A very insightful post from Bloomberg. We added some more explanations. We explained that the dollar is currently more overvalued than the Swiss Franc. Swiss National Bank President Thomas Jordan keeps saying the franc is “significantly overvalued.” And that’s despite the central bank’s record-low deposit rate and occasional currency market interventions. While the franc is typically a top choice for foreign investors looking for a safe place to park their money, anxieties about the euro area’s debt burden or Brexit aren’t the only factor. The residents of Switzerland — which has a sizable current-account surplus despite its strong currency — are partly to blame because they aren’t moving money abroad, which could help them achieve higher returns. © Dariusz Kopestynski | Dreamstime.com Reason 1: Private Sector Buys Securities in CHF “Roughly speaking, about half the capital inflows are due to domestic investors, which means they’re contributing in a big way to the strength of the franc,” said Maxime Botteron, an economist at Credit Suisse in Zurich. The following four charts illustrate the state of play. Households have an ever-greater share of franc-denominated assets. Switzerland has outperformed the European Union in economic growth from 2008 to 2014.

Topics:

George Dorgan considers the following as important: CHF FX, Credit Suisse, Editor's Choice, Featured, Maxime Botteron, newslettersent, Strong Swiss Franc, Swiss Franc, Thomas Jordan

This could be interesting, too:

investrends.ch writes UBS zahlt für CS-Steuerstreit mit US-Justizministerium weitere halbe Milliarde

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

A very insightful post from Bloomberg. We added some more explanations. We explained that the dollar is currently more overvalued than the Swiss Franc.

|

|

Reason 1: Private Sector Buys Securities in CHF

Switzerland has outperformed the European Union in economic growth from 2008 to 2014. No wonder that the Swiss prefer Swiss securities. We explained that Swiss will buy foreign securities only when

|

It’s worth noting that the development of that ratio over time doesn’t factor in valuation effects due to changes in the exchange rate. |

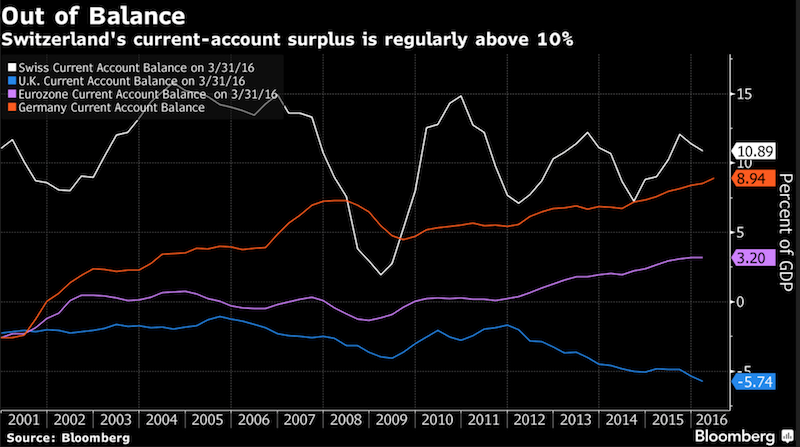

Reason 2: Massive Swiss Current Account Surplus

We explained here that one main reason is the rising Swiss savings rate, while Americans or Europeans save less. Savings is done in cash or in Swiss securities (reason 1) or -even better – in Swiss real estate, where prices rose by 7% per year until 2014. |

|

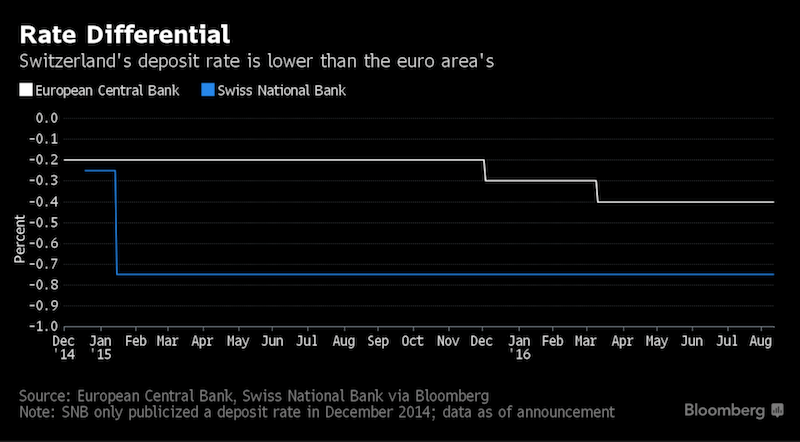

Reason3: Rate-Differential not big enough

We explained that Swiss investors expect a sufficient risk-reward combination, when buying foreign securities. We judge that a rate differential of 1.5% is needed. Moreover, the majority of Swiss savers are not punished yet with negative rates. |

|

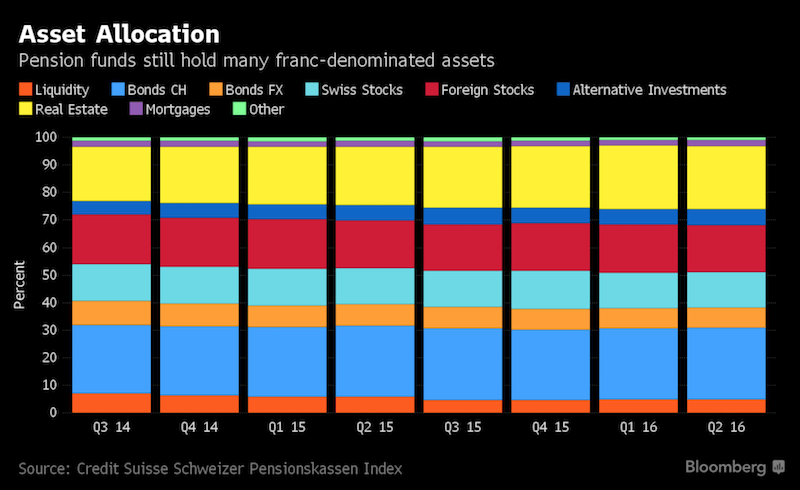

Reason 4: Pension Funds Hold (too) many Swiss Franc Investments

|

The post was originally published by Catherine Bosley (Bloomberg)