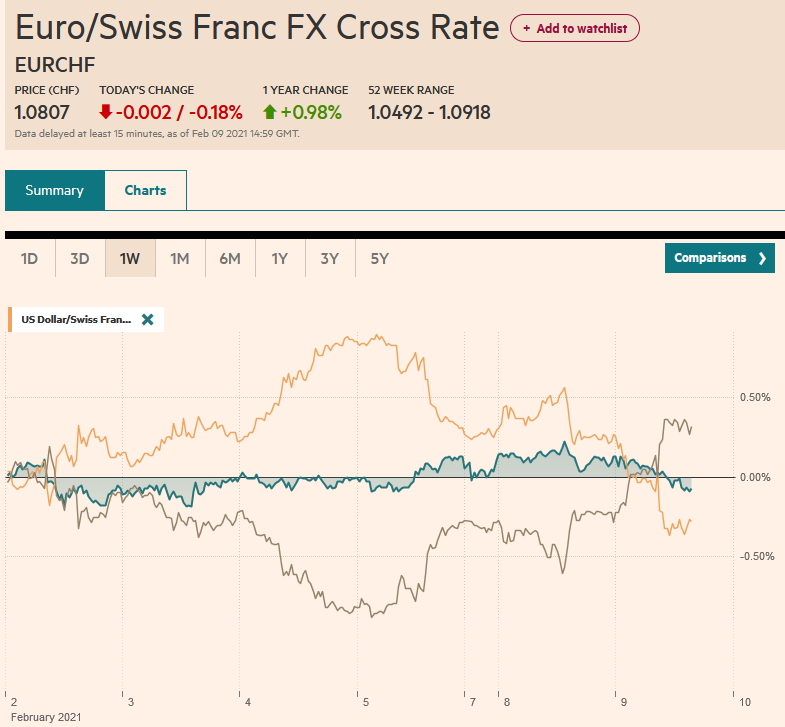

Swiss Franc The Euro has fallen by 0.18% to 1.0807 EUR/CHF and USD/CHF, February 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally of US benchmarks to new record highs helped lift most Asia Pacific markets today, but the bulls are pausing in Europe, and there has been little follow-through buying of US shares. Australia, South Korea, and Indonesia did not participate in today’s regional advance led by a 2% rally in China’s main indices. Most European markets are lower, and the Dow Jones Stoxx 600 may post its first loss of the month. US shares are trading a bit lower. The US 10-year note began recovering yesterday as buyers emerged as the yield approached 1.20%. It is not below 1.15% and set to snap

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Brexit, China, Currency Movement, Featured, Fiscal policy, Interest rates, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.18% to 1.0807 |

EUR/CHF and USD/CHF, February 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

