Summary Hong Kong may impose a tax on unsold apartments as an effort to increase supply and cool off the housing market. Bank of Israel’s MPC had a split vote last month for the first time in three years. South Africa President Ramaphosa said the ANC wants Julius Malema of the opposition EFF to rejoin the party. Former South Africa President Zuma will face trial on 16 criminal charges. Stock Markets In the EM equity space as measured by MSCI, Qatar (+8.5%), China (+2.2%), and Hungary (+2.0%) have outperformed this week, while Mexico (-3.0%), South Africa (-3.0%), and Brazil (-2.9%) have underperformed. To put this in better context, MSCI EM rose 0.4% this week while MSCI DM fell -0.6%. In the EM local currency bond

Topics:

Win Thin considers the following as important: China, emerging markets, Featured, Israel, newsletter, South Africa, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

Stock MarketsIn the EM equity space as measured by MSCI, Qatar (+8.5%), China (+2.2%), and Hungary (+2.0%) have outperformed this week, while Mexico (-3.0%), South Africa (-3.0%), and Brazil (-2.9%) have underperformed. To put this in better context, MSCI EM rose 0.4% this week while MSCI DM fell -0.6%. In the EM local currency bond space, Colombia (10-year yield -18 bp), Hong Kong (-14 bp), and Brazil (-12 bp) have outperformed this week, while Turkey (10-year yield +38 bp), the Philippines (+34 bp), and Russia (+8 bp) have underperformed. To put this in better context, the 10-year UST yield fell 1 bp to 2.85%. In the EM FX space, TWD (+0.6% vs. USD), COP (+0.5% vs. USD), and THB (+0.4% vs. USD) have outperformed this week, while TRY (-2.7% vs. USD), RUB (-1.5% vs. USD), and ZAR (-1.3% vs. USD) have underperformed. To put this in better context, MSCI EM FX fell -0.1% this week. |

Stock Markets Emerging Markets, March 14 Source: economist.com - Click to enlarge |

ChinaHong Kong may impose a tax on unsold apartments as an effort to increase supply and cool off the housing market. A tax would be aimed at empty homes that are being hoarded by developers. Financial Secretary Chan said that the number of unsold units had increased significantly this year, adding that the tax would probably need to “have a particular target, and not apply across the board.” IsraelBank of Israel’s MPC had a split vote last month for the first time in three years. One member voted for a rate hike to 0.25%, while five members voted to keep rates steady at 0.10%. The last time the monetary policy committee split was in February 2015. The dissenter said low inflation did not reflect a problem with demand. Next policy meeting is April 16. South AfricaSouth Africa President Ramaphosa said the African National Congress wants Julius Malema of the opposition Economic Freedom Fighters to rejoin the party. Malema was a former ANC Youth League leader but was expelled from the ANC. The EFF is much more radical than the ANC, and has called for the nationalization of land, banks, and mines. Former South Africa President Zuma will face trial on 16 criminal charges. These include graft and racketeering as prosecutors announced they’re pursuing a case that was shelved nine years ago. The renewed charges came after the Supreme Court of Appeal upheld a lower court ruling last year that the decision to drop the charges in 2009 was “irrational.” |

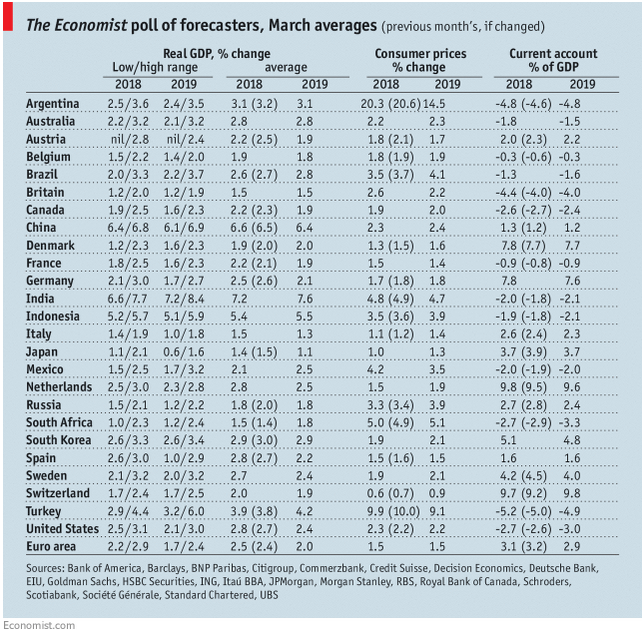

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: China,Emerging Markets,Featured,Israel,newsletter,South Africa,win-thin