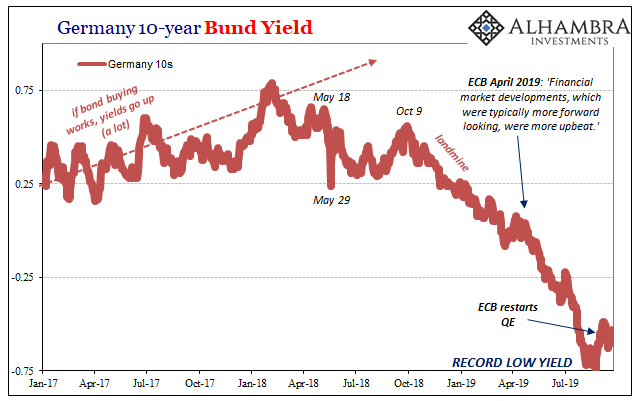

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement. Other than that, and that wasn’t much, you wouldn’t have known QE is already back on the table. It barely registered, the massive program practically ignored. With inflation expectations tumbling to record lows, Mario Draghi has a real problem on his hands – and the market, the bond market, anyway, knows he doesn’t know what to do about it. I wrote on Saturday: What that says is pretty simple – no matter what the ECB

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, 5) Global Macro, bond market, bonds, Christine Lagarde, currencies, Draghi, ECB, economy, factor orders, Featured, Federal Reserve/Monetary Policy, Germany, inflation expectations, Mario Draghi, Markets, newsletter, QE, Recession

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement.

Other than that, and that wasn’t much, you wouldn’t have known QE is already back on the table. It barely registered, the massive program practically ignored. With inflation expectations tumbling to record lows, Mario Draghi has a real problem on his hands – and the market, the bond market, anyway, knows he doesn’t know what to do about it. I wrote on Saturday:

Authorities, and not just those in Europe, are going to keep feeding us their theater. The global economy demands a monetary response and central banks have none to give. They don’t understand the monetary system, which is why they don’t really understand what’s happening in the real economy. |

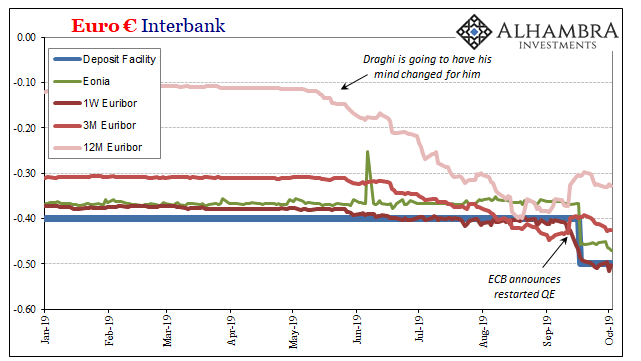

Euro Interbank, 2019 |

| Part of the reason bond markets haven’t reacted to the ECB is that the ECB only recently acknowledged there might, maybe, perhaps be a problem. It’s hardly encouraging when before you ever begin you put your denial on full display. Before around July, like Powell’s Fed Draghi’s ECB was sticking to the idea of “transitory” factors.

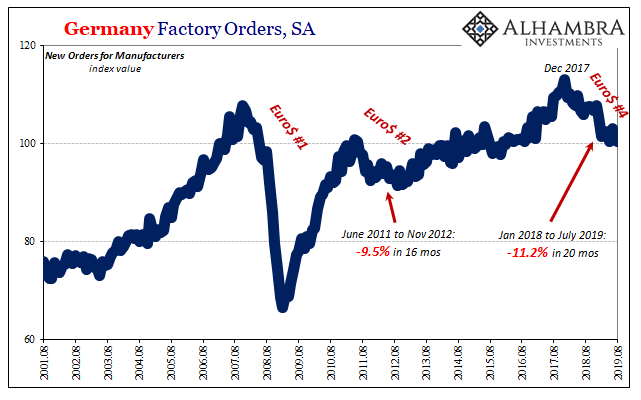

Even the mess in Germany was supposed to sort itself out. Left alone to its own idiosyncrasies, emissions regulations and the water levels in the Rhine, supposedly, these would eventually end their harmful if temporary intrusions. The ECB wasn’t going to act because it didn’t believe there was anything worth reacting to. At least that was the initial story. It has since changed. Not long after restarting QE last month, and moving its negative deposit rate “floor” to even more negative, Draghi appeared in front of the European “Parliament” one last time before his retirement at the end of this month. He told them Europe’s economy now faces a “prolonged sag”, which I don’t believe is a precise term. Then again, neither is “quantitative easing” though this latter one is meant to convey that very notion. In other words, for all the public projection of competence and science, as I wrote before, these people really have no idea what they are doing. It is showing. To emphasize that very point, Germany’s continued contraction. Where 2019 was supposed to have been Europe getting back to normal as the normal consequence of a sustained, and real, boom, Draghi’s post-retirement parade and enshrinement has been entirely canceled as the German factory sector can’t seem to find a bottom. |

