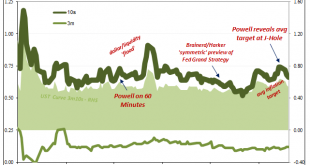

Since the unnecessary destruction brought about by GFC2 in March 2020, there have been two detectable, short run trendline upward moves in nominal Treasury yields. Both were predictably classified across the entire financial media as the guaranteed first steps toward the “inevitable” BOND ROUT!!!! Each has been characterized as the handywork of master monetary tactician Jay Powell. There is some truth underlying, only stripped of all that hyperbole. These backups in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org