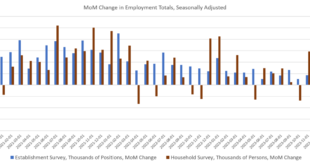

According to a new report from the federal government's Bureau of Labor Statistics last Friday, the US economy added 216,000 jobs for the month while the unemployment rate held at 3.7%. NBC news was sure to tell us that this "beat expectations." Market estimates suggested total jobs added at 170,000 with the unemployment rate at 3.8%. The media's general consensus on the report is that the jobs economy is "robust" and everything is heading on schedule toward a...

Read More »Week Ahead: Real Economy

Given the world's turmoil, including the escalation, and broadening of the conflict in the Middle East and China's continued aerial harassment of Taiwan ahead of the election, the capital and commodity markets have remained firm. February WTI fell about 1.7% last week and March Brent slipped around 0.65%. Shipping costs are rising as the Rea Sea is avoided and supply chain disruptions are threatened. Still the MSCI index of developed equity market rose by nearly...

Read More »The Draconian Budget Slashing Act of 2024

On this week's episode, Mark opens the Congressional Political Playbook to examine the proposed Congressional compromise spending legislation—and what they might name it. Be sure to follow Minor Issues at Mises.org/MinorIssues. Get your free copy of Murray Rothbard's Anatomy of the State at Mises.org/IssuesFree. [embedded content]...

Read More »Are You an Enemy of the State? Most likely

Donald Trump, Julian Assange, Alex Jones, and Rudy Giuliani are in deep trouble with the US state. How about you? Most likely you feel safe because your voice hasn’t attracted a large following. What would the state’s enforcers gain by attacking a little guy? They’re big-game hunters. Pull the plug on the big guys and their everyday followers float away like bathtub water down a drain. Possibly you believe you aren’t really attacking the state with your social media...

Read More »Expect More Currency Destruction and Weak Economies in 2024

Markets closed 2023 with the strongest rally for equities, bonds, gold, and cryptocurrencies in years. The level of complacency was obvious, registering an “extreme greed” level in the Greed and Fear Index. 2023 was also an unbelievably bad year for commodities, particularly oil and natural gas, something that very few would have predicted in the middle of two wars with relevant geopolitical impact and significant OPEC+ supply cuts. It was also a poor year for...

Read More »Time Is Running Out for Construction Loans

Back when I was a construction lender, I thought the perfect construction loan would pay off after one day, just long enough to collect the loan fee. After all, time is your enemy in construction lending. Any of a myriad of unknowns can keep construction from being completed: the market may evaporate for what is being built, interest rates may rise to make a loan uneconomic, construction costs could increase to require a loan modification or more borrower equity...

Read More »Garett Jones on the Legacy of Robert Solow

Economic giant Robert Solow died in December 2023. He was a Nobel laureate, and four of his PhD students went on to also receive the Nobel. He is known for the growth model named in his honor. Garett Jones of GMU joins Bob to discuss the work of Solow, focusing on the possible tension between the Solow model's conclusions about capital accumulation vis-à-vis the Austrian School. Join Tom DiLorenzo, Joe Salerno, and Patrick Newman in Tampa on February 17:...

Read More »When Medical Authorities Went Totalitarian: Understanding Covid Policies and Protocols

The response to the covid-19 outbreak is better understood as a tool of the national security state rather than as a public health measure. Original Article: When Medical Authorities Went Totalitarian: Understanding Covid Policies and Protocols [embedded content] Tags: Featured,newsletter

Read More »The Problems with Post-Trump Populism

As both progressives and conservatives turn authoritarian, libertarian populism inspired by Murray Rothbard provides an alternative to the statist nonsense that dominates political discourse. Original Article: The Problems with Post-Trump Populism [embedded content] Tags: Featured,newsletter

Read More »Modern Portfolio Theory Is Mistaken: Diversification Is Not Investment

While the creator of modern portfolio theory was awarded a Nobel Prize, that doesn't mean the theory isn’t flawed. In fact, it explains very little about investments. Original Article: Modern Portfolio Theory Is Mistaken: Diversification Is Not Investment [embedded content] Tags: Featured,newsletter

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org