See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. “On résiste à l’invasion des armées; on ne résiste pas à l’invasion des idées.” These are the actual words written by Victor Hugo in Histoire d’un Crime (History of a Crime).Translated literally, it means an invasion of armies can be resisted; an invasion of ideas cannot be resisted. However, there are many alternative translations that try to express the sentiment, if not the exact meaning. Perhaps the most famous of them is this. “Nothing can stop an idea whose time has come.” This, itself, is a powerful idea (we have seen it misattributed both to Ghandi and Martin Luther King). It is rife with implications. At least

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Basic Reports, capital destruction, Chart Update, dollar price, Featured, Gold, gold basis, gold bond, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver, silver basis, Silver co-basis, silver price, Tags: Chart Update, yield

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

“On résiste à l’invasion des armées; on ne résiste pas à l’invasion des idées.”

These are the actual words written by Victor Hugo in Histoire d’un Crime (History of a Crime).Translated literally, it means an invasion of armies can be resisted; an invasion of ideas cannot be resisted. However, there are many alternative translations that try to express the sentiment, if not the exact meaning. Perhaps the most famous of them is this.

“Nothing can stop an idea whose time has come.”

This, itself, is a powerful idea (we have seen it misattributed both to Ghandi and Martin Luther King). It is rife with implications. At least for ideas about how a society ought to be organized, for ideas about governance.

First is that until the time has come, the idea will not be adopted. Second, ideas drive history. When people are ready for a new idea, institutions change. Hugo wrote the above regarding the French revolution. The French people no longer supported the so called Divine Right of Kings.

It may seem like common sense, that there’s a perpetual conflict between the elites and the people. However, the people generally want the status quo. Change is scary. The present may have problems, but most prefer the devil they know to the devil they don’t. Even those who criticize the system may be satisfied with their comfortable opposition role (replete with salary and tenure or cushy think tank job).

Third, when people don’t want the status quo any more, then the time has come for a new idea. And woe betide any government or army that would seek to suppress it.

Fourth, the time comes for a new idea only when the old one has become untenable. We are not historians, nor experts on late 18th century France. But we think of the last Louis, number XVI, as a man who vacillated between despotic and desperate to be loved. He took power at a time when the monarchy had run the country deep into debt. He failed to fix the problem, and despite wanting to be loved, he was hated both by the peasantry and the nobility. Interestingly, Wikipedia says this:

“…although the King enjoyed as much absolute power as his predecessors, he lacked the personal authority crucial for absolutism to function properly.”

This illustrates the fifth implication to the idea that ideas become relevant when it’s time. The old idea is not discarded simply because it’s a bad one. It goes without saying that it’s bad. But it was bad for hundreds of years, with no change. According to Wikipedia—so take this with a grain of the money that was used before silver (salt)—absolute monarchy needed a king with a domineering personality. When there was a crisis, and a new king was crowned who lacked this trait, absolutism no longer “functioned properly.” See even Wikipedia, written by relatively free people who were never oppressed serfs, concedes that the old idea worked.

And when it no longer works, it’s time for a new idea.

We certainly believe that the creative mind who thinks up a new idea deserves full credit. However, something separates those who die frustrated (perhaps their idea is adopted after their deaths) and those who succeed and become great leaders and who are hailed as visionaries. Timing. To grow a plant, you need both the seed (idea) and fertile soil (the right timing).

Can you think of an idea that fits the above description?

Many smart thinkers told the world that we need the gold standard. Ludwig von Mises did. Ayn Rand did. Even Alan Greenspan did, in an essay published by Ayn Rand in 1966. It was not time, the world was not ready. We have seen many discussions of why Greenspan betrayed everything he said he stood for, in that essay. Perhaps the simplest one is right, that he knew the time wasn’t right for that idea. If he wanted power and fame, he would not get them in his lifetime by advocating honest money.

The idea of John Maynard Keynes had taken hold. He had a simple idea, a powerful idea, though wrong and evil. But it ruled the world. The idea is that central planners can make us more prosperous that we would be if left free. He didn’t propose price fixing for corn, nor quotas for timber. He proposed managing the money. When Milton Friedman, otherwise known for championing free markets came on board (he reportedly told China that it had to get control of their money supply), the idea was unstoppable. Friedman blamed the Fed—for not monetizing enough bonds, and keeping the money supply up (yes, we know we are oversimplifying a bit).

Unlike in the 1950’s or even 1970’s, today there are large constituencies who are not served by the dollar. Just ask a pension or insurance fund manager how 37 years of falling interest rates have worked out for them. One good thing to come of the bitcoin mania is that most techies and many millennials have had conversations about fiat money. And in 2008, many investors lost their shirts and have since become aware of the case for gold. Add retirees who can’t live on the interest on their savings, and workers who can’t accumulate savings.

