Overview: After modest US equity gains yesterday, the weaker yen and Beijing’s approval of 60 new video games helped lift most of the large markets in the Asia Pacific region. South Korea and India were notable exceptions. Europe's Stoxx 600 is off for the second day as Monday's 0.9% advance continues to be pared. US futures are trading lower. The 10-year Treasury yield continues to hover around 3%, and European yields are up 3-5 bp today. The euro is little changed...

Read More »Synchronizing Chinese Prices (and consequences)

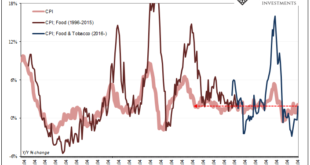

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things. To start with, yesterday China’s NBS reported the index for its consumer prices rose 2.1% year-over-year in April 2022. That’s up from...

Read More »Fed Day

Overview: The markets are mostly treading water ahead of the FOMC decision later today. Tech stocks tumbled in Hong Kong and the Hang Seng fell a little more than 1%, while India was the worst performer in the region falling over 2% following an unexpected and intra-meeting hike by the Reserve Bank of India. It raised the repo rate to 4.4% from 4.0%. Europe's Stoxx 600 is a little lower and has been unable to close the gap from Monday created from the lower...

Read More »So Much Fragile *Cannot* Be Random Deflationary Coincidences

At first glance, or first exposure to this, there doesn’t seem to be any reason why all these so many pieces could be related. Outwardly, from the mainstream perspective, anyway, you’d think them random, and even if somehow correlated they’re supposed to be in the opposite way from what’s happened. Too much money, they said. It began with the Fed’s Reverse Repo (RRP) use suddenly going nuts. From seemingly out of nowhere, this was mid-March last year, and, from what...

Read More »FX Daily, June 04: US and Canada Report on Jobs as G7 Fin Mins Talk Taxes

Swiss Franc The Euro has fallen by 0.12% to 1.094 EUR/CHF and USD/CHF, June 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Stronger than expected US employment data, ahead of today’s monthly report and compromise proposal on corporate tax by the White House to help secure a deal on infrastructure sent US bond yields and the dollar high. Late dollar shorts were forced to cover. The greenback is mixed now,...

Read More »FX Daily, April 26: Big Week Begins Quietly, with the Greenback Still Under Pressure

Swiss Franc The Euro has fallen by 0.03% to 1.1048 EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: What promises to be a notable week has begun off quietly: the US, EMU, and South Korea report Q1 GDP. The eurozone also provides its first estimate of April inflation. Corporate earnings feature tech and financial firms. Equities are mostly firmer in the Asia Pacific region and...

Read More »FX Daily, February 05: Position Squaring Weighs on the Dollar Ahead of the Jobs Report

Swiss Franc The Euro has risen by 0.04% to 1.0821 EUR/CHF and USD/CHF, February 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: While equities continue to march higher, the dollar is softer amid position squaring ahead of the US jobs data. Gold has stabilized after yesterday’s shellacking. Estimates for US nonfarm payrolls appear to have been creeping higher, encouraged by the ADP, PMI, and weekly initial...

Read More »Is the West repeating India’s mistakes? – Part II

Interview with Jayant Bhandari Claudio Grass (CG): In such a vast and incredibly diverse country like India, can top-down measures and centralized policies like affirmative action or caste-based economic incentives effectively force social change and economic equality? Or can they be seen as merely symbolic moves, or perhaps just political maneuvers? Jayant Bhandari (JB): The government should get completely out of the business of social engineering. Even under a purely...

Read More »FX Daily, June 24: Risk Appetites Satiated for the Moment

Swiss Franc The Euro has fallen by 0.07% to 1.0672 EUR/CHF and USD/CHF, June 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally in risk assets in North America yesterday is failing to carry over into today’s activity. Asia Pacific equities were mixed. Korea and Indonesia led the advances with more than 1% gain. China and Taiwan also gained. Japan and Hong Kong. Europe’s Dow Jone’s Stoxx 600 is giving...

Read More »“The illusions of Keynesianism create a morally corrupt society”

Interview with Jayant Bhandari: Part I of II The global economic shutdown has inflicted unprecedented damage and caused widespread destruction both in the economy and in our societies. While the true scale of the crisis is yet to be revealed, we already have enough data to support the case for a deep recession that will likely last for a long time. And yet, mainstream media reports and “expert” commentary has so far largely been focused on the impact of the crisis in the West. ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org