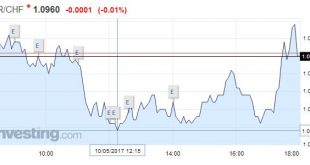

Swiss Franc EUR/CHF - Euro Swiss Franc, May 10(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea’s ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula. The Dollar...

Read More »FX Daily, April 26: Dollar Stabilizes Ahead of Trump and ECB

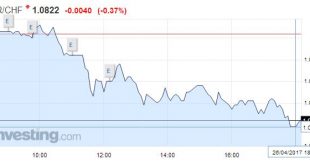

Swiss Franc EURCHF - Euro Swiss Franc, April 26(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Last week Theresa May called a snap General election due to take place on 8th June. Historically a snap election has caused the currency in question to weaken, however on this occasion Sterling strengthened. It was a shrewd move by May to call an election while the competition is so weak. A conservative...

Read More »Oil Supply Remains Resilient, Prices Heavy

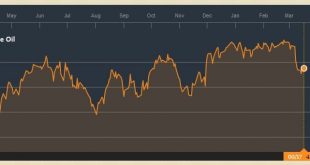

Summary: Nearly half of OPEC’s intended cuts are being offset by an increase in US output. The contango rewards the accumulation of inventories. The drop in oil prices probably weighs more on European reflation story than the US. Oil prices are lower for the seventh consecutive session. Light sweet crude prices had fallen 10.3% over the past two weeks, and with today’s losses are off another 1.6% already...

Read More »FX Daily, February 08: EUR/CHF down to 1.630, Swiss Boom Starting?

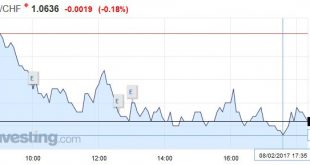

Will EUR/CHF fall to 1.00 The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come. I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015. What is the definition of a “boom”? It is economic activity mostly driven by...

Read More »FX Daily, 01 February: Markets Stabilize, Investors Await Signals from US data and FOMC, and POTUS

Swiss Franc Switzerland SVME Purchasing Managers Index (PMI), January 2017(see more posts on Switzerland SVME PMI, ) Source: Investing.com - Click to enlarge GBP / CHF The pound still remains on the back foot against the Swiss Franc with rates for GBP CHF sitting just below 1.25 for this pair. The pound is struggling to gain momentum against all of the major currencies as Brexit is just around the corner. The...

Read More »Trade is Trump’s Centerpiece

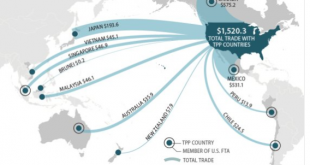

Investors are anxiously awaiting more details on the new US Administration’s economic policies and priorities. Part of the challenge is that the cabinet represents a wide range of views and it is not clear where the informal power lies, or whose call is it. In terms of economic policy, trade is being given priority. It is seen as the key to the jobs and growth objectives. There have been two initiatives: formally...

Read More »FX Daily, November 02: Standpat FOMC Trumped by US Political Jitters

Comment on GBP and CHF by Jonathan Watson My articles My siteAbout meMy booksFollow on:TwitterLinkedIN Swiss Franc The Swiss Franc is a safe haven currency and benefits in time of uncertainty. With Donald Trump now looking much more likely to win the Election the Swissie has found favour. If you are buying the Franc with sterling in the future the combination of global uncertainty and a weak pound looks set...

Read More »FX Daily, October 13: Dollar Edges Higher, though US Rates Soften

Swiss Franc The EUR/CHF remains in the range of 1.0815 to 1.0980. The SNB usually intervenes below 1.0850. I am expecting that speculators are reducing their CHF short positions. More tomorrow. EUR/CHF - Euro Swiss Franc, October 13 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is firm, and the euro has slipped below $1.10 for the first time since late-July. Although the dollar’s...

Read More »FX Daily, September 28: Dollar Mostly Firmer, but Going Nowhere Quickly

Swiss Franc Click to enlarge. FX Rates The US dollar is enjoying a firmer bias today, but it remains narrowly mixed on the week. It is within well-worn ranges. Of the several themes that investors are focused on, there have not significant fresh developments. In terms of monetary policy, both Draghi and Yellen speak today. The former is behind closed doors with a Germany parliamentary committee. While Draghi’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org