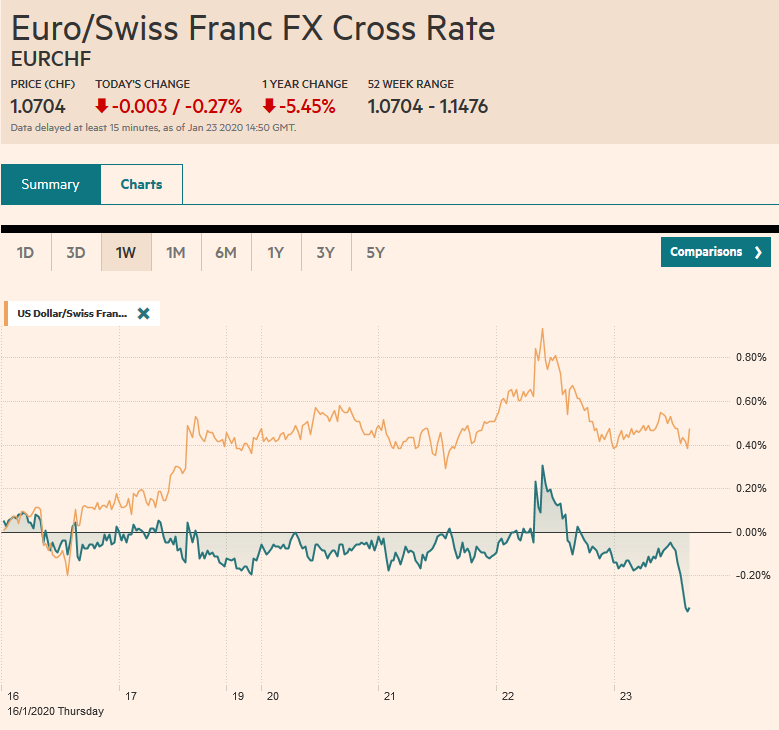

Swiss Franc The Euro has fallen by 0.27% to 1.0704 EUR/CHF and USD/CHF, January 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The spread of the coronavirus and the lockdown in the epicenter in China has again sapped the risk-taking appetite in the capital markets. Asia is bearing the brunt of the adjustment. Tomorrow starts China’s week-long Lunar New Year celebration when markets will be closed, which may have also spurred today’s drama that aw the Shanghai Composite tumbled 2.75%, bringing the week’s loss to 3.2%, the most in five months. India was among the few markets in the region that managed to post small gains today. Europe equities are lower for the fourth day, but losses have been minor, and

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, China, Currency Movement, ECB, Featured, Japan, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.27% to 1.0704 |

EUR/CHF and USD/CHF, January 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

