Chancellor for the fourth time later this year. The political risk that was so evident in Europe at the start of the year continues to unwind. News that French President Macron is considering naming a prime minister from the center-right Republican Party is a supportive and suggestive gesture ahead of next month’s parliament election. Sterling remains firm. Many still have their sights on the $1.3000-$1.3055 area. This week’s data is expected to show firmer prices (CPI) and a recovery in the retail sale after March weakness. Meanwhile, the latest polls show the Tories with a commanding lead ahead of the June election. |

FX Daily Rates, May 15 |

| The dollar ran into resistance in the JPY114.35 area last week. It has back off but found bids ahead of JPY113.00, but faltered ahead of JPY113.80. A return to the JPY113.00-JPY113.20 looks likely unless the US 10-year yield gains some traction.

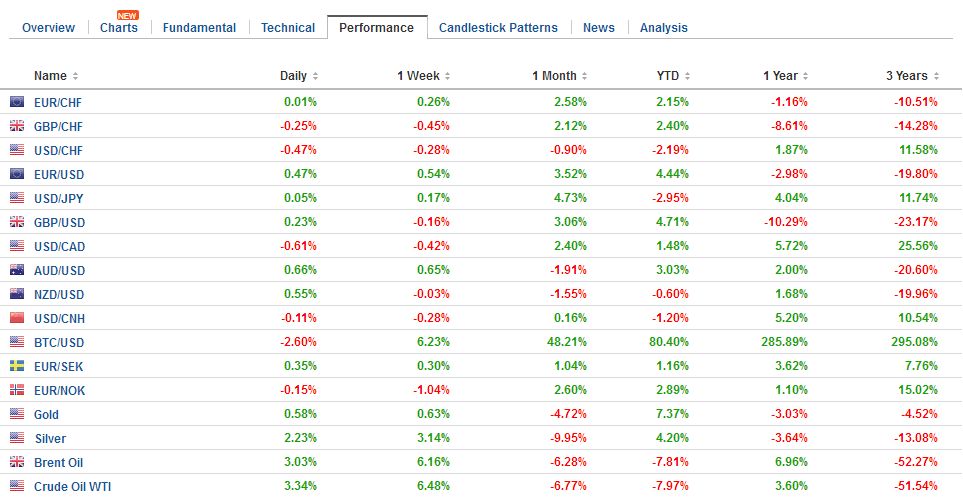

Dollar-bloc currencies are making headway against the greenback today. The Antipodeans and the Canadian dollar are up 0.5%-0.6% late in the European morning. The US dollar is approaching the 20-day moving average against the Canadian dollar near CAD1.3620. Additional bids may be found near CAD1.3580. The Australian dollar is also approaching its 20-day moving average near $0.7465., which also corresponds with the 61.8% retracement of this month’s decline. The New Zealand dollar made new lows for the year last week but has been pulled back up above $0.6900. The $0.6950 area offers resistance. The euro staged a key reversal last Monday on a classic “sell rumor buy fact” activity on Macron’s victory. It pulled back nearly two cents before recovering ahead of the weekend and helped by the disappointing data. It is now flirting with the 61.8% retracement of last week’s fall ($1.0955). A move above there signals a retest on the $1.1025 high. Support is seen in the $1.0900-$1.0920 area. The markets have not been disturbed by the North Korean missile test over the weekend. Korea’s Kospi gained 0.2% to keep it near last week’s record high. The Korean won has gained 0.35% against the dollar. It is the fourth consecutive advance and the fifth in six sessions. The MSCI Asia Pacific Index rose 0.3% to a new two-year high. It is the third advance in four sessions. |

FX Performance, May 15 |

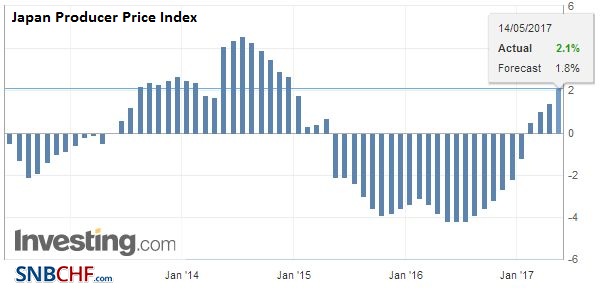

Japan |

Japan Producer Price Index (PPI), April 2017(see more posts on Japan Producer Price Index, ) Source: Investing.com - Click to enlarge |

