A study of data from 195 countries from 1990 to 2015 published recently in the medical journal The Lancet, ranks Switzerland’s healthcare system third. The analysis looked at mortality rates from causes that should not be fatal in the presence of effective medical care. It considered both healthcare access and quality and was designed with the aim of normalising for local environmental and behavioural risks. - Click...

Read More »The Internet Helped Kill Inflation In America, Says Credit Suisse

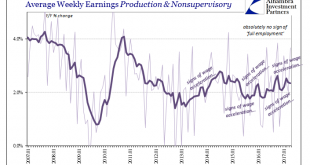

Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen – as he told CNBC two days ago – is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt....

Read More »Simple (economic) Math

.The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing...

Read More »The Gold Conundrum

Keeping it Simple We recently (on Thursday last week to be precise) put together a few gold-related charts based on the “keep it simple” principle. The annual Incrementum “In Gold We Trust” report is going to be published shortly and contains a quite thorough technical analysis section, so we will keep this brief and just discuss a few things that have caught our eye. So what is the “conundrum”? We will get to that...

Read More »FX Daily, June 01: Greenback Steadies at Lower Levels, Sterling Struggles

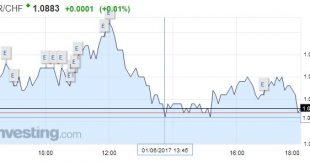

Swiss Franc The Euro has risen by 0.01% to 1.0883 CHF. EUR/CHF - Euro Swiss Franc, June 01(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is mostly firmer against the major currencies. It is consolidating yesterday’s losses more than staging much of a recovery. Even sterling, where a YouGov poll has the Tory lead at three percentage points, down from seven previously, is above yesterday’s...

Read More »Record research spending defies currency woes

Companies have been spending money thinking of ways to cope with the strong franc - Click to enlarge Swiss companies invested record volumes in research and development (R&D) in 2015, despite the franc exploding in value at the start of that year. The private sector was responsible for most of the CHF22 billion ($22.6 billion) R&D spending in 2015, according to official figures released on Monday. This was an...

Read More »Silver Bullion In Secret Bull Market

Do you think silver is poised to go higher? I sure do. That’s because I’m watching what is going on in the world’s silver ETFs. I’m also watching the mountain of forces that are piling up to push the metal higher. Look at this chart. It shows all the metal held by the world’s physical silver ETFs (black line). And all the metal held by the world’s physical gold ETFs (blue line) … Gold And Silver Prices, May 2016 - May...

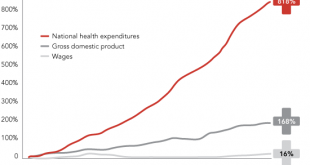

Read More »Inflation Isn’t Evenly Distributed: The Protected Are Fine, the Unprotected Are Impoverished Debt-Serfs

The Consumer Price Index (CPI) measure of inflation is bogus on a number of fronts, a reality I’ve covered a number of times: though the heavily gamed official CPI is under 2% for the past four years, the real rate is 7% to 12%, depending on whether you happen to live in locales with soaring rents/housing and healthcare costs. The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016) Revealing the...

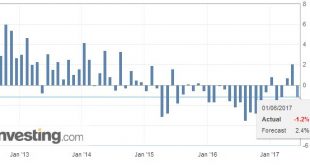

Read More »Swiss Retail Sales, April: -1.4 percent Nominal and -1.2 percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More »Switzerland Q1 GDP: Gross domestic product in the 1st quarter 2017

Switzerland’s real gross domestic product (GDP) grew by 0.3 % in the first quarter of 2017*. Private consumption growth expanded only slightly, while government consumption rose moderately. Following the previous quarter’s fall, investment in construction and equipment increased. The trade balance contributed notably to overall GDP growth. On the production side, growth was largely driven by manufacturing, while service...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org