Swiss Franc The Euro has risen by 0.12% to 1.093 EUR/CHF and USD/CHF, December 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets continue to tread water as investors await this week’s key events. The first, the FOMC meeting concludes later today. Tomorrow features the UK election, where the race appears to have tightened, and Lagarde’s first ECB meeting at the helm. Global equities continue...

Read More »FX Daily, November 13: Investors Temper Euphoria

Swiss Franc The Euro has fallen by 0.27% to 1.09 EUR/CHF and USD/CHF, November 13(see more posts on EUR/CHF, USD/CHF, ) Source: market.ft.com - Click to enlarge FX Rates Overview: The recent rise in equity markets and backing up in yields spurred many observers to upgrade their macroeconomic outlooks rather than the other way around. Yet we continue to see may worrisome signs. It is not just trade, though, of course, that is part of it. Sentiment itself is...

Read More »Dollar Mixed on Central Bank Thursday

As expected, the Fed cut rates by 25 bp; the dollar firmed after the decision but has since given back some gains During the North American session, there will be a fair amount of US data BOE is expected to keep rates steady; UK reported August retail sales SNB and BOJ kept rates steady, as expected; Norges Bank unexpectedly hiked 25 bp Brazil cut rates 50 bp to 5.5%; Indonesia cut rates 25 bp to 5.25%; Taiwan kept rates steady at 1.375%; SARB is expected to remain...

Read More »FX Daily, April 17: Veracity of Chinese Data Questioned, but Lifts Sentiment Nevertheless

Swiss Franc The Euro has risen by 0.24% at 1.1395 EUR/CHF and USD/CHF, April 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The veracity of Chinese data will be questioned by economists, but today’s upbeat reports round out a picture that began with stronger exports and a surge in lending. Chinese officials, we argue, had a “Draghi moment” and decided to...

Read More »If Bitcoin Is A Bubble…

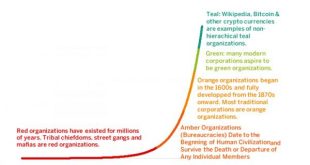

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

Read More »Key Events In The Coming Week: All Eyes On Fed Balance Sheet Announcement

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA highlights the week's key global events: Central bank meetings: US FOMC and BoJ The Fed will make policy announcement on Wednesday. Balance sheet...

Read More »Talking Global Macro Investing With A 25-Year Market Veteran

- Click to enlarge By Chris at www.CapitalistExploits.at If you were rich, successful, and intelligent – which often, not always, go hand in hand together – where would you live? The last time I was in the Rockies, I remember thinking to myself. You know what, if it weren’t for the fact it’s so damn far from the beach I could actually live here. It’s really quite lovely....

Read More »Talking Global Macro Investing With A 25-Year Market Veteran

By Chris at www.CapitalistExploits.at If you were rich, successful, and intelligent - which often, not always, go hand in hand together - where would you live? The last time I was in the Rockies, I remember thinking to myself. You know what, if it weren't for the fact it's so damn far from the beach I could actually live here. It's really quite lovely. Bite-your-hand-to-stop-you-from-crying-out-loud-lovely and if, like me, you're a sucker for snowboarding, then it's pretty hard to be...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

Read More »Risk Off: Global Stocks Slide As “Fire And Fury” Results In “Selling And Fear”

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday’s sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org