Martin Nydegger, left, is the new head of Switzerland Tourism. (Keystone) - Click to enlarge New head of Switzerland Tourism Martin Nydegger expects hotel bookings to rise by 4% this winter season, owing to abundant snow. In an interview with Sonntagszeiting and Le Matin Dimanche newspapers, he also talks about priorities for 2018. Nydegger took over on January 1 from Jürg Schmid, who had headed the...

Read More »Gold Rises As Global Stocks Plunge and Bitcoin Crashes 70 percent

– Gold gains 0.6% in USD and surges 1.7% in euros and pounds – European stocks fall more than 3% at the open after sharp falls in Asia – DJIA falls 1,175 points, S&P 500 down 4.1% and Nikkei plummets 4.7%– Gold rises from $1,330 to $1,342, £942 to £960 and €1,067 to €1,085 /oz– Bitcoin crashes another 10% and has now plummeted by 70% to below $6,000 – Increased risk aversion will drive safe haven demand for gold as...

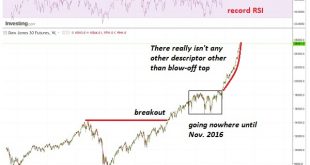

Read More »Is the 9-Year Long Dead Cat Bounce Finally Ending?

Ignoring or downplaying these fundamental forces has greatly increased the fragility of the status quo. The term dead cat bounce is market lingo for a “recovery” after markets decline due to fundamental reversals. Markets tend to bounce back after sharp declines as participants (human and digital) who have been trained to “buy the dips” once again buy the decline, and the financial media rushes to reassure everyone...

Read More »How to Buy Low When Everyone Else is Buying High

When to Sell? The common thread running through the collective minds of present U.S. stock market investors goes something like this: A great crash is coming. But first there will be an epic run-up climaxing with a massive parabolic blow off top. Hence, to capitalize on the final blow off, investors must let their stock market holdings ride until the precise moment the market peaks – and not a moment more. That’s...

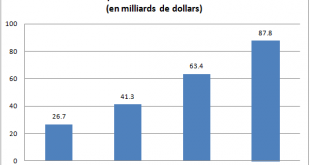

Read More »Favoritisme délibéré ou perte de contrôle ? La politique d’investissement chaotique de la Banque nationale suisse

Favoritisme délibéré ou perte de contrôle ? La politique d’investissement chaotique de la Banque nationale suisse « Je peux vous assurer que nos spécialistes en investissement connaissent parfaitement leur métier » (Fritz Zurbrügg) « La BNS n’a aucun spécialiste qui peut dire ‘il faut prendre le titre A plutôt que le titre B’ » (Jean-Pierre Danthine) « Nous décidons de nos placements avec le concours d’un...

Read More »FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Swiss Franc The Euro has risen by 0.19% to 1.1622 CHF. EUR/CHF and USD/CHF, February 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past...

Read More »Shrinkflation Intensifies – Stealth Inflation As Thousands of Food Products Shrink In Size, Not Price

– Shrinkflation continues to take hold across UK, Ireland and US for sixth year running– Shrinkflation sees consumers gets less product, but at the same or increased price– 2,500 products have shrunk according to Office of National Statistics in UK– Reported inflation is between 1.7% and 3% but actually much higher– Shrinkflation is financial fraud, unreported inflation in stealth mode– Gold is hedging inflation and...

Read More »Ja oder Nein zu No-Billag?

Von Daniel Annen – Auch auf die Gefahr hin, den Leser mit einem weiteren Beitrag zu langweilen, möchte ich die Gelegenheit nutzen, ein paar Missverständnisse aus dem Weg zu räumen, die in der Diskussion über die letzten Wochen entstanden sind. Primär: Die No-Billag-Initiative ist keine...

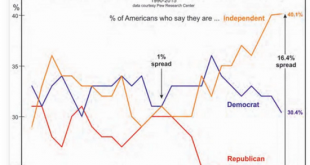

Read More »Is Congress Finally Pushing Back Against Security Agencies’ Over-Reach?

The last time the U.S. Congress pushed back against the Imperial Presidency and the over-reach of the nation’s Security Agencies was 43 years ago, in 1975. The last time the U.S. Congress pushed back against the Imperial Presidency and the over-reach of the nation’s Security Agencies was 43 years ago, in 1975. In response to the criminal over-reach of the Imperial Presidency (Watergate) and to the criminal over-reach of...

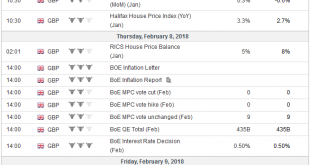

Read More »FX Weekly Preview: Changing Fortunes in the Capital Markets or Long Overdue Correction?

The chief development in the capital markets has been the sharp drop in equities after a significant rally since late last year and the rise in yields. The dollar had fallen alongside the exuberant appetite for risk assets. Anecdotal evidence supports the idea that the greenback was used as a funding currency to purchase those risk assets. The Dollar Index’s first weekly advance since the middle of last December amid...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org