Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »BOE Surprises by Doing Nothing, but Tips August Action

Summary: BOE neither cut rates not announced a new asset purchase plan. Sterling rallied hard. However, the BOE indicated an August ease and I look for sterling to pare knee-jerk gains. The Bank of England surprised many, if not most, participants by not changing policy. There was no rate cut and no asset purchase plan. However, there can be little doubt that the BOE will take action next month. The minutes...

Read More »Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Negative for 10 Years Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon. As it turned out the issue was historic in another way as well: with the prevailing 10Y bond trading well in negative yield territory, it was largely expected that today’s bond auction would likewise issue at a negative yield, and...

Read More »Swiss Producer and Import Price Index, June 2016: +0.1 percent MoM, -1.0 percent YoY

14.07.2016 09:15 – FSO, Prices (0353-1607-00) Producer and Import Price Index in June 2016 0.1% rise in Producer and Import Price Index Neuchâtel, 14.07.2016 (FSO) – The Producer and Import Price Index rose in June 2016 by 0.1% compared with the previous month, reaching 99.9 points (base December 2015 = 100). Whereas the Producer Price Index declined by 0.2%, the Import Price Index rose by 0.8%. The slight increase...

Read More »FX Daily, July 11: Dollar Extends Gains

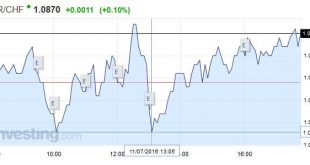

Swiss Franc Improving US job data also helped to increase demand for EUR/CHF long. For last week’s sight deposits see here. Click to enlarge. The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put...

Read More »Caixin Monthly Column: Brexit

(Here is the latest monthly column I write for Caixin. It is on Brexit and I wrote it as an email to my mother. Here is the link. The text follows) To: Mother Date: July 4, 2016 Subject: Re: Did you know Britain was leaving Europe? Should I worry? Glad to see you figured out how to access your email account. I smiled when I saw your note in my inbox. Thank you, though I am not sure that Thomas Watson felt the...

Read More »New Wrinkle in European Bail-In Efforts

Summary: European Court of Justice could rule on July 19 that private investors do not have to be bailed in before public money can be used to recapitalize banks. Italy stands to gain the most, at least immediately, from such a judgment. Italian bank shares recovered after initial weakness. After the 2007-2008 bank recapitalization by governments, which means taxpayers’ money, Europe changed the rules. The...

Read More »Fat People for Trump!

Alphas and Epsilons BALTIMORE – One of the delights of being an American is that it is so easy to feel superior to your fellow countrymen. All you have to do is stand up straight and smile. Or if you really need an ego boost, just go to a local supermarket. Better yet, go to a supermarket with a Trump poster in the parking lot. Trigger warning: In the following ramble, we make fun of democracy, Trump, obesity,...

Read More »A Sense of Foreboding

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Amerexit and Brexit… Doubts About Debt This was a shortened week, due to the American holiday of July 4, celebrating the start of the war that lead to “Amerexit”, 240 years ago. The prices of the metals were up this week, +$25 in gold and +$0.48 in silver. The gold to silver ratio dropped a fraction of a point, showing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org