Swiss Franc Currency Index The Swiss Franc index gained nearly 3% last week, while the dollar index lost over 2%. This gives a total gain of 5%. Swiss Franc Index (see more posts on Swiss Franc Index) Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three years interval, the Swiss Franc had a weak performance....

Read More »Speculators Make Small Bets in FX, but Bears Run for Cover in Treasuries and Oil

Summer doldrums continue to depress speculative activity in the currency futures market. In the CFTC Commitment of Traders reporting week ending August 16 speculators made small adjustments to gross currency positions. There was only one change more than 6k contracts. The Aussie bulls added 9.4k contracts to their gross long position, lifting it to 68.9k contracts. Of the other 15 gross positions we track, there...

Read More »What the Fed Hasn’t Fixed (and Actually Made Worse)

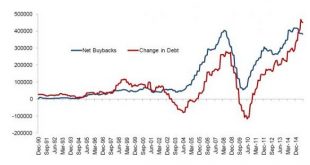

The Fed has not only failed to fix what’s broken in the U.S. economy–it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don’t hurt yourself patting your own backs, Fed governors past and present: it’s bad enough that the Fed can’t fix the economy’s real problems–its policies actively make them...

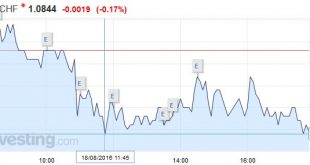

Read More »FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

Swiss Franc A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. Click to enlarge. FX Rates It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting. The...

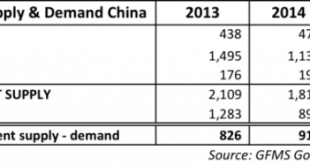

Read More »Spectacular Chinese Gold Demand Fully Denied By GFMS And Mainstream Media

Submitted by Koos Jansen of BullionStar In the Gold Survey 2016 report by GFMS that covers the global gold market for calendar year 2015 Chinese gold consumption was assessed at 867 tonnes. As Chinese wholesale demand, measured by withdrawals from Shanghai Gold Exchange designated vaults, accounted for 2,596 tonnes in 2015 the difference reached an extraordinary peak for the year. In an attempt to explain the 1,729...

Read More »Arizona Considers Issuing a Gold Bond

The Arizona House of Representatives has convened an Ad Hoc Committee on Gold Bonds. The purpose is to explore if and how the state could sell a gold bond. This is an exciting development, as the issuance of a gold bond would be a major step towards a working gold standard. Yours truly is a member of the committee. At the first meeting, I gave a proposal for how a gold bond could work to the benefit of the state and...

Read More »The Need for Higher Wages: Lots of Thunder, No Rain

Summary: Major central banks and many economists are calling for higher wages. However, they are reluctant to offer proposals to strengthen those institutions who’s goal is to boost labor’s share of national income. The advocates are more interested in boosting prices than in lifting aggregate demand or addressing the disparity of income and wealth. Charlie Chaplin All that is solid is melting. After...

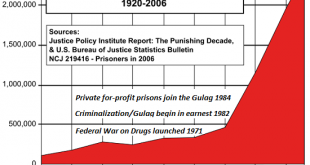

Read More »It’s Time to Abolish the DEA and America’s “War on Drugs” Gulag

Addiction and drug use are medical/mental health issues, not criminalization/ imprisonment issues. It’s difficult to pick the most destructive of America’s many senseless, futile and tragically needless wars, but the “War on Drugs” is near the top of the list.Prohibition of mind-altering substances has not just failed–it has failed spectacularly, and generated extremely destructive and counterproductive consequences....

Read More »Why Switzerland’s franc is still strong in four charts

A very insightful post from Bloomberg. We added some more explanations. We explained that the dollar is currently more overvalued than the Swiss Franc. Swiss National Bank President Thomas Jordan keeps saying the franc is “significantly overvalued.” And that’s despite the central bank’s record-low deposit rate and occasional currency market interventions. While the franc is typically a top choice for foreign...

Read More »FX Daily, August 17: Dollar Snaps Back

Swiss Franc Click to enlarge. FX Rates The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley’s comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent. Many...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org