Swiss Franc The Euro has fallen by 0.32% at 1.135 EUR/CHF and USD/CHF, October 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is rising against most of the major and emerging market currencies. The Swiss franc and the Japanese yen are the exceptions and are holding their own. Global equities are mixed. Asia, excluding Japan, was mostly lower,...

Read More »FX Daily, October 01: NAFTA Deal Struck, Softer EMU Mfg PMI, and Firm Greenback Starts Week

Swiss Franc The Euro has risen by 0.16% at 1.1415 EUR/CHF and USD/CHF, October 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Canadian dollar and Mexican peso are extending its pre-weekend gains on news that a new NAFTA deal (US-Mexico-Canada Agreement USMCA) has been struck. Against most of the other major and emerging market currencies, the US dollar...

Read More »FX Daily, September 25: Greenback Remains at the Fulcrum

Swiss Franc The Euro has risen by 0.35% at 1.137 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The major currencies are mixed in quiet turnover. Most of the European currencies are firmer, while the dollar-bloc currencies, yen and Swiss franc are softer. Emerging market currencies are steady to higher, though there are a few...

Read More »Dollar Slips, though Emerging Markets Trade Heavily

The US dollar is beginning the new week on a soft note, as China threatens not to accept the invitation for trade talks in Washington if the US imposes new tariffs on $200 bln of its goods, which the Wall Street Journal reports could come as early as today. Meanwhile, the MSCI Emerging Markets Index is giving back half of the 2.5% rally seen in the second half of last week. The Turkish lira is leading the emerging...

Read More »FX Weekly Preview: Trade Trumps US Jobs and Rising Stress in Spain and Italy is More Important than the PMI

The first week of a new month features the US jobs data. It is the most important economic report of a new month. It sets the broad tone for much of the economic data over the next several weeks, including consumption, industrial production, and construction spending. However, there are two reasons why it may not pack the punch it has in the past. First, the bar to dissuade the market against a 25 bp rate hike on...

Read More »FX Daily, August 14: Brief Respite but Little Relief

Swiss Franc The Euro has fallen by 0.41% to 1.1282. EUR/CHF and USD/CHF, August 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Corrective pressures grip the capital markets today, helped by the easing of the selling pressure on Turkey, but its more a respite than a relief as no new policy initiatives are behind the lira’s upticks. The implication of this is that it...

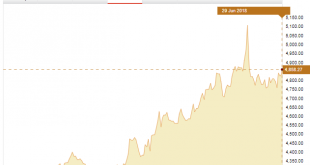

Read More »Gold’s Price Performance: Beyond the US Dollar

With the first half of 2018 now drawn to a close, much of the financial medias’ headlines and commentary relating to the gold market has been focusing on the fact that the US dollar gold price has moved lower year-to-date. Specifically, from a US dollar price of $1302.50 at close on 31 December 2017, the price of gold in US dollar terms has slipped by approximately 3.8% over the last six months to around $1252.50, a...

Read More »Greenback Corrects Lower

The consensus narrative is that with rising inflation it is understandable that next week’s meeting is live and that the confirmation of such has lifted the euro to ten-day highs, dragging the dollar broadly. However, to accept this is to accept the debasement of language. Until now, we dubbed central bank meeting that could result in action as “live.” For example, given that the Fed has not changed interest rates since...

Read More »FX Weekly Preview: Still Looking for Terra Firma

The weekend strike by the US, British and French forces against Syria appear to have been conducted in ways that minimize the risks of escalation by Russia. The limited nature of the strike and objectives suggest that the impact on the constellation of forces in Syria will be minimal. There is unlikely to be much of an impact in the global capital markets, though thin markets in early Asia could see a knee-jerk effect....

Read More »FX Daily, November 17: Euro, Yen and Sterling Regain Footing

Swiss Franc The Euro has fallen by 0.09% to 1.1686 CHF. EUR/CHF and USD/CHF, November 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trading with a heavier bias against the euro, sterling, and yen, but is firmer against the Antipodean currencies and many of the actively traded emerging market currencies. This mixed performance is the story of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org