Since the beginning of the year, the corona crisis has monopolized news coverage to the extent that a lot of very important stories and developments either went underreported or were ignored altogether. One such example was the very surprising ruling that came out of the German Constitutional Court in early May, which challenged the actions and remit of the European Central Bank (ECB). In essence, the court’s decision made it clear that the ECB’s quantitative easing...

Read More »FX Daily, June 11: Are Risk Appetites Satiated, or Simply Taking the Day Off?

Swiss Franc The Euro has fallen by 0.28% to 1.0707 EUR/CHF and USD/CHF, June 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Many observers are attributing the sell-off in risk assets today to the Federal Reserve’s pessimistic outlook, yet, as we note below, the Fed’s median GDP forecast this year is better than many international agency forecasts, including the OECD’s that was issued yesterday. Moreover,...

Read More »Swiss Post set to relaunch its e-voting system

The controversial issue of e-voting is back: Swiss Post, which had halted the development of a project in July 2019, has bought a Spanish-owned system and plans to propose a platform ready for testing by 2021. Opposition to the plans of Swiss Post remains strong. The purchase was reported on May 17 by the SonntagsBlick newspaper, who wrote that the deal between Swiss Post and Spanish firm Scytl had been settled for an unspecified amount. The deal follows the...

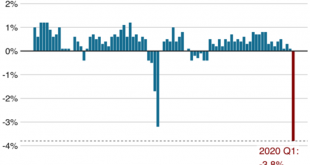

Read More »OECD forecasts drop in Swiss economic growth in 2020

Restrictions imposed to fight the Covid-19 pandemic, such as store closures, will have a major impact on Swiss GDP in 2020, the OECD predicts. Keystone / Laurent Gillieron Even though restrictions aimed at slowing the spread of Covid-19 were less strict than in other countries, Switzerland will still see its GDP fall by 7.7%, if the pandemic is contained by summer. Gross domestic product will not rebound until 2021, according to the forecast published by the...

Read More »Dollar Broadly Weaker Ahead of FOMC Decision

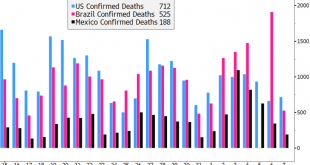

The FOMC decision comes out this afternoon and we expect a dovish hold; this would of course be negative for the dollar Ahead of the decision, May CPI will be reported; the budget statement will be of interest; Brazil reports May IPCA inflation We are still getting mixed messages about Europe’s flagship €750 bln recovery package; French April IP fell -20.1% m/m Japan reported weak May PPI and April core machine orders; Australia reported mixed sentiment indicators;...

Read More »Dollar Stabilizes as the New Week Begins

The dollar has stabilized a bit; Friday’s US jobs data could be a game changer The US bond market selloff continues; for now, the weak dollar trend is hard to fight The Brazilian government has found a way to make a bad situation worse by trying to control its Covid-19 statistics German IP came in a bit worse than expected at -17.9% m/m; the OPEC+ deal ended with the expected supply cut deal, lending continued support to crude prices Japan Q1 GDP revised higher on...

Read More »Why Gold Is Safe Haven Money And Will Go Over $3,000/oz

James Rickards holds a gold bar in a vault near Zurich, Switzerland. The bar is a so-called LBMA “good delivery” bar which weigh 400 ounces (over 99.9% purity), and is worth about $700,000 at current market prices. In 1971 it was worth $14,000. ◆ WHY GOLD? That’s a question I’m asked frequently. It’s usually followed by a comment along the lines of, “I don’t get it. It’s just a shiny rock. People dig it out of the ground and then put it back in the ground. What’s the...

Read More »Technocracy vs Liberty

“I prefer true but imperfect knowledge, even if it leaves much undetermined and unpredictable, to a pretense of exact knowledge that is likely to be false.” Friedrich August von Hayek On Friday Dave from X22 and I discussed the planned “Cultural Revolution 2020” led by “the anointed” technocrats and whether we have to accept their reality as ours – or not? [embedded content] This work is licensed under a Creative Commons Attribution 4.0 International License....

Read More »FX Daily, June 10: Corrective Forces Still Seem in Control Ahead of the FOMC Outcome

Swiss Franc The Euro has fallen by 0.31% to 1.0743 EUR/CHF and USD/CHF, June 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The pullback ins US shares yesterday has not derailed the global advance. Japanese and Chinese markets were mixed, the Hang Seng slipped, and Indonesia was hit with profit-taking, but the MSCI Asia Pacific Index eked out a small gain. It has fallen once past two and a half weeks. The...

Read More »Swiss develop first see-through mask

The transparent HelloMask allows non-verbal communication between patients and nursing staff Visualisation: EPFL A fully transparent surgical mask that filters out germs but allows facial expressions to be seen has been developed by Swiss scientists. Caregivers should be able to wear them from the summer of 2021. “For some segments of the population – like children, the elderly and the hearing impaired – the [current] masks are a major obstacle to communication,”...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org