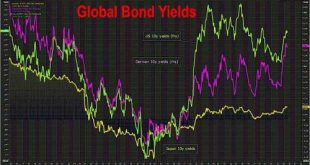

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

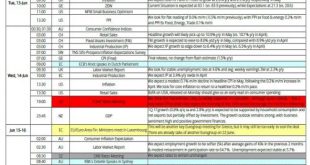

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »Europe, US Futures Slip Despite Brent Bouncing Back To $51

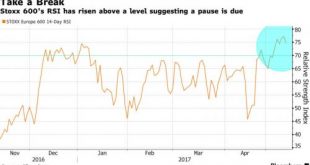

Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

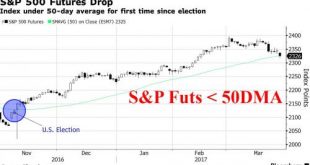

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

Read More »Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017’s ‘known unknowns’ suggest a year of more mayhem awaits… Here’s a selection of key events in the year ahead (and links to Bloomberg’s quick-takes on each). January Donald Trump will be sworn in as U.S. president on Jan. 20.QuickTakes: Immigration Reform, Free Trade and Its Foes, Supreme Court, Oil Sands, Confronting Coal, Climate Change,...

Read More »Negative and the War On Cash, Part 2: “Closing The Escape Routes”

Submitted by Nicole Foss via The Automatic Earth blog, Part 1 Here. History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966: In the absence of the gold...

Read More »FX Daily, August 11: Sterling Struggles to Find a Bid, While RBNZ Can’t Knock Kiwi Down

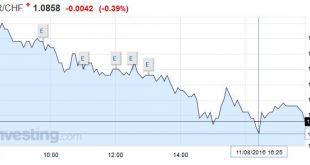

Swiss Franc Once again, EUR/CHF reverses in the middle of the week. A part from technical reasons, the weak French CPI (+0.4% YoY) and Italian CPI (-0.2% YoY) exercised downwards pressure on the euro. Click to enlarge. FX Rates The US dollar has found steadier footing today after trading heavily yesterday. There are two main themes. The first is sterling’s heavy tone. After closing the North American session...

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

Read More »5 Things The Media Isn’t Telling You About The Olympics

Submitted by Alice Salles via The AntiMedia.org, This year’s Olympics have a particularly romantic setting: Rio de Janeiro. In the 1950s and 60s, Rio’s most prominent artists were international stars, which made the popularity of “Bossa Nova” the perfect opportunity for Brazilians to share their culture and approach to life with the world. But throughout the following decades, Brazil changed considerably in the eyes of foreigners. It became the land...

Read More »Global Peace Index: Only 10 countries not at war (among them Switzerland)

Authored by Adam Withnall, originally posted at The Independent, The world is becoming a more dangerous place and there are now just 10 countries which can be considered completely free from conflict, according to authors of the 10th annual Global Peace Index. The worsening conflict in the Middle East, the lack of a solution to the refugee crisis and an increase in deaths from major terrorist incidents have all...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org