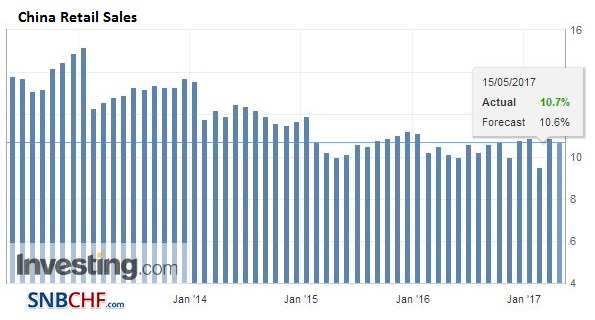

ChinaThere is also recognition that the Chinese economy is likely slowing again after stabilizing in recent quarters. Retail sales and fixed investment held up better than industrial output in April. Specifically, retail sales rose 10.7% down from 10.9% in March. The year-to-date pace of 10.2% is a small improvement from the 10.0% pace in March. |

China Retail Sales, April 2017(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

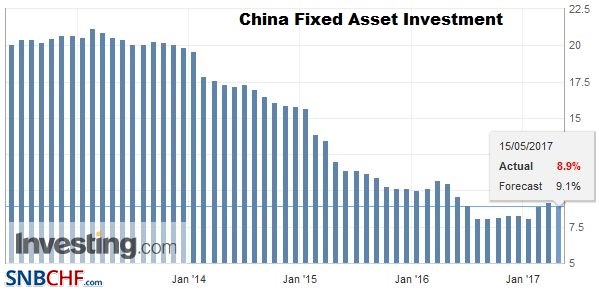

| Fixed investment slowed to an 8.9% increase from 9.2%. |

China Fixed Asset Investment YoY, April 2017(see more posts on China Fixed Asset Investment, ) Source: investing.com - Click to enlarge |

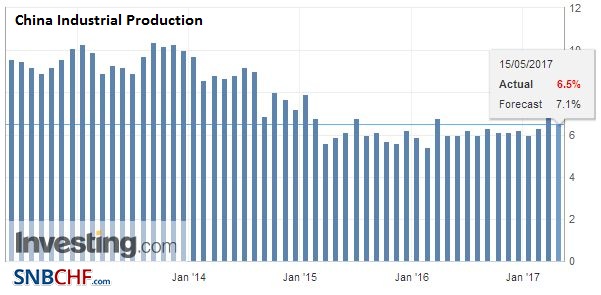

| This is a somewhat larger decline than expected, but the pullback in industrial output was more pronounced. It fell to 6.5% from 7.6% in March. The year-to-date pace slowed from 6.8% to 6.7%.

Last week the US and China announced some details of a tentative trade agreement. The agreement addresses some longstanding issues, like US agricultural exports to China, especially beef, and access for credit card companies, bond rating agencies. US concessions, outside of willingness to import cooked chicken from China, seems largely political. The US may reconsider the extent are arms sales to Taiwan, and President Trump will reportedly refrain from talking to Taiwanese President Tsai without notifying Beijing first. Also, the US recognized the importance of China’s One Belt, One Road initiative and agreed to send delegates to the OBOR forum. |

China Industrial Production, April 2017(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

Italy |

Italy Consumer Price Index (CPI) YoY, May 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Austria

The collapse of the Austrian coalition government poses a new opportunity for the populist-nationalist forces. The Freedom Party appears to be polling a little ahead of the Social Democrats. Paradoxically, it was the People’s Party, the center-right coalition partner of the Social Democrats that signaled the end of the grand coalition, though it is running several percentage points behind the Social Democrats. It has adopted a strong anti-immigrant stance and apparently hopes to steal some thunder from the Freedom Party.

Eurozone

European bourses are narrowly mixed, leaving the Dow Jones Stoxx 600 little changed. Energy and financials are leading the gaining sectors. Health care and consumer discretionary are laggards. Oil is extending last week’s recovery. Brent is up 2.5% to push through $52 a barrel. The $52.80-$53.00 area is the next immediate target. Light sweet crude is up 2.5% as well and is trying to establish a foothold above $49 a barrel. The next target is seen in the $50.00-$50.20 area. News that Saudi Arabia and Russia are talking about extending the current output targets by nine instead of six months helped bolster prices. OPEC meets on May 25.

Still not only has the political risk diminished in Europe, but the economic news is also constructive. Moody’s upgrade of Ireland’s credit rating (A3 from Baa1) is another reminder of the improvement taking place. Greece’s 10-year bond yield is near a three-year low. Growth in the region has broadened, and expectations are running high for the ECB to change its risk assessment and forward guidance at next month’s policy meeting. The market will likely exaggerate this significance.

Investors have long understood that interest rates would unlikely be cut again and that the risk assessment has been so diluted at recent meetings as to be fairly balanced in spirit if not a word. However, the minus 40 bp deposit rate will likely persist well into next year, and the ECB’s balance sheet will also likely continue to expand into 2018 even if at a somewhat slower pace.

Canada

The North American session features the May Empire State manufacturing survey (small gain expected) and the TIC data late in the session. Canada reports existing home sales.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$CNY,$EUR,$JPY,China Fixed Asset Investment,China Industrial Production,China Retail Sales,EUR/CHF,Featured,FX Daily,Italy,Italy Consumer Price Index,Japan Producer Price Index,newsletter