© Michael Müller | Dreamstime.com Official data recently released by the Swiss National Bank (SNB) show it sold 51.5 billion Swiss francs while acquiring US dollar and euro-denominated assets in a bid to weaken the franc over the first quarter of 2020. The data followed comments by SNB President Thomas Jordan signalling that even larger ...

Topics:

Investec considers the following as important: 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

© Michael Müller | Dreamstime.com

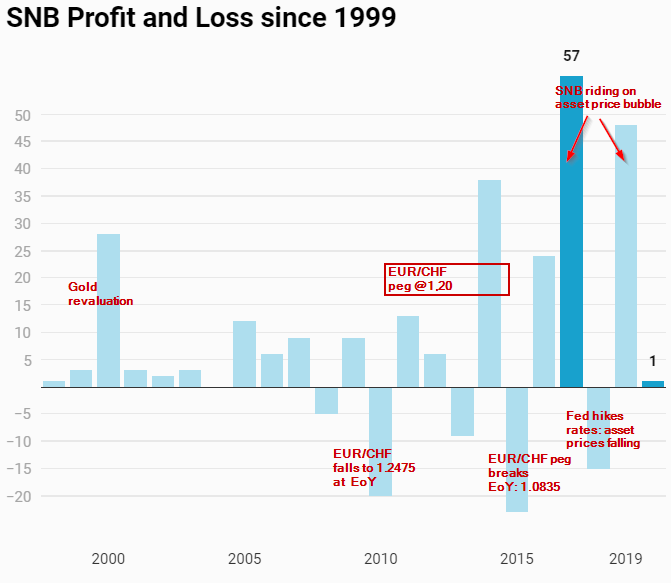

Official data recently released by the Swiss National Bank (SNB) show it sold 51.5 billion Swiss francs while acquiring US dollar and euro-denominated assets in a bid to weaken the franc over the first quarter of 2020.

The data followed comments by SNB President Thomas Jordan signalling that even larger interventions may be on the cards in the future.

Switzerland’s long-running battle with its overvalued currency has drawn criticism from the US.

In January 2020, the US Treasury added Switzerland to its “monitoring list”. Those on the list are trading partners whose currency practices merit close attention. It is no secret that the SNB has been actively trying to weaken the Swiss franc, which is widely considered overvalued.

The SNB has long argued that controlling the franc’s appreciation is critical to the health of Switzerland’s large export-oriented manufacturing industry.

Tags: Featured,newsletter