The week ahead features the ECB meeting and the US February jobs report. The Reserve Bank of Australia meets, Europe reports industrial production, Japan reports January current account figures, and China reports its latest inflation and lending figures. We frame this week’s discussion of the drivers in terms of four sets of questions and offer some tentative answers. United States What is the significance of the...

Read More »Emerging Market Preview for the Week Ahead

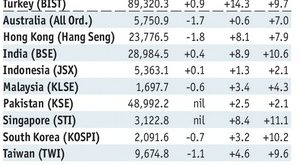

Stock Markets EM FX was mostly softer last week, though it ended the week firmer, buoyed by outsized MXN gains Friday. The Fed is sending very strong signals for a March hike, which should keep EM FX on its back foot. However, with the March 15 FOMC embargo coming into effect, there will be no Fed speakers after Kashkari on Monday. Jobs data on Friday will be the highlight, but given the Fed’s signals, we do not...

Read More »Sender must now pay Swiss Post for customs checks

© Denis Linine | Dreamstime.com Currently, anyone ordering something from outside Switzerland, must pay Swiss Post an administrative charge if their package attracts import tax (duty and/or VAT). In addition, they must pay Swiss Post an additional CHF 13 if the parcel needs to be opened, usually because the package has been poorly labelled. Swiss Post has a contract with Swiss customs to process packages coming into the...

Read More »FX Weekly Review, February 27 – March 04: Dramatic Shift in Fed Expectations Spurs Dollar Gains, but Now What?

Swiss Franc Currency Index The Swiss Franc index remained in its ranges. It is now trending downwards, while the dollar index is strengthening Trade-weighted index Swiss Franc, March 04(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years...

Read More »Government stops tax rises on Swiss cigarettes

© Ocskay Mark | Dreamstime.com Swiss cigarette prices will not rise over the coming years unless manufacturers increase the underlying price. On Tuesday, Switzerland’s Council of States (upper house), withheld permission to allow the Federal Council (cabinet) to continue hiking the tax on smokes. From 2005 to 2015, the price of Switzerland’s best selling cigarettes rose from CHF 6 to CHF 8.50. Of this increase only CHF...

Read More »Bi-Weekly Economic Review

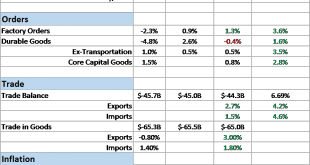

Economic Reports Scorecard The economic data released since my last update has been fairly positive but future growth and inflation expectations, as measured by our market indicators, have waned considerably. There is now a distinct divergence between the current data, stocks and bonds. Bond yields, both real and nominal, have fallen recently even as stocks continue their relentless march higher. The incoming, current...

Read More »Swiss government drops plan to restrict lobbyists’ access to parliament

© Lianna2013 | Dreamstime.com One year after Switzerland’s Council of States (upper house) voted in favour of controlling lobbyists’ access to parliament, the draft proposed implementation plan has been rejected by the commission in charge of it. Back in March 2016, the Council of States voted in favour of a parliamentary initiative put forward by state councillor Didier Berberat calling for those accessing parliament...

Read More »The Resilience of Globalization and the US Dollar

Summary: Populism-nationalism is not really a wave sweeping across the world. Where it succeeded was where a center-right party in a two-party system embraced part of the populist agenda. Center-right parties in Europe are not embracing key agenda for populist-naitonalist, but appear to be tacking to the right on domestic issues. The conventional narrative is that in the aftermath of the Great Financial...

Read More »Importance of Hiding Gold Creatively and Securely If Taking Delivery

Why gold retains value? Interesting unknown gold facts “Prepare your jaws for a sizeable drop!” History, finite, rare and peak gold “It is beautiful to look at…” ‘Heavy metal’ – Thud sound of a gold bar (kilo) ‘Going for gold’ – Olympic gold medals to Chelthenham ‘Gold Cup’ Peak gold … “Hard work to get gold out of the ground…” How much an Oscar is actually worth? Importance of hiding gold creatively and securely if...

Read More »Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony. But that may only be true because “accommodation” doesn’t ever achieve what it aims to....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org