© Haris Mulaosmanovic | Dreamstime.com The World Health Organization (WHO) recently changed its advice on face masks. It now recommends healthy people wear them in public when social distancing is not possible, stating that they could provide a barrier for potentially infectious droplets. The WHO had previously said there was not enough evidence to recommend healthy people should wear them, although it has always advised that medical face masks should be worn by...

Read More »Our Latest Thoughts on the Dollar

The dollar remains under pressure, due in large part to the Fed’s aggressive efforts to inject stimulus. We see dollar weakness persisting near-term. From a longer-term perspective, we note that the greenback remains largely rangebound and is unlikely to fall below its 2018 lows. Dollar Index, 2015-2020 - Click to enlarge RECENT DEVELOPMENTS There is a growing debate as to the root causes of recent dollar weakness. Is it the burgeoning national debt? The poor US...

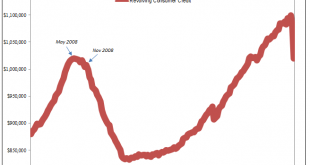

Read More »A Second Against Consumer Credit And Interest ‘Stimulus’

Credit card use entails a degree of risk appreciated at the most basic level. Americans had certainly become more comfortable with debt in all its forms over the many decades since the Great Depression, but the regular employment of revolving credit was perhaps the apex of this transformation. Does any commercial package on TV today not include one or more credit card offers? It certainly remains a staple of junk mail. Leaning more and more on credit cards during the...

Read More »Monetary Metals Provides Gold Loan to Sector Resources

The loan is denominated in gold with interest and principal paid in gold Scottsdale, Ariz., June 9, 2020—Monetary Metals® announced today that it has loaned gold to Sector Resources Canada Ltd., a British Columbia based gold mining company. The private transaction was conducted off-market, and the interest rate and terms were not disclosed. Monetary Metals’ innovative business model enables gold-owning investors to lease or lend gold to businesses that use gold....

Read More »The Search for Yield

A no-holds-barred discussion of the economy after the coronavirus shutdown and George Floyd protests. Are we facing another Great Depression? Can there be a V-shaped recovery or is this wishful thinking? What will all the new money and credit created by Congress and the Fed mean for the dollar? What kind of economic mess will Trump or Biden inherit in 2021? How far will Fed chair Powell go to keep markets propped up? And how can you protect yourself and your...

Read More »Selma vs Yova – Best Robo-Advisor for Sustainable Investing?

(Disclosure: Some of the links below may be affiliate links) Many of you have asked me about sustainable investing and how they should invest in Sustainable Instruments. Specifically, many have asked which Robo-Advisor they should use for sustainable investing. The two main Robo-Advisors for sustainable investing in Switzerland are Selma Finance and Yova. So, today, we are going to compare Selma vs Yova for easy investment in sustainable companies. Both Selma and...

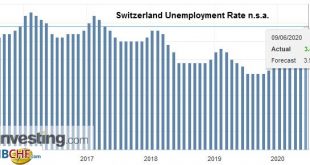

Read More »Switzerland Unemployment in May 2020: rose to 3.4percent, seasonally adjusted rose to 3.4percent

Unemployment Rate (not seasonally adjusted) Bern, June 9, 2020 – Registered unemployment in May 2020 – According to surveys by the State Secretariat for Economic Affairs (SECO), 155,998 unemployed people were registered with the regional employment centers at the end of May 2020, 2,585 more than in the previous month. The unemployment rate rose from 3.3% in April 2020 to 3.4% in the reporting month. Unemployment rose by 54,628 people (+ 53.9%) compared to the same...

Read More »FX Daily, June 9: Profit-Taking Gives Turn Around Tuesday Its Name

Swiss Franc The Euro has fallen by 0.23% to 1.0788 EUR/CHF and USD/CHF, June 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 turning higher on the year was the last straw before an arguably overdue bout of profit-taking kicked-in and is the dominant feature today in the capital markets. It began slowly in the Asia Pacific region. Equities were mixed, and Australia’s 2.4% rally and the 1.6% gain...

Read More »Coronavirus: Switzerland to reopen borders with EU, EFTA and UK on 15 June

© Denis Linine | Dreamstime.com Switzerland recently announced that it will lift existing entry restrictions with all EU and EFTA nations and the UK on 15 June 2020. In mid-May the Swiss government announced plans to fully reopen borders with France, Germany and Austria. On 2 June 2020, it decided to hold off on a full reopening of borders with Italy despite Italy’s decision to fully reopen its borders with Switzerland on 3 June 2020. However, on 5 June 2020, Federal...

Read More »Global Crisis: the Convergence of Marx, Kafka, Orwell and Huxley

The global crisis is not merely economic; it is the result of profound financial, sociological and political trends described by Marx, Kafka, Orwell and Huxley. The unfolding global crisis is best understood as the convergence of the dynamics described by Marx, Kafka, Orwell and Huxley. Let’s start with Franz Kafka, the writer (1883-1924) who most eloquently captured the systemic injustices of all-powerful bureaucratic institutions–the alienation experienced by the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org