Has the time for a new idea come? Several states including Utah, Texas, Oklahoma, Arizona, and Wyoming have enacted legislation to help move forward towards gold. And now the state of Nevada has, well, we will discuss that in a separate piece this week.

These state governments did not move towards gold merely because the fiat dollar sucks. It sucked a decade ago, too. Pardon our language, but we’re making a key point. These states did what they did because the dollar doesn’t merely suck any more. Now it’s not serving major constituencies. The Fed is sworn to two percent debasement, but savers get scant yield. So they are herded into bubble after bubble, seeking speculative gains, which of course causes other problems. Including risk of giant losses, like those experienced by bitcoin bettors this year.

The dollar has long been a machine purpose built for capital destruction. However, now the curtain has been raised and a much larger number of people see it. They experience it directly. They feel acutely the choice of steady erosion of their savings in a bank account or betting it on the asset du jour in the casino.

Perhaps, like poor ol’ Louis, the Fed just doesn’t have the forceful personality to go with its absolute power anymore? Whatever it is, it’s catching. And Nevada is not just the latest to come on board, that state will also drive yet others.

A yield on gold, paid in gold® is an idea whose time has come.

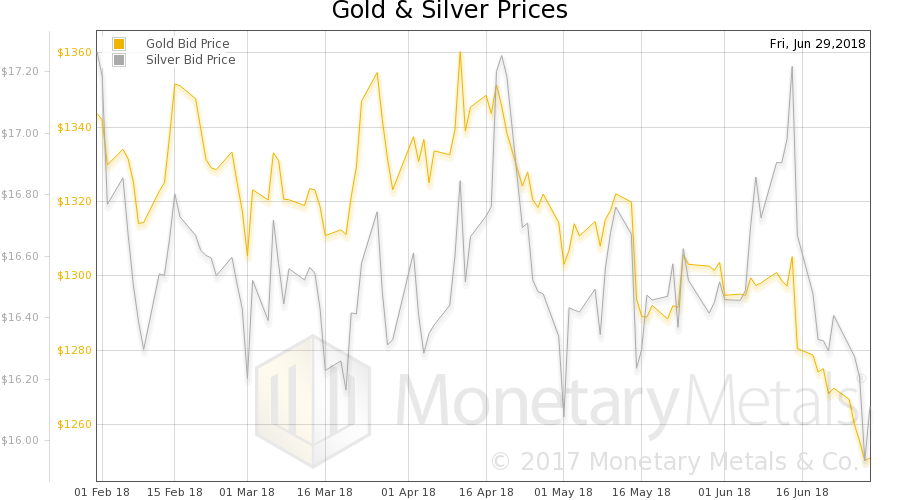

Supply and Demand FundamentalsThe price of gold fell $17, and that of silver $0.30. Why? We can tell you about the fundamentals. We can show charts of the basis. But we can’t get into the heads of the sellers. We can say that in the mainstream view, the dollar is rising. The dollar, in their view, is not measured in gold but in rupees in yuan and rubles. You know, all the superior forms of money… OK, all joking aside, the reality is that most currencies are falling. Which means the people in most countries are getting poorer, the capital is getting sucked out. Perhaps those who have gold, to hedge against the risk of a rainy day, now feel the water falling onto their faces? Whatever it is, in just over two months the price of gold has dropped $100. And the fundamentals of gold have softened right along with the price. So whither the price of gold next? We will provide a picture of the changing gold and silver fundamentals. But first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

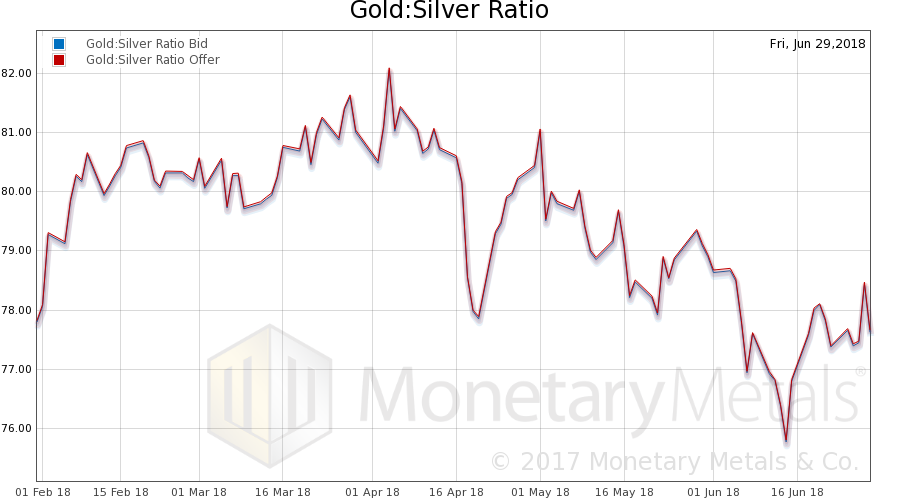

Gold: Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It went up a bit this week. |

