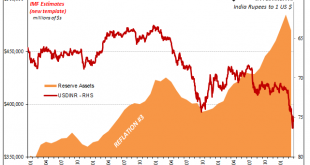

India like many emerging market countries around the world holds an enormous stockpile of foreign exchange reserves. According to the latest weekly calculation published by the Reserve Bank of India (RBI), the country’s central bank, that total was a bit less than half a trillion. While it sounds impressive, when the month began the balance was much closer to that mark. Over the last several crisis-filled weeks, officials in India have been fighting against a...

Read More »Time Again For Triple Digit Dollar

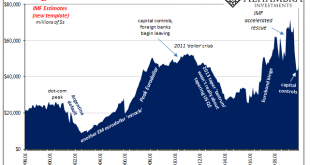

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig. Lagarde had staked a lot on the organization’s largest ever rescue plan. It was a show of force meant to shore up...

Read More »The Scientism of Trade Wars

One year ago, last October, the IMF published the update to its World Economic Outlook (WEO) for 2018. Like many, the organization began to talk more about trade wars and protectionism. It had become a topic of conversation more than concern. Couched as only downside risks, the IMF still didn’t think the fuss would amount to all that much. Especially not with world’s economy roaring under globally synchronized growth. Even though there were warning signs already by...

Read More »Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset

On 17 April, Turkish news publication Ahval published a report stating that during 2017, Turkey withdrew 26.8 tonnes of gold that it had stored in the vaults of the New York Federal Reserve, and moved this gold under the custodianship of the Bank of England and the Bank for International Settlements (BIS). The source of the Ahval report was a Turkish language article from the popular Hürriyet newspaper in Turkey....

Read More »IMF forecasts 2.25 percent Swiss GDP growth in 2018 while pointing to risks

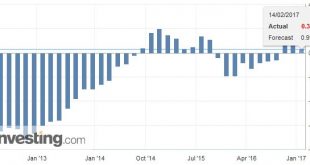

A boost to investment and net exports from the tailwind of strong external demand, together with faster expansion of household spending owing to rising employment, are forecast to lift GDP growth to around 2¼ percent in 2018, said the IMF in a statement referring to Switzerland issued on 26 March 2018. © Tibor Ritter | Dreamstime.com - Click to enlarge On the downside the IMF said: rising international trade tensions...

Read More »Why the World’s Central Banks hold Gold – In their Own Words

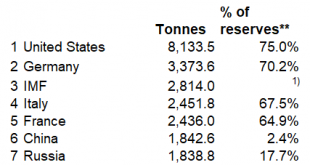

Collectively, the central bank sector claims to hold the world’s largest above ground gold bar stockpile, some 33,800 tonnes of gold bars. Individually within this group, some central banks claim to be the top holders of gold bullion in the world, with individual holdings in the thousands of tonnes range. This worldwide central bank group, also known as the official sector, spans central banks (such as the Deutsche...

Read More »FX Weekly Preview: A New Phase Begins

There were no celebrations; no horn or trumpets, nary a sound, but an important shift took place last week. The shift was signaled by two events. The first was the US strike on Syria, and the second was investors’ willingness to look past Q1 economic data. The US missile strike on Syria was significant even if it fails to change the dynamics on the ground. It undermines the Trump Administration’s ability to “reset” the...

Read More »Greece and the Return of the Repressed

Summary: Don’t expect a deal between Greece and its official creditors until late spring or early summer. Grexit is still not a particularly likely scenario. It was the European governments not Greece which put other taxpayers’ skin in the game. Freud warned that unresolved psychological conflicts might be repressed but they keep returning. So too with Greece debt problems. A new crisis is at hand. Investor...

Read More »Greek Bonds may Soon be Included in ECB Purchases

Summary: The ECB accepts Greek bonds as collateral but does not include them in its asset purchases. A new staff-level agreement by the end of the year could change that. Finance ministers imply that Greece’s debt is sustainable, but the IMF disagrees. The ECB does not include Greek bonds in its sovereign bond purchase operation. However, the progress is being made, and it is possible that starting early next...

Read More »What the Greek Deal Does and Does Not Do

For investors, the most important thing about the successful review of Greece’s implementation of last year’s agreement is that it effectively removes it from the list of potential disruptive factors in the coming quarters. There will be no repeat of last year’s drama. Assuming Greece resolves a few outstanding issues in the next few days, it will be given roughly 7.5 bln euros next month and another three bln euros over the summer. The funds will be in Greece’s hands for the shortest...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org