This is Part 2 of a two-part series. The series focuses on collusive discussions and meetings that took place between the world’s most powerful central bankers in late 1979 and 1980 in an attempt to launch a central bank Gold Pool cartel to manipulate and control the free market price of gold. The meetings centered around the Bank for International Settlements (BIS) in Basle, Switzerland. Part 2 takes up where Part 1...

Read More »State of Denial: The Economy No Longer Works As It Did in the Past

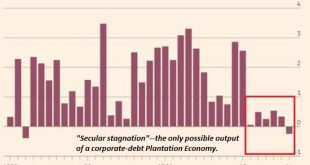

There’s no Plan B for a state-corporate form of central-planning capitalism that is no longer functioning.If there is one reality that is denied or obscured by the Status Quo, it is that the economy no longer works as it did in the past. This is the fundamental economic context of our current slide into political-social disintegration.The Status Quo narrative is: the policies that worked for the past 70 years are still...

Read More »Swiss Labour Force Survey 1th quarter 2017: Number of employed persons +0.6 percent; unemployment rate (ILO) 5.3 percent

Swiss Labour Force Survey 1th quarter 2017: labour supply First quarter 2017: Employment rate increases by 0.6 percent. Unemployment rate according to ILO is 5.3 percent Neuchâtel, 19.05.2017 (FSO) – The number of employed persons in Switzerland rose by 0.6% between the 1st quarters of 2016 and 2017. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) remained stable...

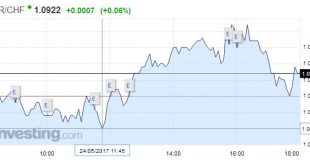

Read More »FX Daily, May 25: Euro Strength more than Dollar Weakness

Swiss Franc The Euro has fallen by 0.14% to 1.0903 CHF. EUR/CHF - Euro Swiss Franc, May 25(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Pound to Swiss Franc exchange rates have seen a choppy day of trading but almost no net movement whatsoever, with the percentage difference on buying Swiss Franc rates since the opening bell at a paltry 0.01%. Why the quiet market? We are at the back end of the month...

Read More »Swiss rated third in health services quality survey

Members of the public visit the Geneva University Hospitals during an open day in its new Gustave Julliard building (Keystone) Switzerland has been rated third in a global ranking of the access to and the quality of healthcare systems – a report that shows large gaps between the best and worst ranked countries. The survey, published online on Thursday in the medical journal The Lancetexternal link, looked at...

Read More »Bern train station to expand to meet growing rail traffic

Some 202,000 passengers pass through Bern's train station during the week - Click to enlarge Bern railway station, Switzerland’s second busiest after Zurich, is set to expand with the creation of a new underground rail station serving regional trains between Bern and Solothurn. A pedestrian access area is also planned. Some 202,000 passengers pass through Bern’s main train station – the second largest in Switzerland –...

Read More »Manchester Attack Sees Asian Stocks Fall, Gold Firm

The appalling attack in Manchester overnight in which over 22 people have been killed has led to a slight uptick in risk aversion in markets. Investors are cautious after police said they were treating a bombing at a concert in the Manchester Arena as a “terrorist incident”. Asian stocks gave up gains after the attacks and European indices had a subdued start. Gold rose in the aftermath of the attacks to three week...

Read More »Less Than Nothing

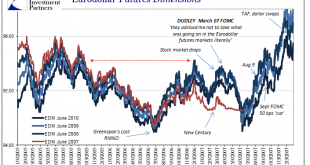

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs. It has been this way from the beginning, even before the beginning as if that was possible. The Great Financial Crisis has no official start date, but we...

Read More »India: Why its Attempt to Go Digital Will Fail

India Reverts to its Irrational, Tribal Normal (Part XIII) Over the three years in which Narendra Modi has been in power, his support base has continued to increase. Indian institutions — including the courts and the media — now toe his line. The President, otherwise a ceremonial rubber-stamp post, but the last obstacle keeping Modi from implementing a police state, comes up for re-election by a vote of the legislative...

Read More »FX Daily, May 24: Dollar Consolidates, While Market Shrugs Off China Downgrade

Swiss Franc EUR/CHF - Euro Swiss Franc, May 24(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Labour gains ground The Conservatives were in a very strong position following the election announcement. A snap election historically causes the currency in question to weaken, but on this occasion the opposite occurred. A Torie victory is deemed to be positive for the UK economy. Investor confidence grew and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org