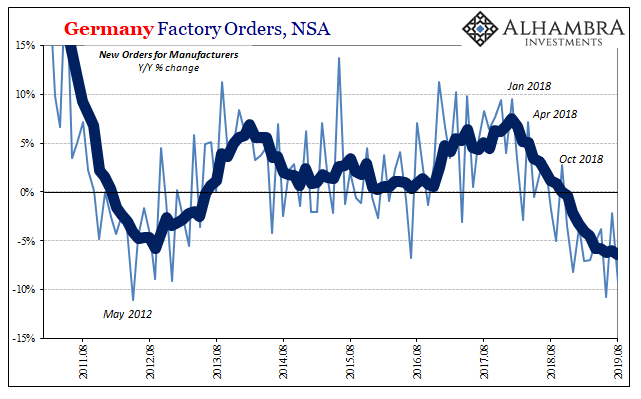

Germany Factory Orders, NSA 2011-2019(see more posts on Germany Factory Orders, ) |

| At least policymakers have finally acknowledged some truth to the situation – the longer this drags out, the greater the risk all of Europe is dragged down into it. As Draghi said, “the longer the weakness in manufacturing persists, the greater the risks that other sectors of the economy will be affected by the slowdown.”

According to the latest estimates from DeStatis, the German government’s keeper of the major economic statistics, factory orders fell once again by nearly 10% year-over-year in August 2019. And that follows a near 2% annual decline in August 2018 – the negative numbers are now stacking up as the downturn laps itself on the calendar. That is Draghi’s “prolonged sag”; a term of art where “prolonged” is the far more apt description, and far more relevant, than “sag.” Germany’s “manufacturing recession” is closing in on two years. That’s the part most people, including policymakers, have the most trouble with. A recession of any kind is supposed to be a quick, sharp decline followed by an equally quick and robust recovery. The V-shape. Ever since the Great “Recession”, though, things have been very different; these downturns play out slowly, drawn out over long lengths of time. Typical recessions throughout history were caused by a combination of factors, too, but they were also preceded by a significant “shock” or trigger. Often an obvious one. Europe’s economy, Germany first, hit a wall right away in January 2018. It didn’t fall immediately into recession, instead it began to decelerate, then it decelerated some more, turned slightly negative later in 2018, and then grew more negative throughout 2019. It wasn’t the historic shock/contraction process, it was the familiar squeeze/strangulation of the post-crisis monetary regime. |

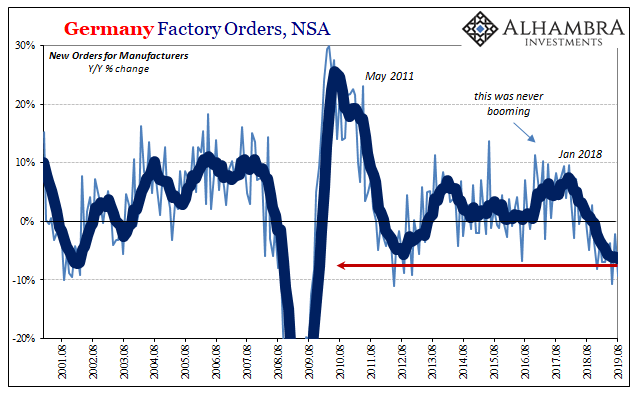

Germany Factory Orders, NSA 2001-2019 |

| Because it was a slow-burn degradation, policymakers were first tempted to outright dismiss it and then seeing it as something but still nothing too serious they expected it would just go away on its own (whatever it was). There’s never been much appreciation for its significance, and therefore what might really be behind it, because it seemingly took forever to become obviously, undeniably serious.

Which is finally where Europe is now. Mario Draghi’s primary problem, as he prepares to hand off to Christine Lagarde fresh off her Argentina fiasco, is how hard it is to regain credibility (which the puppet show of QE absolutely requires) after he’s completely changed his mind (had it changed for him): it’s nothing, it’s nothing, it’s really nothing, yeah it’s serious. |

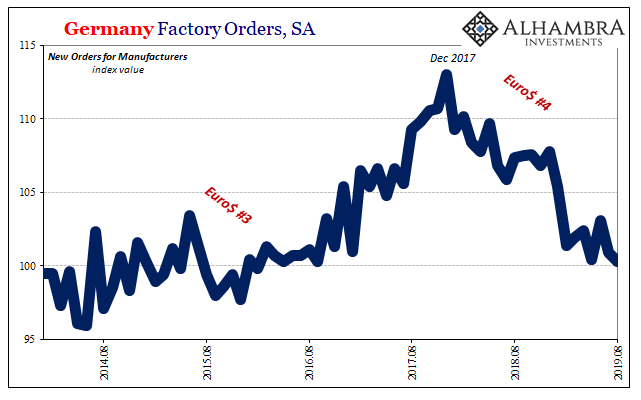

Germany Factory Orders, SA 2014-2019(see more posts on Germany Factory Orders, ) |

| All he did was prove he’s not serious, and the person who is replacing him has already done the same thing in the same overall context if in a different place. |

Germany Factory Orders, SA 2001-2019(see more posts on Germany Factory Orders, ) |

| Therefore, there’s now more QE in Europe simply because they don’t know what else to do – but now they know they have to do something. And everyone else knows, too, that they don’t know what else to do, and that there is no way they’ll sit there and do nothing.

It’s not quite the convincing picture of a solid solution to serious woes that just won’t go away. In fact, it actually explains a lot about how those woes won’t go away. |

Germany 10-year Bund Yield, 2017-2019 |

Tags: bond market,Bonds,Christine Lagarde,currencies,Draghi,ECB,economy,factor orders,Featured,Federal Reserve/Monetary Policy,Germany,inflation expectations,Mario Draghi,Markets,newsletter,QE,recession