In spite of euro strength, a decision on tapering QE will likely come in October. We believe a reduction in monthly asset purchases could commence in H1 2018.The ECB left its assessment and communication broadly unchanged at its meeting on 7 September. Draghi confirmed that “the bulk of the decisions” on QE extension should be made at the 26 October meeting.The statement mentioned recent currency volatility as “a source of uncertainty” to be monitored in the future, and the staff projections for inflation were revised down due to EUR appreciation. However, the ECB also believes that the EUR is appreciating for good reasons. In the end, the medium-term outlook for inflation was broadly unchanged.At this stage, our impression is that the ECB is leaning towards a reduction in QE size (to

Topics:

Frederik Ducrozet considers the following as important: ECB asset purchases, ECB monetary policy, ECB quantitative easing, ECB September meeting, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In spite of euro strength, a decision on tapering QE will likely come in October. We believe a reduction in monthly asset purchases could commence in H1 2018.

The ECB left its assessment and communication broadly unchanged at its meeting on 7 September. Draghi confirmed that “the bulk of the decisions” on QE extension should be made at the 26 October meeting.

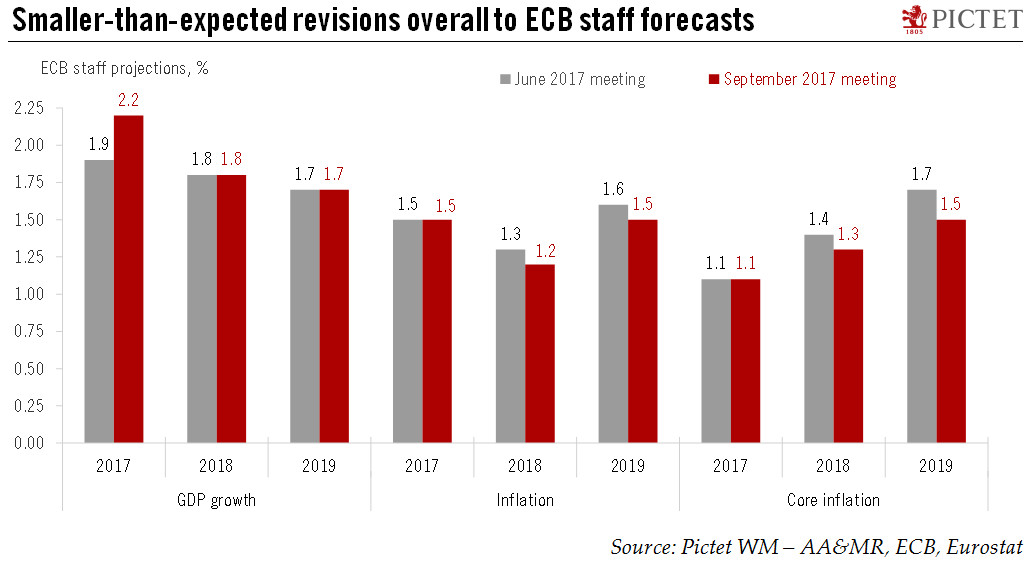

The statement mentioned recent currency volatility as “a source of uncertainty” to be monitored in the future, and the staff projections for inflation were revised down due to EUR appreciation. However, the ECB also believes that the EUR is appreciating for good reasons. In the end, the medium-term outlook for inflation was broadly unchanged.

At this stage, our impression is that the ECB is leaning towards a reduction in QE size (to EUR40bn in H1 2018) and a change in QE composition and parameters, possibly favouring private debt at the expense of sovereign debt purchases. The biggest wild card remains a potential shift from capital keys, but a formal change in rules looks unlikely at this stage.