Summary: The GDP deflator may be just as important as overall growth for BOJ considerations and the possibility of fresh action next month. Falling UK rates and a weaker pound are desirable from a policy point of view. Dudley’s press conference may be more important than FOMC minutes. Two German state elections that will be held next month comes as Merkel’s popularity has waned. Japan Japan’s Q2 GDP: The...

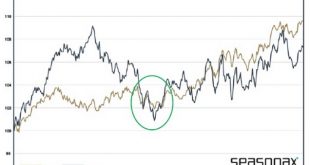

Read More »The Fundamentals behind Gold Price Seasonality

Seasonality of gold and silver In the Six Major Fundamental Factors that Determine Gold and Silver Prices we have learned that prices of gold and silver represent the growth difference between Europe and the Emerging Markets on one side and the United States on the other. When the former two are weak, then gold prices tend to fall. When the U.S. economy is weak, however, then gold prices tend to rise. While...

Read More »FX Daily, July 20: Sterling’s Jump Slows Dollar’s Ascent

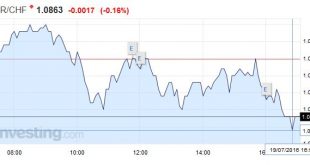

Swiss Franc The euro Swiss remains at relatively low levels, compared to the ones achieved in the recent risk-on enviornment. Click to enlarge. It is a bizarre turn of events. Just like the Game of Throne’s Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered...

Read More »The Central Planning Virus Mutates

Chopper Pilot Descends on Nippon Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect. Amid stubbornly stagnating economic output, Japan has amassed a debt pile so vast since the bursting of...

Read More »The Day They Killed the Dollar

Hell With Air-Conditioning LAS VEGAS – It was 113 degrees outside when we rolled through Baker, California, a few days ago. We drove along in comfort, but our sympathies turned to the poor pilgrims who made their way to California in covered wagons. How they must have suffered! Our suffering didn’t begin until we checked into the Planet Hollywood Hotel in Las Vegas. What a horrible place. You stand in line for half...

Read More »The World’s Central Banks Are Making A Big Mistake

Authored by John Mauldin via MauldinEconomics.com, While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national...

Read More »Great Graphic: Aussie Approaches Two-Month Uptrend

Summary: Australian dollar is the second heaviest currency this week after a key downside reversal at the end of last week. It is approaching an uptrend line near $0.7450. Many perceive an increased likelihood that the RBA eases and many are reassessing chance of a Fed hike later this year. Australian dollar The Australian dollar recorded a key downside reversal last Friday (July 15) and had seen follow...

Read More »The Curious Case of Vanishing Lady Liberty; Only Gold and Silver Remember Her

The very first word anyone ever saw on a circulating United States coin was the word “LIBERTY.” From half-cents to silver dollars, each featured the likeness of an unnamed woman. The images varied, thanks to different engravers, but together they became recognized as Lady Liberty. Many, maybe most, of young America’s citizens were illiterate. “Liberty” may have been the first word they ever learned to read. If not,...

Read More »FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

Swiss Franc Click to enlarge. FX Rates The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today. The Canadian dollar is being dragged lower (~).5%0 in what looks to be primarily sympathy, but it had seemed vulnerable to us in any event....

Read More »Dollar Bull Case Intact: It is All About the Perspective

Summary: Our bullish dollar outlook was based on divergence and we judge it to still be intact. The Dollar Index has been trading broadly sideways since March 2015, but never did more than a minimum retacement of its earlier rally. The Dollar index is at it highest level since March today. Our underlying constructive outlook for the US dollar remains intact. It is broadly based on the divergence between the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org