[unable to retrieve full-text content]The new month has begun with a couple of surprises. The biggest surprise has been the record jump in the UK manufacturing PMI to 53.3 from 48.3. A much smaller rebound was expected in August after the Brexit shock drop in July.

Read More »Swiss Retail Sales -2.6 percent nominal (YoY) and -2.2 percent real (YoY)

[unable to retrieve full-text content]Turnover in the retail sector fell by 2.6% in nominal terms in July 2016 compared with the previous year. This decrease has been ongoing since January 2015. Seasonally adjusted, nominal turnover rose by 0.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »Gold Sector Correction – What Happens Next?

[unable to retrieve full-text content]The gathering of central planners at Jackson Hole was widely expected to bring some clarity regarding the Fed’s policy intentions. This is of course a ridiculous assumption, since these people have not the foggiest idea what they are doing or what they are going to do next. Like all central planners, they are forever groping in the dark.

Read More »The “Secret Sauce” of the Byzantine Empire: Stable Currency, Social Mobility

[unable to retrieve full-text content]One of my reading projects over the past year is to learn more about empires:how they are established, why they endure and why they crumble. To this end, I've recently read seven books on a wide variety of empires. The literature on empires is vast, so this is only a tiny slice of the available books. Nonetheless I think these 7 titles offer a fairly comprehensive spectrum:

Read More »Dollar Weakness and Fed Expectations

Summary: Dollar weakness does not line up with increased perceived risk of Fed hiking rates. Frequently the rate differentials lead spot movement. Some now turning divergence on its head, claiming too expensive to hedge dollar-investments so liquidation. TIC data, though, shows central banks not private investors, were the featured sellers in June, the most recent month that data exists. The US dollar has...

Read More »Silver is in a Different World

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Lighthouse Problem Measured in gold, the price of the dollar hardly budged this week. It fell less than one tenth of a milligram, from 23.29 to 23.20mg. However, in silver terms, it’s a different story. The dollar became more valuable, rising from 1.58 to 1.61 grams. Most people would say that gold went up $6 and...

Read More »Yarns, Mysteries, and the CPI

No CPI Change Several ill-defined economic data points were unveiled this week. Namely, the Labor Department’s July consumer price index report. According to the government data, on whole, consumer prices for the month didn’t change one iota. Reportedly, energy prices went down, food prices were unchanged, and all other items slightly increased. So when the official number crunchers tallied them all up, the...

Read More »Should we Be Concerned About the Fall in Money Velocity?

Alarmed Experts A fall in the US velocity of money M2 to 1.44 in June from 1.51 in June last year and 2.2 in May 1997 has alarmed many experts. Note that the June figure is the lowest since January 1959. Some commentators are of the view that this points to a severe liquidity crunch, which could culminate in a massive stock market collapse and an economic disaster in the months ahead. Money velocity is widely...

Read More »Does the UK Need Even More Stimulus?

AEP Speaks for Himself “We are all Keynesians now, so let’s get fiscal.” This is one view according to Ambrose Evans-Pritchard from The Telegraph who believes the time is right for the UK government to loosen its fiscal stance. He suggests that the “Bank of England has done everything possible under the constraints of monetary orthodoxy to cushion the Brexit shock. It is now up to the British government to save the...

Read More »Don’t Expect a Return to a Gold Standard Any Time Soon

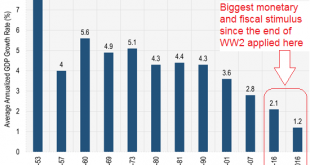

Lies and Distortions Despite trillions of paper currency units poured into the world economies since the start of the financial crisis, there has been no recovery, in fact, all legitimate indicators have shown worsening conditions except, of course, for the pocketbooks of the politically – connected financial elites. Economy is “Recovering” at its Slowest Pace Since WW2 A comparison of average annual GDP growth in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org