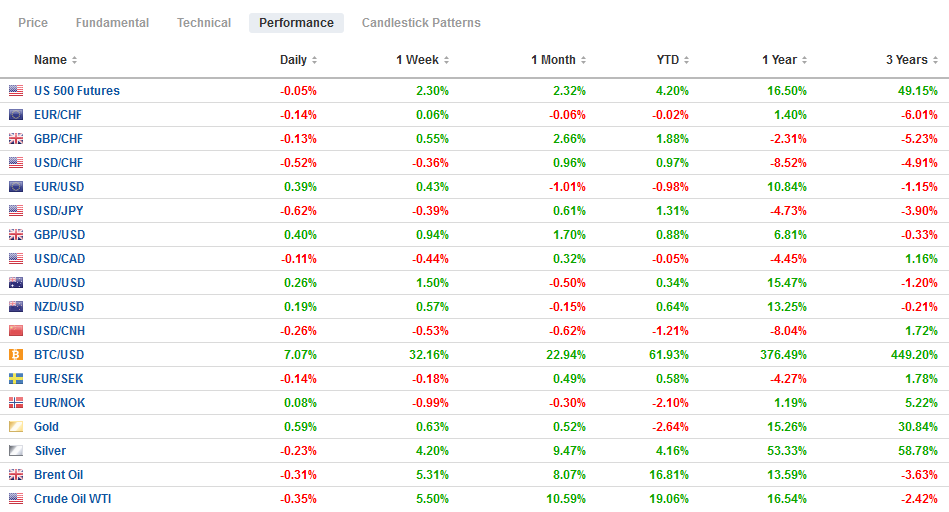

FX RatesOverview: The rally of US benchmarks to new record highs helped lift most Asia Pacific markets today, but the bulls are pausing in Europe, and there has been little follow-through buying of US shares. Australia, South Korea, and Indonesia did not participate in today’s regional advance led by a 2% rally in China’s main indices. Most European markets are lower, and the Dow Jones Stoxx 600 may post its first loss of the month. US shares are trading a bit lower. The US 10-year note began recovering yesterday as buyers emerged as the yield approached 1.20%. It is not below 1.15% and set to snap an eight-day rise. European bonds are slightly lower and Italy’s 10-year has edged to a new record low of almost 50 bp. The dollar had begun off firmly yesterday after the pre-weekend drop in response to the disappointing employment report. Still, as the session progressed, it softened, and today, it is being sold across the board. The yen and Swiss franc are the strongest (~0.6%), while as typically the case in periods of a soft greenback, the Canadian dollar is a laggard (~0.2%). Nearly all the emerging market currencies are also firmer today, with the notable exception of the Turkish lira, which is off about 0.3%. Gold is higher for a third session. It has risen from last Thursday’s low of $1785 to poke above $1847.50 today. The surge in oil prices continues, and the March WTI is up for the seventh consecutive session. It is consolidating after reaching a high slightly above $58.60 today. Recall it ended January near $52.20. |

FX Performance, February 9 |

Asia Pacific

China reported a surge in January lending, a typical calendar effect as new lending quotas are available. New yuan loans, which is about bank lending, rose to CNY3.58 trillion, up from a revised CNY1.26 trillion in December. For comparison, December 2019 and January 2020 figures were CNY1.14 and CNY3.34, respectively. Aggregate financing includes bank lending and activity from the so-called shadow banking sector, which in China includes banks and non-bank lenders’ wealth management arm. It surged to CNY5.17 trillion from CNY1.72 trillion. While these are strong lending figures, it has not shaken the sense that officials are trying to rein in leverage, and the slowing in M2 growth support such suspicions.

Labor earnings continue to decline in Japan. In December, cash earnings fell 3.2% year-over-year after a revised 1.8% decline in November (from -2.2% initially). It is the ninth consecutive year-over-year decline, even though it beat forecasts for a 4.8% decline (median estimates in the Bloomberg survey). Even though popular data surprise models would count this as good news, it is the largest decline since mid-2015. Part of the weakness stems from the 5.4% decline in bonuses. The labor income weakness cannot help consumption and underscore the prospects for a broader economic contraction in Q1. Separately, Japan reported a 9.7% year-over-year rise in machine tool orders after a 9.9% gain in December. On the month, it reflects a 10.5% decline in orders. Domestic orders fell by 17.2% and foreign orders by 7.4%.

The dollar is posting its largest decline against the yen in three months. It is off about 0.6% in the European morning to trade near JPY104.60. It had stalled last week a little above JPY105.75. It has entered our target area (~JPY104.40-JPY104.60). Below there, support is seen near JPY104.20. Similarly, the Australian dollar is moving higher for the third session, and it has entered our target zone of $0.7720-$0.7740. Above there, the next immediate target is the $0.7760 area. The dollar’s reference rate was set at CNY6.4533, slightly higher than the median forecast in Bloomberg’s survey. The PBOC’s quarterly report, which committed the central bank from making “sharp turns,” may have helped stabilize the money market, where officials have been stingy. The overnight repo rate fell 15 bp to 1.74%. The greenback is at the lower end of this year’s range against the yuan. It has only been below today’s low (~CNY6.4225) on three occasions this year.

