The “racial equality” debates are characterized by evolving concepts and terminology in a constant search for better ways to express the ideals and values of the protagonists. The mantras of “diversity, equity, and inclusion” (DEI) are now under increasing attack as several states move to ban DEI programs. In search of an alternative conceptual foundation for their equality schemes, many liberals (both progressive and conservative) who wish to promote equality have...

Read More »Finklestein’s Folly: How Not to Discredit One’s Opponents

The ongoing Israeli-Palestine conflict continues to captivate podcasters and listeners. So, Lex Friedman tapped into this interest by assembling a panel of experts to debate the issue. However, his decision to invite online personality Destiny as a commentator to defend Israel elicited criticisms, as Destiny is a college dropout who was parachuted to fame as a videogame streamer before becoming a political commentator.Since then, he has established a reputation for...

Read More »“Desire Paths” and the Problem with Central Planning

I recently attended the Austrian Economics Research Conference, which is held annually at the Mises Institute on the campus of Auburn University. After an inspiring day of presentations, I began my trek back to the Auburn University Hotel. As I made my way down the sidewalk, I found myself walking along a well-trodden dirt path. Soon enough I was back on the sidewalk, and I turned around, quickly realizing I had taken the “wrong” path. The correct one entailed taking...

Read More »McConnell Cannot Stop the Non-Interventionist Tide

Even Republican stalwarts like current Senate Minority Leader Mitch McConnell are starting to notice that something is shifting in the party. While McConnell announced recently that he would step down as Republican leader in the US Senate, in an interview last week he was adamant that he would continue to serve out his term in the Senate with one purpose in mind: “fighting back against the isolationist movement in my own party.”He sounds worried.What McConnell deems...

Read More »US CPI, New Security Initiatives with Tokyo and Manila, Bank of Canada Meeting

Overview: The dollar has been confined to narrow ranges ahead of the US CPI report. Given the backup of US rates and the stronger-than-expected jobs growth, the greenback's performance has been unimpressive. The Reserve Bank of New Zealand signaled that it was in no hurry to cut rates and it helped underpin the New Zealand dollar. Up about 0.2% today, it is leading the G10 currencies higher. Strong earnings from TSMC may have helped underpin the Taiwanese dollar...

Read More »Invasion Alert

Many Americans care about the dangers of mass immigration. Are they right to be concerned? In what follows, I’ll try to show that they are right. Immigration of elements hostile to American values does indeed pose a grave threat. But, if we are libertarians, don’t we have to defend “open borders”? I will argue that we don’t.One of the most obvious reasons mass immigration is a problem is its immense cost—hundreds of billions of dollars. A post from November 2023 that...

Read More »Biden’s Inflation Narrative Dies as Price Growth Rises to a Seven-Month High

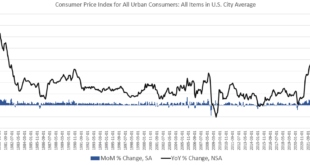

According to the Bureau of Labor Statistics' latest price inflation data, CPI inflation in March rose to a seven-month high, and price inflation hasn't proven nearly as transitory as the regime's economists have long predicted. According to the BLS, Consumer Price Index (CPI) inflation rose 3.5 percent year over year during March, without seasonal adjustment. That’s the thirty-seventh month in a row of inflation well above the Fed’s arbitrary 2 percent inflation...

Read More »Let’s Be Honest: The Economy Is NOT Doing Well

The American economy is not all right. But to see why, you need to look beyond the dramatic numbers we keep seeing in the headlines and establishment talking points.Take, for instance, the latest jobs report. For the third month in a row, the American economy added significantly more jobs than most economists had been expecting—a total of 303,000 for March. On its face, that’s a good number.But as Ryan McMaken laid out over the weekend, things don’t look as strong...

Read More »Watch Our New Fed Documentary Teaser Now!

Dr. Paul is right! People need to look at the money issue. Wars, spending, debt accumulation, subsidies, and foreign aid are intimately linked to the money machine known as the Federal Reserve.Central banks have two main purposes: inflate the money supply and bail out the big financial firms. By inflating the money supply, governments can finance their operations cheaply and surreptitiously at our expense. If we wish to expose the state and all its...

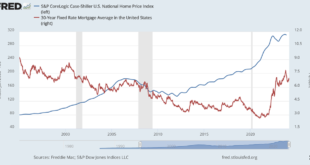

Read More »Hair of the Dog — Progressives in Congress Need Another Hit of Low Interest Rates

Bernie Sanders, Elizabeth Warren, and the Congressional Progressive Caucus recently sent an open letter to the chairman of the Federal Reserve, Jerome Powell, demanding lower interest rates.The letter is full of the economic illiteracy one would expect from progressives, especially those in Congress. For example, it misreads price inflation data and argues that the failure to lower interest rates endangers home affordability and increases income inequality. These...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org