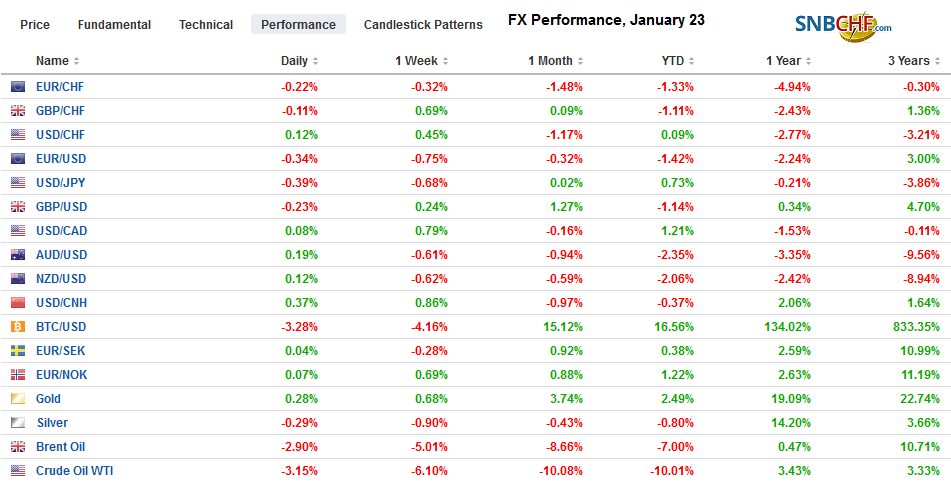

FX RatesOverview: The spread of the coronavirus and the lockdown in the epicenter in China has again sapped the risk-taking appetite in the capital markets. Asia is bearing the brunt of the adjustment. Tomorrow starts China’s week-long Lunar New Year celebration when markets will be closed, which may have also spurred today’s drama that aw the Shanghai Composite tumbled 2.75%, bringing the week’s loss to 3.2%, the most in five months. India was among the few markets in the region that managed to post small gains today. Europe equities are lower for the fourth day, but losses have been minor, and over the four sessions, the Dow Jones Stoxx 600 is off around 0.5%. US shares are trading with a slight downside bias. The US 10-year benchmark is near 1.74%, the lows for this year, while European bonds yields are off 2-4 bp, with Italy fully participating after yesterday’s wobble on changes in the Five Star Movement. The US dollar retains firm tone, rising against most of the world’s currencies today. The Australian dollar and Japanese yen are notable exceptions among the majors. The dovish twist by the Bank of Canada yesterday is behind the Canadian dollar’s underperformance today. It is the heaviest of the majors, extending yesterday’s 0.5% loss with another 0.25% today. Among emerging market currencies, the Chinese yuan fell a little more than 0.35%, and the 1% loss for the week is the most since August. Gold is trading heavier but is rangebound between roughly $1546 and $1568. Growth concerns and a build in US inventories (API says 1.57 mln barrels) continues to pressure oil prices. The March WTI futures contract is extending yesterday’s 2.8% loss with another 1.7% leg lower bring light sweet crude prices to their lowest level since early December, which is around 15% below the US-Iran confrontation high (~$65.40) on January 8. A broad measure commodity price (CRB Index) is falling for the fourth consecutive week, during which time it has fallen about 3.75%. |

FX Performance, January 23 |

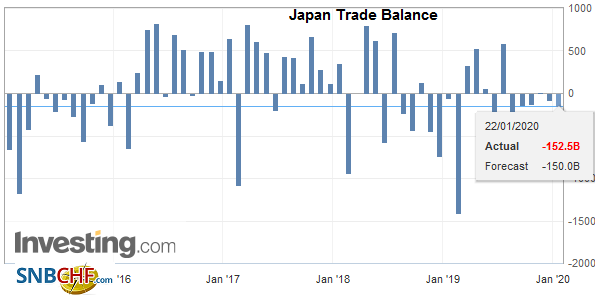

Asia PacificWithin the disappointing Japanese December trade report, there were a few bright spots. First negative signals need to be recognized to appreciate the positive signs. Exports and imports were weaker than expected. Exports fell 6.3% year-over-year, nearly half again as big as the median forecast in the Bloomberg survey (-4.3%). Imports were off 4.9% compared with the median estimate for a 3.2% decline. The auto sector remained problematic. Auto exports were off 11.8%, and parts exports fell almost 11%. Given that exports fell nearly 15% to the US, we suspect that it may show up in US auto import and inventory data. It is the fifth consecutive month exports to the US fell. The constructive news is that exports to China rose for the first time in 10 months (albeit less than 1%). Moreover, the export of semiconductor making equipment surged by a little more than a quarter. The two are no unrelated. Japan’s exports of chip fabrication equipment to China jumped 60%. This is important too because semiconductor chips (design and manufacturing) are seen to be a bottleneck for China. As part of its import-substitution strategy, it will likely ramp up its efforts to become more independent. Separately, Japan reported a 0.9% rise in its November all-industries index. It was near twice the gain expected and as another piece of data showing recovery after the October typhoon and sales tax boost. |

Japan Trade Balance, December 2019(see more posts on Japan Trade Balance, ) Source: investing.com - Click to enlarge |

Australia’s full-time job growth is grinding down. It fell (~300) in December and rose an average of 5.3k a month in H2 19. This compares with 20.1k average in the first half of last year. Part-time employment positions rose almost three-times the median forecast (Bloomberg survey) of 10k. The unemployment rate unexpectedly slipped to 5.1% from 5.2%, last seen in March 2019. Officials indicated that the fires disrupted the data collection. The Reserve Bank of Australia meets on February 4. The PMIs and Q4 CPI in the coming days may impact expectations, but the market has six basis points of a 25 bp move discounted.

The dollar is falling against the yen for the third session. The upside momentum had stalled as the dollar poked above JPY110. The technical indicators warned that the rally from the geopolitical-inspired loss near JPY107.65 had overextended the market. Today’s setback brought the greenback to JPY109.50, where it has found new bids. There are expiring options at JPY109.15 ($440 mln) and JPY109.80 (~$350 mln). Chart support is seen near JPY109.30, and the 20-day moving average is found near there. The Australian dollar has bounced back from yesterday’s drop to almost $0.6825 to reach nearly $0.6880 today. The Aussie is flirting with the A$500 option stuck at $0.6865 that expires today. There is a larger one for A$1.9 bln at $0.6915 that seems out of reach today.