Europe

Italy’s Draghi continues to draw support for putting together a new government from the old parliament. The next focus is on a potential cabinet. The issue here is whether it will be a technocrat government, which may lack democratic roots, or a political cabinet, which may be unwieldy, as former Prime Minister Conte can attest. Although Draghi’s commitment to a common EU budget is notable, it is not new or particularly relevant to Italy’s pressing problems. It may even be a distraction.

The EC is expected to reject the UK request for a two-year extension of a grace period before the full trade rules regarding goods entering Northern Ireland are fully implemented. Ireland says it is open to a “modest” extension, while the EC will only agree to a 3-6 month extension. To avoid violating the Good Friday Agreement by erecting a hard border between Northern Ireland and the Irish Republic, the trade deal stuck at the end of last year means goods from the UK must be checked in Belfast or Larne. As warned, the UK was ill-prepared, and this has caused a disruption, and even some food shortages in Ulster, according to reports.

The euro is moving above the 20-day moving average (~$1.2100) for the first time in a month and is overcoming the downtrend drawn off the early and late January lows. We have suggested the correction to the euro’s downtrend since that high on January 6 near $1.2350 can extend into the $1.2100-$1.2150 area. The upper end of that band remains a reasonable near-term target. After a quiet start in Asia, the euro was bid in early European turnover. Some consolidation would not be surprising in North America. Initial support is now seen in the $1.2060-$1.2080 area. Sterling is trading a new high since May 2018 as it edges toward $1.38 (having been to almost $1.3790). During early Asian hours, sterling pushed above $1.3780, and there has not been any momentum since then, of which to speak. Support is seen in the $1.3740-$1.3760 area.

America

There are two main talking points: the stimulus bill and the current debt sales. Today kicks off the quarterly refunding with a $58 bln offering of three-year notes. This is a $4 bln increase from November, but unchanged from the size offered in January. Today’s sale is about 46% of the $126 bln quarterly refunding. With such low long-term yields, the US debt managers seem to be missing an opportunity to lengthen the maturity of the US outstanding debt.

The Democrats criticize themselves for not taking advantage of its congressional strength to push through larger stimulus in Obama’s first term as a consensus was sought with Republicans. The Biden administration is loath to repeat that experience now. Targeting the $1400 checks more than previously is not about winning Republican votes but securing the moderate wind of the Democrat Party. While Summers (and Blanchard)’s economic arguments about the risk of inflation have been batted aside, the political concern raised has been all but ignored. The argument is that this large stimulus package, which is likely to be closer to $1.5 trillion, may sap the enthusiasm for a large infrastructure spending bill. The reconciliation maneuver that may get the stimulus through cannot be used a second time this year.

The US sees the JOLTs report, but it does not move the market, and December job data seems less relevant now. The January CPI will be reported tomorrow. Mexico’s January CPI will be released today, and a 0.77% increase on the month is expected to lift the year-over-year rate to 3.45% (from 3.15%). The core rate is expected to have risen by 0.35%. Barring a significant upside surprise, Banixco is expected to deliver a 25 bp rate cut on Thursday. Brazil reports the IPCA monthly inflation figures. A 0.31% rise on the month will lift the year-over-year rate to 4.62% from 4.52%. The Selic rate stands at 2.0%. Brazil’s central bank’s next move will likely be a hike, even if not at the next meeting on March 17.

The greenback peaked on January 28 near CAD1.2880. It closed below the 20-day moving average (~CAD1.2745) for the first time since January 26. Follow-through selling pushed it briefly below CAD1.2715 today before the US dollar caught a bid in the European morning and lifted it above CAD1.2740. Resistance is seen in the CAD1.2760-CAD1.2780 area. The dollar was rebuffed near MXN20.50 last week and made a new low for the month just above MXN20.01 today. It has not closed below its 20-day moving average (~MXN20.03) since January 21, and an intrasession break of MXN19.95 may suggest near-term potential toward MXN19.80.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Brexit,China,Currency Movement,Featured,fiscal policy,Interest rates,newsletter