Via FinancialSense.com, One of the world's most powerful supercomputers, retrofitted for trading the stock market, appears to be betting on a crash in the months ahead. The Financial Crisis Observatory (FCO) at ETH Zurich released its latest Global Bubble Status Report on July 1st. As we discussed with FCO’s director, Didier Sornette, on our podcast in May, they use one of the world’s leading supercomputers to monitor global markets each day for two distinct bubble-like...

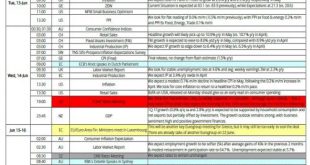

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »Negative Rates: The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension). And now companies that operate storage facilities for precious metals and other...

Read More »The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension). And now companies that operate storage facilities for precious metals and other valuables are ramping up their capacity to help cash in on the soaring...

Read More »Saxo Warns Reflation Trade Ends In Q2 With “Healthy Correction”

The reflation trade that started before Donald Trump’s victory in the US presidential elections accelerated in Q1 as global economic data improved and surprised against expectations. Global equities are up 6.5% in dollar terms with markets such as Hong Kong, emerging markets, and Brazil the clear outperformers. In its Q2 2017 Outlook report, Saxo Bank warns that the reflation trade will end in Q2 with a healthy correction in global equities. The biggest perception-versus-reality...

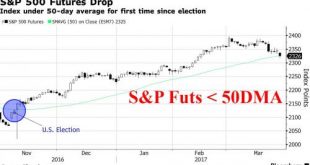

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

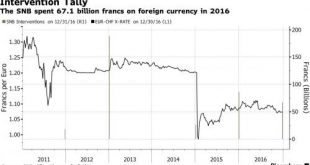

Read More »SNB Spent $68 Billion On Currency Manipulation In 2016

While Donald Trump has repeatedly expressed his displeasure with China for manipulating its currency, he appears to have recently figured out that over the past 2 years Beijing has been spending hundreds of billions in dollar to strengthen, not weaken, the Yuan and to halt the ~$1 trillion in capital flight from China. But while everyone knows that the biggest currency manipulation in the world, and perhaps the Milky...

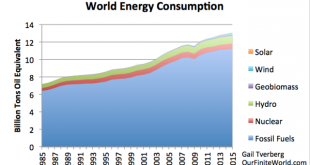

Read More »Destroying The “Wind & Solar Will Save Us” Delusion

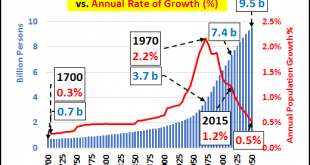

The “Wind and Solar Will Save Us” story is based on a long list of misunderstandings and apples to oranges comparisons. Somehow, people seem to believe that our economy of 7.5 billion people can get along with a very short list of energy supplies. This short list will not include fossil fuels. Some would exclude nuclear, as well. Without these energy types, we find ourselves with a short list of types of energy — what...

Read More »Policy Makers – Like Generals – Are Busy Fighting The Last War

Submitted by Chris Hamilton via Econimica blog, The Maginot Line formed France’s main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success…as the Germans never seriously attempted to attack it’s...

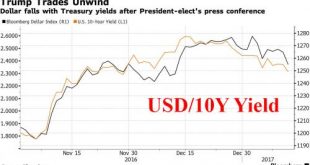

Read More »Dollar, Futures Slump; Gold Spikes Over $1,200 After Trump Disappoints Markets

Risk assets declined across the globe, with European, Asian shares and S&P 500 futures all falling, while the dollar slumped against most currencies after a news conference by President-elect Donald Trump disappointed investors with limited details of his economic-stimulus plans, and the Trumpflation/reflation trade was said to be unwinding. "The risk was always that a president like Trump would end up upsetting that consensus (of faster U.S. growth, stronger dollar) view by introducing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org