Swiss Franc The Euro has risen by 0.14% at 1.1373 EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equities are finishing softly after the rally stalled in the middle of the week. The large markets in Asia fell, led by China, and the MSCI Asia Pacific Index fell for a third session, the longest losing streak in two months. Europe’s...

Read More »Europe and China

The US-China trade talks look like they may very well continue through most of the second quarter, despite how much progress is being claimed. Meanwhile, the tariffs remain in effect, but the market’s sensitivity to developments has slackened since it was clear the Trump and Xi were not going to meet at the end of this month. Europe’s relationship with China will eclipse the US-China trade talks that resume with Mnuchin...

Read More »It’s Not That There Might Be One, It’s That There Might Be Another One

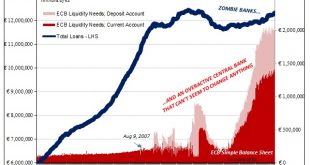

It was a tense exchange. When even politicians can sense that there’s trouble brewing, there really is trouble brewing. Typically the last to figure these things out, if parliamentarians are up in arms it already isn’t good, to put it mildly. Well, not quite the last to know, there are always central bankers faithfully pulling up the rear of recognizing disappointing reality. At the end of November, Mario Draghi went...

Read More »FX Weekly Preview: The Week Ahead: Don’t Skip Steps on Escalation Ladders

United States The drop in US yields and disappointing economic data weighed on sentiment and the dollar last week. Even weakness in equities, which had seemed to lend the greenback support, failed to do so at the end of last week. With the real Fed funds rate (adjusted for inflation) below zero, employment at 50-year lows, and some fiscal stimulus still in the pipeline, the doom and gloom cant of a recession next year...

Read More »FX Weekly Preview: Unfinished Business

Often, and apparently wrongly attributed to Mark Twain is the observation that it is not what we know that gets into trouble, but “what we know that just ain’t so.” Now though, investors suffer from a different problem. Several processes are in motion, and there is little confidence in their outcomes. Among these are Brexit, US-China trade, the trajectory of Fed policy, and the EC’s efforts to enforce the agreed-upon...

Read More »Harmful Modern Myths And Legends

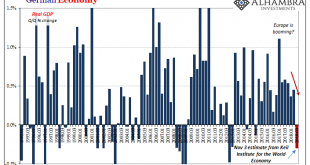

Loreley Rock near Sankt Goarshausen sits at a narrow curve on the Rhine River in Germany. The shape of the bluff produces a faint echo in the wind, supposedly the last whispers of a beautiful maiden who threw herself from it in despair once spurned by her paramour. She was transformed into a siren, legend says, a tantalizing wail which cries out and lures fishermen and tradesmen on the great river to their death. While...

Read More »FX Weekly Preview: What Can Bite You This Week?

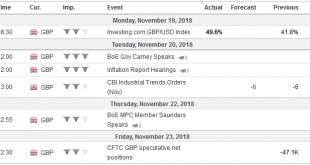

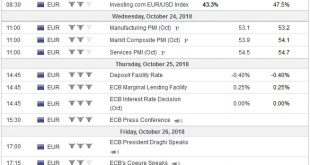

Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets. Also, the...

Read More »FX Weekly Preview: Has an Inflection Point been Reached for Investors?

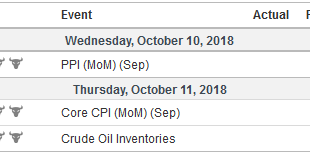

Interest rates, led by the US, have accelerated to the upside. With price pressures generally rising and oil prices at four-year highs, it is understandable. Market participants need to see the breakout that has lifted US 10-year yields to their highest level in seven years is confirmed in subsequent price action. The first test was passed as the disappointing jobs growth in September could have been an excuse to push...

Read More »FX Daily, October 01: NAFTA Deal Struck, Softer EMU Mfg PMI, and Firm Greenback Starts Week

Swiss Franc The Euro has risen by 0.16% at 1.1415 EUR/CHF and USD/CHF, October 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Canadian dollar and Mexican peso are extending its pre-weekend gains on news that a new NAFTA deal (US-Mexico-Canada Agreement USMCA) has been struck. Against most of the other major and emerging market currencies, the US dollar...

Read More »FX Weekly Preview: Next Week’s Drivers

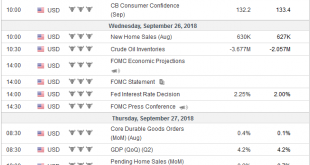

It is a testament to the Federal Reserves communication and the evolution of investors’ understanding that we can say that the rate hike that the central bank will deliver is not as important as what it says. A rate hike is a foregone conclusion. According to the CME’s model, there is about an 85% chance of December hike discounted as well. The effective Fed funds rate is 1.92% with the target range of 1.75%-2.00%. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org