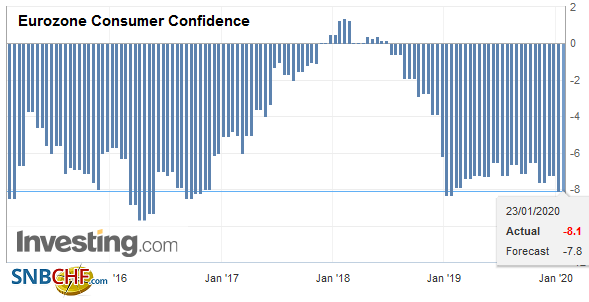

EuropeNorway’s central bank, as widely anticipated, left policy on hold. The ECB is center stage now. Lagarde’s assessment that the economic and financial conditions in the eurozone have gotten less bad remains valid. A formal update of the economic forecasts will be delivered at the next meeting (March 12). The most important element of today’s meeting will be the framing of the strategic review that Lagarde will announce. Investors are most interested in how the price stability objective is defined. The irony is that while market participants seem to be putting emphasis on the signaling of the ECB, many are continuing to reject the importance of the Fed’s signaling. The Fed has consistently argued that its bill purchases and repos are not QE, but the critics see the balance sheet expanding and dismiss the Fed’s signaling as disingenuous. Since the ECB’s last review in 2003, the central bank has unveiled several new policy tools to achieve its objective. An assessment of the efficacy of the new tools may also be included in the review, for which Lagarde says will “leave no stone unturned,” which may hint at covering a broad range of stakeholders. Lastly, the ECB’s communication will also be re-examined. Part of this seems to be in reaction to Draghi’s style, which itself may have been a product of the crisis and efforts of the creditors to stymie efforts to protect the system (recall the President of Germany’s Bundesbank testified against the ECB before the European Court of Justice). The economic and financial conditions have changed, and Lagarde offers a different management style from Draghi, and this has implications for how the diversity of opinion can be respected and incorporated as it is at other major central banks. |

Eurozone Consumer Confidence, January 2020(see more posts on Eurozone Consumer Confidence, ) Source: investing.com - Click to enlarge |

Both US President Trump and Treasury Secretary Mnuchin reiterated America’s threat to impose tariffs on European autos. Although the French seemed to agree not to collect the new digital tax until the end of the year, ostensibly to see if a multilateral agreement can be struck in exchange for the US not imposing the up to 100% tariff on nearly $2.5 bln French goods. However, the US pushed back hard against the UK and Italy, imposing their own digital tax. There are three reasons why this is an important issue for businesses and investors. First, it is a bit of a canary in a coal mine story. Having secured trade agreements with Japan, South Korea, China, and modernized NAFTA, Europe was moving into the US trade cross-hairs, and the digital tax can be the initial spark. Second, the hope of a quick US-UK trade agreement that Lighthizer optimistically suggested could be struck by the end of the summer seems misplaced. The UK government reaffirmed its plans for a digital tax, and the draft budget includes it. Third, what is prompting the national solutions is, at least in part, the failure of the EU (due to objections by Sweden, Denmark, Finland, and Ireland) and the OECD (with the US arguing the agreement should not be binding). Economic nationalism undermines the multilateral efforts and moves into the space abdicated by its failure.

The euro is in about a 20-tick range below $1.1100 in uninspiring activity ahead of the ECB meeting. There is an option for about 855 mln euros struck at $1.1110 that will be cut today. The euro has been stuck in nearly a half-cent range this week between $1.1070 and $1.1120. Sterling has also been confined to narrow ranges today but is in the upper end of a two-week range as the market tones down the dovish expectation for next week’s BOE meeting. At the end of last week, the market was pricing in about a 70% chance of cut next week now it is less than a 60% chance. Sterling looks comfortable in the $1.3020-$1.3060 range, and technical indicators suggest the extension is more likely to the upside than the downside.

America

The Bank of Canada took another step to soften its neutral stance. As investors adjusted to the new signal, the Canadian dollar weakened to its lowest level since Boxing Day. It seems that the main deterrence to a rate hike is not inflation (headline CPI stands at 2%, and underlying measures are a little firmer), but the risks associated with the household leverage. Until it becomes clearer if the slowdown that began in the middle of last year persists, the trade-off is not seen as desirable.

However, that is likely to change by the middle of the year. Previously, the market had seen only a one-in-four chance that the Bank of Canada would cut rates by the middle of the year. After the meeting, it became a little better than even money. The Canadian dollar may trade more sensitive to the domestic macro-economic data in the period ahead. That said, soft Q4 19 data is baked in the cake. This makes the next Bank of Canada meeting in early March may be too soon for a cut. Poloz steps down in mid-June, and he would not be the first Bank of Canada governor to change policy at their last meeting (e.g., Thiessen and Dodge).

The US reports weekly jobless claims and the Leading Economic Indicator. The LEI has not risen since last July and fell three months through November, which investors used to see as an indication that the economy was struggling. These days, it has little market impact. The decision by the World Health Organization about the new virus (apparently linked to snakes and bats) and whether to declare a public emergency was postponed from yesterday to today. The decision could have more impact than the US data.

Canada reports November retail sales figures tomorrow, and an uptick may help steady the Canadian dollar, as the US dollar approaches our initial target near CAD1.3180. Above there and the charts warn of potential into the CAD1.3235 area, where the 200-day moving average is found. Nearby support is seen near CAD1.3130. The US dollar continues to move sideways in its trough against the Mexican peso. It has forged a base around MXN18.65 and has not managed to close above MXN18.80 since January 9. The sideways movement has neutered the trend-following technical indicators, but we suspect the next move is toward a stronger US dollar.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,China,Currency Movement,ECB,Featured,Japan,newsletter