It appears nothing can stop the upward moment of equities heading into the year end, and as has been the case for the past few weeks, US traders walk in with futures higher, propelled by European stocks which climbed to their highest in almost a year, while the dollar rose and bonds and gold fell, failing again to respond to a series of geopolitical shocks following terrorist attacks in Ankara, Berlin and Zurich. The yen tumbled after the Bank of Japan maintained its stimulus plan even as the...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

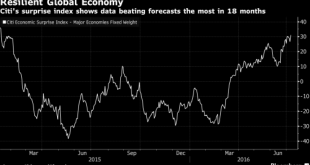

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

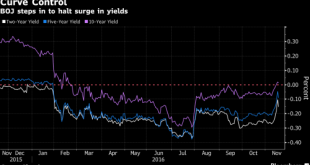

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

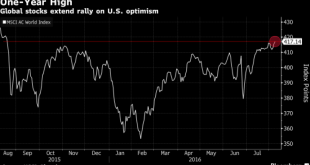

Read More »S&P To Open At New Record High As Commodities Rise, China Trade Disappoints

The meltup continues with the S&P500 set to open at new all time highs as futures rise 0.2% overnight, with European, Asian stocks higher, as job data pushed MSCI Asia Pacific Index towards highest close since Aug. 2015. Germany, U.K. economic data seen positive, with dollar, oil rising, and gold declining. Global equities advanced with commodities and emerging markets on speculation the U.S. economy is strong enough to sustain growth while only triggering a gradual increase in interest...

Read More »Greenspan explains negative Swiss Yields

Jeff Gundlach is not the only person who is feeling “maximum negative” on Treasuries. In an interview, none other than the “Maestro” Alan Greenspan, the man whose “great moderation” policy made the current global bond bubble possible, said that he is worried bond prices have risen too high. Asked if he finds what is happened in the bond market right now “in any way, shape, or form concerning for financial...

Read More »“The World Is Walking From Crisis To Crisis” – Why BofA Sees $1,500 Gold And $30 Silver

Gold With both stocks and US Treasury prices at all time highs the market is sensing that something has to give, and that something may just be more QE, which likely explains the move higher in gold to coincide with both risk and risk-haven assets. As of moments ago, gold rose above $1,370, and was back to levels not seen since 2014. Curiously, the move higher is taking place after Friday’s “stellar” jobs report,...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

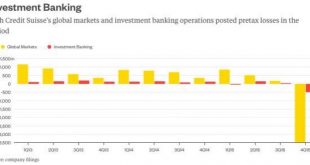

Read More »Why An Ex-Credit Suisse Banker In Brazil Made More Money Than The CEO

Ever had to testify in a trial involving your father’s dealings in corrupt activities, and as a result had your tax records leaked for all of the public to see? Sergio Machado, the ex-head of Credit Suisse’s Brazil fixed-income business has, and now everyone knows how much he made in 2015. Sergio’s father, who goes by the same name, is a former Brazilian politician who went on to head the state run oil company...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org