After a roughly CHF 40 billion blow to Swiss public finances due to the Covid pandemic, Switzerland’s financial outlook is beginning to look positive, according to a recent government press release. © Photo4dreams | Dreamstime.comFigures from the Federal Finance Administration (FFA) forecast a surplus of CHF 1.5 billion in 2022, an amount equivalent to 0.2% of GDP. In 2023, a government surplus of CHF 0.6% of GDP is forecast. Government expenditure in Switzerland is expected to be 33.6% of GDP in 2022, 1.6 percentage points above the pre-pandemic level of 32.0%. Compared with OECD nations this is well below average, said the FFA. In 2023, government expenditure is expected to be 32.4% of GDP. The largest slice of expenditure is on welfare. In 2020 this accounted for 43% of the

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Personal finance, Public debt Switzerland, Public debt Switzerland 2022, Public debt Switzerland forecast

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

After a roughly CHF 40 billion blow to Swiss public finances due to the Covid pandemic, Switzerland’s financial outlook is beginning to look positive, according to a recent government press release.

Figures from the Federal Finance Administration (FFA) forecast a surplus of CHF 1.5 billion in 2022, an amount equivalent to 0.2% of GDP. In 2023, a government surplus of CHF 0.6% of GDP is forecast.

Government expenditure in Switzerland is expected to be 33.6% of GDP in 2022, 1.6 percentage points above the pre-pandemic level of 32.0%. Compared with OECD nations this is well below average, said the FFA. In 2023, government expenditure is expected to be 32.4% of GDP.

The largest slice of expenditure is on welfare. In 2020 this accounted for 43% of the total – Switzerland spends more than the European (42%) and OECD (36%) averages on welfare. Next was spending on education (16%), general administration (9%), health (7%), transportation and telecommunications (7%) and public order and security (7%).

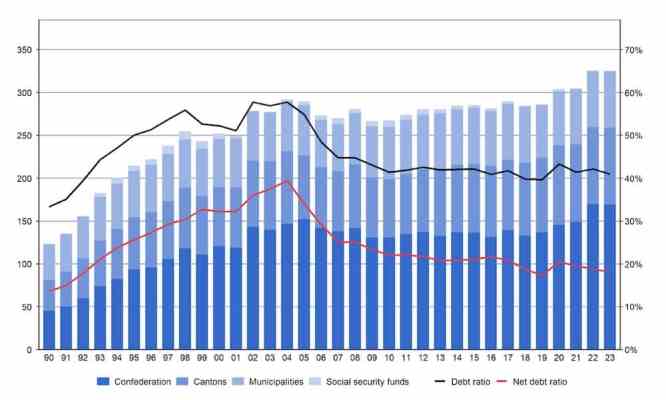

Switzerland’s overall public debt is likely to rise to a peak of CHF 324 billion. However, the gross debt ratio is expected to decline from 2023 onward as a result of an anticipated increase in economic output.

By the end of 2022, Switzerland’s government gross debt ratio is likely to be 42%, compared with 115% for the euro area and 124% for the OECD countries.

However there are risks. If Switzerland had an equivalent of Murphy’s law (“Anything that can go wrong will go wrong.”) it would possibly come with the addendum: but we will be prepared. According to the FFA the greatest source of uncertainty for the nation’s public finances is the impact of international developments, such as the war in Ukraine, sharper rises in energy and commodity prices, further procurement and supply problems for raw materials and goods, and generally tighter monetary policy. This would result in higher government spending and lower tax receipts. In addition, the Swiss National Bank (SNB) announced a loss of CHF 95.2 billion for the first half of 2022. A certain slice of the SNB’s profits are used to support public finances. These currently look less likely to materialise after such a large loss.

And with bond yields rising across the world, government debt is becoming costlier. In Switzerland financial expenditure makes up 1.1% of spending. By comparison, in the UK interest payments for the 2022/23 financial year are expected to make up 5.2% of public spending.

More on this:

Government press release (in French) – Take a 5 minute French test now

For more stories like this on Switzerland follow us on Facebook and Twitter.