The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.” They did it – and it didn’t take. Lagarde’s outreach was simply an act of admitting reality. Having forecast an undercurrent of worldwide inflationary breakout (how...

Read More »Dollar Mixed as Markets Await Fresh Drivers

The virus news stream is mixed; the dollar continues to consolidate; US-China tensions continue to rise US Treasury wraps up its quarterly refunding; April budget statement is a harbinger of things to come; the next round of stimulus will be contentious We got some dovish BOE comments yesterday; UK continues to play Brexit hardball; UK data was slightly better than expected but awful nonetheless Japan reported March current account data; RBNZ expanded its QE program...

Read More »More Protectionism and Regulation Won’t Fix the Economy

In the wake of the COVID-19 pandemic and its attendant economic strains, some protectionists and anti-immigration ideologues are trying to take advantage of this opportunity to advance their nationalist agenda. They argue that if the United States had restricted international trade and immigration more thoroughly in the past, as President Trump had fought to achieve, the public health crisis could have been curtailed. Some are also arguing that imposing further...

Read More »6’000 CHF Dividenden im Jahr 2020 ??

6’000 CHF an Dividenden möchte ich im Jahr 2020 netto verdienen. Ob das machbar ist, möchte ich in diesem Beitrag genauer erläutern und analysieren. Im Jahr 2019 hatte ich 3’001.89 CHF an Dividenden netto erhalten, das möchte ich dieses Jahr verdoppeln. Verdopplung der Dividenden möglich? Ist es möglich, die Dividenden im vergleich zum Vorjahr zu verdoppeln? Ich glaube schon, aber nicht allein durch das Dividendenwachstum. Nein, vielmehr durch weitere...

Read More »FX Daily, May 13: Will Powell have any more Luck Pushing against Negative Rate Expectations in the US?

Swiss Franc The Euro has risen by 0.08% to 1.0521 EUR/CHF and USD/CHF, May 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Another late sell-off in US shares, this one perhaps related to the sobering assessment by the leading medical adviser for the Trump Administration about the risks of opening too early, failed to deter investors in the Asia Pacific region. Although Japanese shares slipped, most other...

Read More »7.9 billion hours worked in 2019

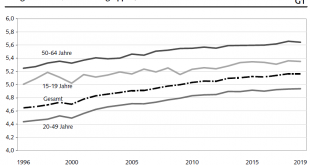

12.05.2020 – In 2019, people spent 7.929 billion hours working. Between 2014 and 2019, the actual weekly hours worked by full-time employees fell by 15 minutes on average, reaching 41 hours and 2 minutes. At the same time, the number of weeks of annual holiday continued its gradual increase to 5.2 weeks, according to the latest results from the Federal Statistical Office (FSO). The results in this press release concern the hours worked in 2019. The effects of the...

Read More »Coronavirus: anti-lockdown protests in Switzerland

© Ocskay Mark | Dreamstime.com Over the weekend, hundreds rallied against lockdown measures across Switzerland in the cities of Bern, Zurich, Basel and St. Gallen. Anti-lockdown protesters in these cities flouted rules introduced in mid-March banning public groups of more than five people, designed to reduce the spread of the SARS-CoV-2 virus. The protestors consider the rules in breach of their fundamental rights. In Bern and St. Gallen, dozens were stopped by the...

Read More »Falcon exits Swiss private banking after 1MDB scandal

Falcon is offering a social plan to staff who will lose their jobs. (Keystone) The Abu Dhabi-owned Falcon private bank says it is winding down activities in Switzerland and is in talks with a Swiss rival to take on its existing clients next year. Falcon was taken to task by regulators in both Switzerland and Singapore for its role in channelling assets from the Malaysian 1MDB fraud. The company says it has changed its name to “Falcon Private” but will remain under...

Read More »Different Type of Crisis, Some Old Concerns

Over the past two months we have witnessed historic turmoil followed by unprecedented intervention by policy makers and central banks in supporting the capital markets (and more). In many ways the 2020 COVID-19 pandemic is very different from the 2008 global financial crisis, but for some, certain old concerns still linger. In the face of short selling bans and worries about market liquidity, we discuss below how best to navigate some of the common objections and...

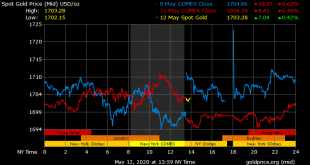

Read More »Pandemic, Lockdowns, Fake and Manipulated Markets – Gold and Silver Outlook

Watch Video Update (Live 12/05/2020 ◆ The massive global debt driven “Everything Bubble” is bursting due to the pandemic and more specifically the governments draconian economic lockdowns ◆ A dollar crisis is inevitable with U.S. government debt surging by some $2 trillion in a matter of weeks and ballooning to over $25 trillion ◆ Wall Street has just been bailed out at the expense of Main Street and families and businesses in the U.S. and throughout most of the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org