The US jobs growth slowed in March more than expected, but the details of the report suggest investors and policymakers will look through it. The poor weather seemed to have played a role. Construction jobs fell (15k) for the first time since last July, and the hours worked by production employees and non-supervisory worker slipped. United States The 103k net new jobs were the least since last September when storms...

Read More »FX Daily, April 09: Asian and European Equities Shrug Off US Decline

Swiss Franc The Euro has risen by 0.10% to 1.1786 CHF. EUR/CHF and USD/CHF, April 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US shares slumped before the weekend amid concern that Trump Administration was prepared to escalate the trade tensions with China. However, cooler heads are prevailing, and there is a recognition that the conflict is still in the posturing...

Read More »Great Graphic: Has the Dollar Bottomed Against the Yen?

The US dollar appears to be carving a low against the yen. After a significant fall, investor ought to be sensitive to bottoming patterns. The first tell was the key reversal on March 26. In this case, the key reversal was when the dollar made a new low for the move (~JPY104.55) and then rallied to close above the previous session high. The second tell was the divergence with the technical indicators. The divergence is...

Read More »FX Daily, April 03: Markets in Search of Footing

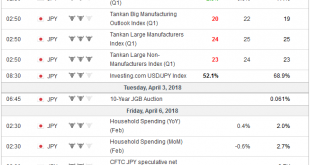

Swiss Franc The Euro has risen by 0.04% to 1.1754 CHF. EUR/CHF and USD/CHF, April 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The sell-off in US tech shares dragged the market lower. The S&P 500 fell for the sixth session of the past eight and closed below the 200-day moving average for the first time in a couple of years. The sell-off in Asia and Europe is...

Read More »FX Weekly Preview: The Start of Q2

The chief uncertainty has shifted from monetary policy and macroeconomics to the increase of volatility in the stock markets and the prospects of a trade war. Some of the major benchmarks, including the S&P 500, the MSCI Asia Pacific Index, the MSCI Emerging Markets Index, and Shanghai Composite held above the February lows in the retreat during the second half of March. Other bourses did not. These include the DAX,...

Read More »FX Daily, March 28: Three Developments Shaping Month-End

Swiss Franc The Euro has risen by 0.34% to 1.1779 CHF. EUR/CHF and USD/CHF, March 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Today may be the last day of full liquidity until next Tuesday, after the Easter holidays. We identify three developments that are characterizing the end of the month, quarter, and for some countries and companies, the fiscal year. Equity...

Read More »FX Daily, March 26: Equity Meltdown Aborted, Dollar Eases

Swiss Franc The Euro has risen by 0.43% to 1.1747 CHF. EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a poor start in Asia, equities recovered. The MSCI Asia Pacific initially extended last week’s losses and fell to its lowest level since February 12 before recovering to finish near its highs, 0.4% above last week’s close. European...

Read More »FX Daily, March 07: Renewed Threat of Trade War Makes Investors Angry

Swiss Franc The Euro has risen by 0.21% to 1.1688 CHF. EUR/CHF and USD/CHF, March 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates In response to the resignation of one of the few “globalist” advisers in the US Administration, the resignation Cohn has sent ripples through the capital markets. Stocks have been marked down across the world. The prospects of a trade war...

Read More »FX Daily, March 06: Resiliency Demonstrated

Swiss Franc The Euro has risen by 0.36% to 1.1634 CHF. EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The resiliency of the status quo is again on display. After much chin wagging and finger pointing after the Italian elections and the modest decline in Italian assets, they have bounced back today. Italian bonds and stocks are participating...

Read More »FX Daily, February 28: It Takes Powell to Convince the Market that Yellen was Right

Swiss Franc The Euro has fallen by 0.19% to 1.1504 CHF. EUR/CHF and USD/CHF, February 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Many market participants think they heard Fed Chair Powell give a fairly strong signal that he favored a more aggressive course. The implied yield on the December Eurodollar futures rose five basis points to 1.535%. The December Fed...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org