Gold: Silver Ratio(see more posts on gold silver ratio, ) |

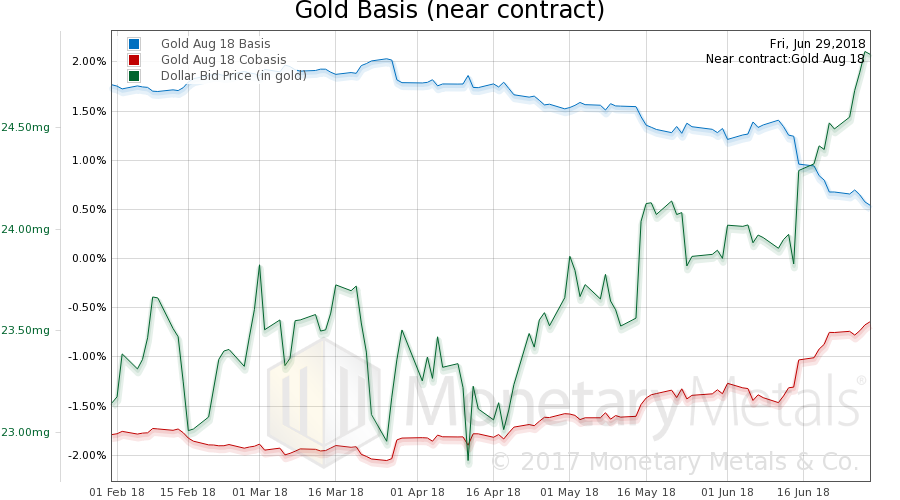

Gold Basis and Co-basis and Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. Yeah, gold looks like it became a bit scarcer, with a rise of about 10bps in the August cobasis. But the August contract is starting to come under pressure due to the roll. Farther contracts show a small rise in abundance. This drop in price is induced by the selling of physical metal. Unsurprisingly, the Monetary Metals Gold Fundamental Price fell another $26 this week to $1,298. What else would you expect it to do if the price drops and the metal becomes more abundant? |

Gold Basis and Co-basis and the Dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

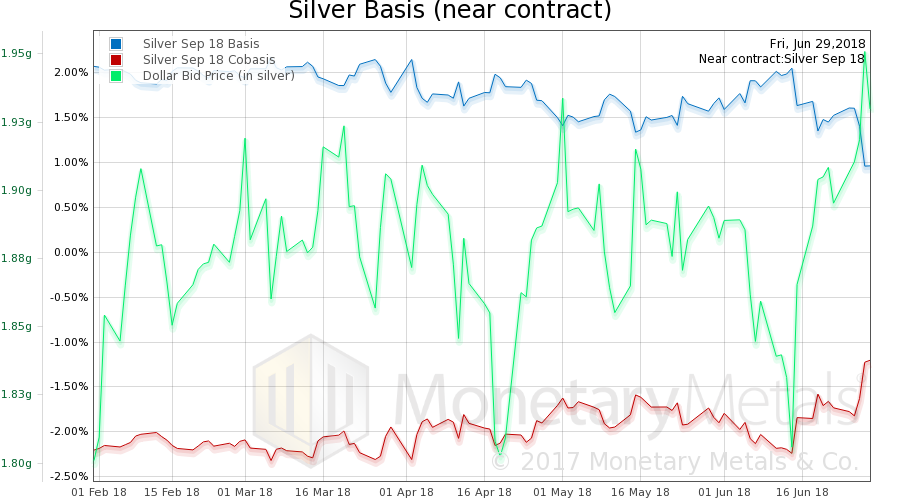

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. The price drop in silver may have been a bit larger, but the move of the basis both near and farther out show a rise in scarcity of this metal. The Monetary Metals Silver Fundamental Price rose 41 cents, just about where it was a week prior at $17.46. This should be interesting to watch. Typically, the prices of both metals move together, with silver moving farther to both extremes. But if the gold fundamental keeps dropping and the silver fundamental rises, well, there are exceptions to every rule. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2018 Monetary Metals

Tags: Basic Reports,capital destruction,Chart Update,dollar price,Featured,Gold,gold basis,gold bond,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver,silver basis,Silver co-basis,silver price,Tags: Chart Update,yield