We continue to think that the US economy is in better shape than most appreciate, and that underpins our strong dollar call Tensions are likely to remain high after reports emerged last week that the US will look into limiting capital flows into China US September jobs data Friday will be the data highlight of the week; there is a heavy slate of Fed speakers this week UK, eurozone, and Japan are expected to report weak data this week RBA meets Tuesday and is expected...

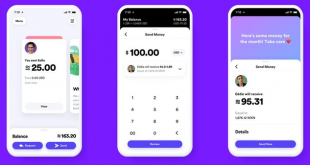

Read More »Libra stablecoin project ‘no threat’ to financial system

Central bankers and politicians in many countries have expressed concerns about Libra’s potential impact. Facebook’s Libra cryptocurrency poses no threat to central banks or to financial law and order, the head of the Geneva-based Libra Association tells swissinfo.ch. Many regulators, politicians and central banks have reacted with alarm to the proposed new digital payments system. Slated to launch next year, Libra plans to create a reserve of currencies – including...

Read More »BNP Paribas bank accused of complicity in Sudan rights abuses

The French complaint said that the US Department of Justice had described BNP Paribas as Sudan’s de facto central bank because it gave the Sudanese government access to international money markets, and allowed it to pay staff, the military and security forces. Victims of rights abuses in Sudan have filed a legal complaint against the French BNP Paribas bank and its Swiss subsidiary, accusing them of complicity in crimes against humanity, genocide and torture...

Read More »Dollar Firm as US Economy Continues to Outperform

Uncle Sam hat and money. American hat. Hat independence day - Click to enlarge Political uncertainty is likely to persist in the US; the big unknown is whether this will impact the US economy US core PCE reading will be of particular interest and is expected to rise 1.8% y/y; Quarles (voter) and Harker (non-voter) speak Dovish BOE comments are weighing on sterling; France reported weak CPI and consumer spending data Tokyo September CPI was lower than expected; FTSE...

Read More »USD/CHF technical analysis: Bulls trying to defend multi-week old ascending trend-channel

Fading safe-haven demand undermined the CHF demand and extended some support. Bears await a sustained weakness below short-term ascending channel support. The USD/CHF pair struggled to register any meaningful recovery and remained well within the striking distance of near three-week lows set in the previous session, coinciding with the lower end of a multi-week-old ascending trend-channel. Given that technical indicators on hourly charts maintained their bearish bias...

Read More »USD/CHF technical analysis: Bounces off 50-day SMA, eyes on Swiss ZEW data, SNB bulletin

USD/CHF takes a U-turn towards 38.2% Fibonacci retracement, 0.9950 resistance confluence. Sustained break of 50-DMA can recall 0.9800 on the chart. September month Swiss ZEW Expectations and SNB’s Q3 Bulletin in the spotlight. With its recent recovery from the 50-day simple moving average (SMA), the USD/CHF pair takes the bids to 0.9875 while heading into the European session on Wednesday. 38.2% Fibonacci retracement level of April-August declines, at 0.9880, becomes...

Read More »Pets Are Now as Unaffordable As College, Housing and Healthcare

Like so many other things that were once affordable, owning pets is increasingly pricey. One of the few joys still available to the average household is a pet. At least this is what I thought until I read 5 money-saving tips people hate, which included the lifetime costs of caring for a pet. It turns out Poochie and Kittie are as unaffordable as college, housing and healthcare (and pretty much everything else). Over the course of 15 years, small-dog Poochie will set...

Read More »World’s Largest Gold ETF Sees Holdings Rise 1.8 percent to 924.94 Tonnes In One Day

◆ Gold prices have inched 0.3% higher today as a sharp drop of nearly 2% yesterday has attracted bargain hunters ◆ Gold tested support at $1,500/oz after another peculiar sell off in the futures market saw prices fall $30 in two hours on the COMEX yesterday with most of the selling coming after European and London markets had closed ◆ The sell off came despite robust demand for gold globally as seen in the world’s largest gold ETF seeing yesterday, in just one day,...

Read More »Chasing wealth managers is a risky business

The centre of banking activity in Zurich Zurich is a sober and orderly city, so a fierce altercation near the Swiss National Bankexternal link between a banker to the world’s billionaires and a private detective who was trailing him is worthy of John Le Carré. It is all the more lurid that Credit Suisse ordered surveillance of Iqbal Khan after he left abruptly for its rival UBS. Credit Suisse was worried that Mr Khan, who led an expansion of wealth management there,...

Read More »FX Daily, September 27: Markets Limp into the Weekend with the Euro Languishing at New Lows and Sterling under Pressure

Swiss Franc The Euro has risen by 0.01% to 1.0851 EUR/CHF and USD/CHF, September 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities remain under pressures. The MSCI Asia Pacific Index lower today, though Chinese and Australian shares were firmer. It is the second consecutive week the benchmark has fallen. European equities are firmer, but not enough to offset the losses earlier this week and are set to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637049959004970218-310x165.png)