With the first half of 2018 now drawn to a close, much of the financial medias’ headlines and commentary relating to the gold market has been focusing on the fact that the US dollar gold price has moved lower year-to-date. Specifically, from a US dollar price of $1302.50 at close on 31 December 2017, the price of gold in US dollar terms has slipped by approximately 3.8% over the last six months to around $1252.50, a...

Read More »Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

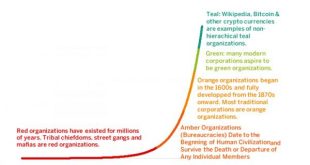

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘. The Sovereign Money referendum...

Read More »Less scope for yen and Swiss franc depreciation

The start of the year has seen the Japanese yen and Swiss franc appreciate strongly against the US dollar (they rose by 5.6% and 4.4% respectively between 1 January and 22 February) despite higher US yields. However, this rise in US yields came with heightened market volatility, favouring safe haven currencies such as the yen and franc. Indeed, both currencies are characterised by structurally large domestic current...

Read More »Swiss franc could hit 1.22 by year end, according to economists

According to Le Matin, economists at Swiss Life think the rise of the Swiss franc is over and predict it will weaken to 1.22 to the euro by the end of the year. © Valeriya Potapova _ Dreamstime.com At the same time they point to risks that could send the currency in the opposite direction, such as the election in Italy, Brexit negotiations and uncertainty surrounding government in Germany. The Swiss National Bank (SNB) abandoned its Swiss-franc-euro exchange rate cap of 1.20 in 2015 under...

Read More »Swiss franc could hit 1.22 by year end, according to economists

According to Le Matin, economists at Swiss Life think the rise of the Swiss franc is over and predict it will weaken to 1.22 to the euro by the end of the year. © Valeriya Potapova _ Dreamstime.com At the same time they point to risks that could send the currency in the opposite direction, such as the election in Italy, Brexit negotiations and uncertainty surrounding government in Germany. The Swiss National Bank (SNB) abandoned its Swiss-franc-euro exchange rate cap of 1.20 in 2015 under...

Read More »If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

Authored by Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels and...

Read More »The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org