This month marks the fourth anniversary of one of the most disastrous assaults on human rights in American history. It was on March 16, 2020 that the President Trump issued "guidelines" for "15 days to slow the spread" which stated that "Governors of states with evidence of community transmission should close schools in affected and surrounding areas." The administration instructed all members of the public to "listen to and follow the directions of your state and...

Read More »Krugman: Low Unemployment Causes Inflation, Not Monetary Expansion

In an article in the New York Times on March 27, 2018, Paul Krugman argues that economists who believe increases in money supply cause inflation are wrong. According to Krugman, the key factor that sets inflation in motion is unemployment. While a decline in the unemployment rate is associated with an increase in the rate of inflation, an upsurge in the unemployment rate is associated with a decline in the rate of inflation.Krugman believes inflation is about general...

Read More »Self-Deception on Social Security

The leftist website Counterpunch has published an article today entitled “Millionaires Stopped Contributing to Social Security on March 2, 2024.” The thrust of the article is that once someone reaches an income of $168,600, “they stop paying in.” The operative terms are “contributing” and “paying in.” They reflect a misguided mindset with respect to Social Security, which is the crown jewel of American socialism. This leftist mindset and terminology have...

Read More »Help Us Celebrate Human Action’s 75th Anniversary!

Investor and author Doug Casey recently wrote that most economists “are political apologists masquerading as economists.” He says they are like witch doctors pretending to be neurosurgeons. They “prescribe the way they would like the world to work and tailor theories to help politicians demonstrate the virtue and necessity of their quest for more power.” The discipline of economics, says Casey, “has been turned into the handmaiden of government in order to give...

Read More »How Would US States Actually Declare Bankruptcy?

Stephen Anderson, in his Mises Wire essays of February 1 (“Are Bankruptcies of Some US States in the Future?”) and February 23 (“US States Have a Long History of Defaulting”), worries that some US states may be on the precipice of bankruptcy. While a potential problem—especially in light of high debt levels among federal government, businesses, and consumers—possible state bankruptcies and defaults must be clarified before we conclude that state bankruptcies lie...

Read More »The Folly of Federal Reserve Stabilization Policy: Part II 1985-2023

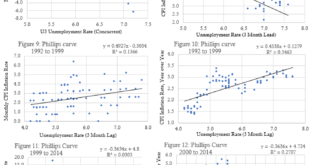

Many economists think the Federal Reserve can use Phillips Curve tradeoffs between inflation and unemployment to guide Fed macro stabilization policy. Inflationary Fed policies may act as a monetary stimulus, to regulate unemployment. Data from 1948 to 1985 indicates that the Phillips Curve doesn’t actually exist. Does the data since 1985 reveal stable Phillips Curve tradeoffs- estimates of the effects of inflation on unemployment that may guide...

Read More »Private REITs Hide Commercial Real Estate Distress While Begging for Bailouts

During the most recent commercial real estate bubble, two things happened in tandem. First, due to the Federal Reserve’s zero interest rate policy, savers were unable to invest their cash at a decent rate of return. Second, prices of illiquid assets inflated in an extreme manner, riding on cheap debt and the rush of investors stretching for yield on their capital.Such was the state of capital markets for several years, as the Obama, Trump, and Biden regimes—along...

Read More »Sound Individualism vs Toxic Collectivism

Share this article Part II of II by Claudio Grass, Switzerland When it comes to the State, however, and all its ministries, branches and institutions, a very different set of rules seems to apply – a much more lenient, flexible and liberal one. For example, the core pledge of security, protection and stability has yet to be fulfilled: no government has ever delivered on any of these promises socially, economically, geopolitically, or monetarily for any...

Read More »Narrowly Mixed Dollar to Start the Big Week for Europe and North America

Overview: The dollar is narrowly mixed against the G10 currencies to begin the week that features a Bank of Canada and ECB meetings, US jobs data, Federal Reserve Chair Powell's two-day testimony before Congress, and US President Biden's State of the Union address. Most emerging market currencies are firmer. The Turkish lira is a notable exception. Higher than expected took a toll, knocking it down by around 0.5%. On the other hand, the Malaysian ringgit is up...

Read More »Elon’s Boring Line of Bull

Something’s rotten under the Las Vegas Convention Center and it turns out it’s a chemical sludge with the “consistency of a milkshake,” reports Bloomberg Businessweek. This sludge is a byproduct of Elon Musk’s Boring Company tunneling from the Las Vegas Convention Center to the Encore and Westgate hotels. These tunnels don’t feature rapid transit but instead individual Teslas ferrying carloads of convention goers at just 40 mph. Workers are being burned by the sludge...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org