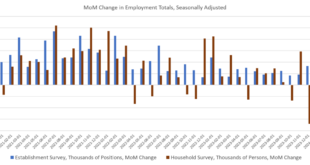

According to a new report from the federal government's Bureau of Labor Statistics last Friday, the US economy added 353,000 jobs for the month of January while the unemployment rate held at 3.7%. CNN news was sure to tell us that this was a "shockingly good jobs report" and it "shows America's economy is booming." At this point, many of us who follow these numbers have become accustomed to the routine: the BLS reports "blowout" jobs numbers each month, and the...

Read More »Fed Wisdom and the Magnificent Seven

In this week's episode, Mark takes a quick look back at Fed wisdom in the year 2000, and then surveys today's stock market—and, in particular, the Magnificent Seven stocks, which represent very narrow leadership of the overall stock market. Be sure to follow Minor Issues at Mises.org/MinorIssues. Get your free copy of Dr. Guido Hülsmann's How Inflation Destroys Civilization at Mises.org/IssuesFree. [embedded content]...

Read More »Week Ahead: Will Soft US CPI and Retail Sales Mark the End of the Interest Rate Adjustment and Help Cap the Greenback?

The markets are still correcting from the overshoot on rates and the dollar that took place in late 2023. The first Fed rate cut has been pushed out of March and odds of a May move have been pared to the lowest since last November. The extent of this year's cuts has been chopped to about 4.5 quarter-point move (~112 bp) from more than six a month ago. The market has reduced the extent of ECB cuts to about 114 bp (from 160 bp at the end of January and 190 in late...

Read More »Do We Really Want to Go There? A Michigan Jury Endorses Vicarious Criminal Liability

A Michigan jury this past week convicted Jennifer Crumbley of “involuntary manslaughter” after her then-fifteen-year-old son Ethan shot and killed four of his classmates at Oxford High School in 2021, using a gun that his parents had given to him as a present. Ethan had suffered from depression and other mental health issues before his deadly actions, and hindsight obviously tells us that he should not have been given a gun in the first place, but the issues this...

Read More »The Fed Claims the Banking System is “Sound and Resilient.” The Banks’ Balance Sheets Say Otherwise

The wordsmiths at the Federal Reserve wisely omitted the line about a “sound and resilient” banking system in its statement on January 31. That same day shares of New York Community Bank plunged when the bank announced a loss of thirty-six cents per share when analysts expected earnings of twenty-seven cents a share for the fourth quarter. Internal or external auditors occasionally comb through individual loans in a bank’s portfolio and make judgments as to whether...

Read More »What Can We Learn from the Latest Pentagon Audit? Both Plenty and Not Much

No one was surprised last November when the Pentagon failed its sixth audit, serving up a sorry record of zero and six. The accomplishment received little mainstream media coverage. Scott Ritter excoriated his former employer (and mine) over the fraud, pointing out that the money wasted and the scope of the United States military activity is so massive, it is nearly incomprehensible to most Americans. Ritter points out that audits are done by accountants, and while...

Read More »“Nonsense on Stilts”: The Rhetorical Cornerstone of the American Welfare/Warfare State

In a 1922 essay about Lincoln’s Gettysburg Address in his book Prejudices: Third Series H.L. Mencken asked, “Am I the first American to note the fundamental nonsensicality of the Gettysburg Address”? One example of the nonsense of Lincoln’s rhetoric as explained by Mencken is as follows: “Think of the argument in it. Put it into the cold words of everyday. The doctrine is simply this: that the Union soldiers who died at Gettysburg sacrificed their lives to the cause...

Read More »Responding to James Lindsay’s Critique of “National Divorce”

Bob goes solo to give a point-by-point rebuttal to James Lindsay's recent essay arguing that "national divorce means national suicide." Bob argues that James employs inconsistent claims and ignores the tremendous economic boon to an independent Texas. James Lindsay's Article "National Divorce is National Suicide": Mises.org/HAP434a Bob's Book "Common Sense: The Case for an Independent Texas": Mises.org/HAP434b AntiWar.com Article on Gaza: Mises.org/HAP434c Scott...

Read More »Über Minderheiten, Föderalismus, Neutralität und die Vermittlerrolle

Dieser Artikel erschient erstmalig im Nebelspalter am 23. März 2022. Es gehört zum Wesen von Prinzipien, dass sie auf Dauer angelegt sind und sich gegenüber dem Wandel des Zeitgeists als resistent erweisen müssen. Was die Schweiz zum Frieden beitragen könnte – und wie dieser aussehen müsste. Robert Nef Wer Prinzipien beharrlich vertritt, muss damit rechnen, dass er immer wieder als «jemand von gestern» und als Feind des Fortschritts hingestellt wird. Gegenwärtig haben die...

Read More »Keine Bomben

Angestachelt vom wütenden, bedauernswerten und bettelnden Selenskyj am WEF, riefen Markus Somm und Dominik Feusi letzte Woche in ihrem Podcast «Bern einfach» nach Bomben auf St. Petersburg, Kursk, Sewastopol, Krim und Moskau. Sie teilen Selenskyjs Sehnsucht nach Vergeltung und Eskalation. Sie wollen den Krieg nach Russland tragen, mit aller Kraft, mit aller Macht. Sie outen sich wörtlich als Kriegstreiber. Es gehe nicht anders, behaupten sie alternativlos. Sanktionen: Ein schädliches...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org