It has been a rough week in most markets with both equities and bonds declining sharply. Tech stocks have been pummeled with many ‘big names’ plunging more than 50% (from their 52-week high). Some of the bigger names include Zoom Video -75%, PayPal -73%, Netflix -72%, Meta Platforms (Facebook), -53%. . The equity market decline is coupled with announced layoffs. Robinhood, the popular online trading platform, announced a 9% reduction in full-time staff this week for...

Read More »The Fed Has No Idea What’s Coming Next!

We will let you know what we are doing once we know what we are doing was the message from the Federal Reserve statement and Chair Powell’s press conference that followed. The Fed, as widely expected did raise their short-term rate, known as the fed funds rate, by .25% to a range of 0.25% to 0.50%. This was the first increase since 2018. Along with the statement FOMC (Federal Open Market Committee) participants also released their Summary of Economic Projections....

Read More »Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More Inflation is Soaring.. America’s Inflation Burst This morning on Face The Nation, Mohamed El-Erian, former Harvard endowment manager, former bond king apprentice, economist and the man who seems to have a permanent presence on CNBC, had this to say: The characterization of inflation as transitory...

Read More »Weekly Market Pulse: Buy The Dip, If You Can

[unable to retrieve full-text content]If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and closed down 725, a loss of a little over 2%. The S&P 500 did a little better but closed down 1.5%.

Read More »Fed Chairman: “We’re Not Even Thinking About Thinking About Raising Rates”

Jerome Powell Market volatility has suddenly spiked in recent days came after the Federal Reserve vowed last Wednesday to keep its benchmark rate near zero through 2022. That’s an unusually long period for the Fed to be projecting rate policy. It reflects the fact that it will take many months and perhaps years for the tens of millions of jobs that were recently lost to return. During his press conference, Chairman Powell stumbled and stammered his way into stating...

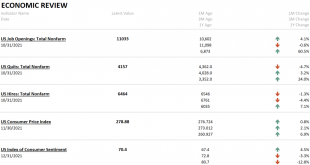

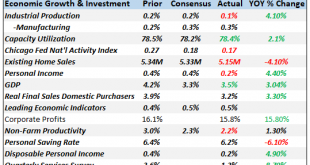

Read More »Monthly Macro Monitor – November 2018

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral. Clarida last week said the FF rate was close to neutral and that future hikes should be “data...

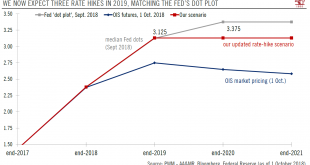

Read More »Taking the Fed’s dots at face value

We now expect the Fed to raise rates three times next year instead of two.The Federal Reserve (Fed) is subtly turning more hawkish, mostly due to its increased confidence in the US outlook. While the Fed’s ‘dot plot’ chart (which illustrates the central bank’s rate hike projections) was unchanged in September from June, we think the chart’s message that there will be three Fed rate hikes next year should be taken more seriously by the market.Consequently, we are revising up the number of...

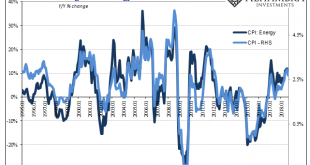

Read More »Downslope CPI

Cushing, OK, delivered what it could for the CPI. The contribution to the inflation rate from oil prices was again substantial in August 2018. The energy component of the index gained 10.3% year-over-year, compared to 11.9% in July. It was the fourth straight month of double digit gains. Yet, the CPI headline retreated a little further than expected. After reaching the highest since December 2011 the month before,...

Read More »What Fed Chair Powell Forgot to Mention

Son of the Imperial City What are the chances of Federal Reserve Chairman Jerome Powell being wrong? The chances he’ll be wrong on the economy’s growth prospects, the direction of the federal funds rate, and inflation itself? Our guess is his chances of being wrong are quite high. The new central planner-in-chief. - Click to enlarge Central banks are facing a special case of the socialist calculation problem...

Read More »Fed update-Jerome Powell’s testimony to Congress

The Fed remains upbeat on growth and its members may be tempted to raise their rate expectations.Fed Chair Jerome Powell highlighted continuity with Janet Yellen’s monetary policy in his testimony before Congress today.He highlighted “positive developments” since the December meeting. This could be a hint that an additional rate hike could be in the pipeline (The Fed indicated three rate hikes in the December dot plot).Reading between the lines, it remains clear that the Powell Fed will not...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org