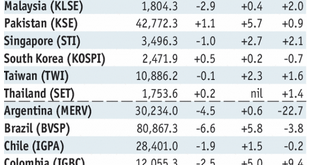

Stock Markets EM FX has started the week mixed. Some relief was seen as US rates stalled out last week, but this Friday’s jobs number could be key for the next leg of this dollar rally. On Wednesday, the Fed releases its Beige book for the upcoming June 13 FOMC meeting, where a 25 bp hike is widely expected. We believe EM FX remains vulnerable to further losses. Stock Markets Emerging Markets, May 23 Source:...

Read More »Gold And Silver Bullion Obsolete In The Crypto Age?

Are Gold And Silver Obsolete In The Crypto Age? What is the outlook for the global economy, financial markets, crypto currencies such as bitcoin and gold and silver bullion in the digital age? TOPICS IN THIS INTERVIEW 01:00 Diagnosis of the economy and rising inflation 06:00 Possible stock market correction? 09:30 What is triggering higher oil prices? 13:05 Impacts of rising oil prices on the mining sector 14:40 Gold...

Read More »Results of the 2017 survey on payment methods

In the autumn of 2017, the Swiss National Bank (SNB) conducted a survey on payment methods for the first time. The aim of the survey is to obtain representative information on payment behaviour and the use of cash by house holds in Switzerland, and to ascertain the underlying motives for this behaviour. As part of the survey, around 2,000 people resident in Switzerland were interviewed to obtain information on their...

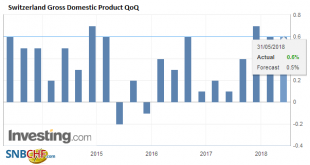

Read More »Switzerland Q1 GDP: +0.6 percent QoQ

Switzerland’s real gross domestic product (GDP) grew by 0.6% in the 1st quarter of 2018.* Although growth lost some momentum in comparison to the second half of 2017, it was nevertheless broad-based across the various business sectors. The secondary sector expanded modestly, while growth in several service sectors accelerated, including in trade and business-related services. The entertainment industry recorded strong...

Read More »Swiss Retail Sales, April: +2.2 Percent Nominal and -0.1 Percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More »Nestlé to cut up to 500 jobs in Switzerland

“Nestlé remains fully committed to its home base in Switzerland”, wrote the company in a press release. Swiss food giant Nestlé plans to cut as many as 500 computer-service jobs in Switzerland as part of a restructuring plan to increase profitability, the company announced on Tuesday. Nestlé will be outsourcing the IT jobs to Spain, according to a press release published on the company’s website. “We understand that...

Read More »FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

Swiss Franc The Euro has fallen by -0.42% to 1.1485 CHF. EUR-CHF and USD-CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today’s activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. ...

Read More »In Gold We Trust, 2018

The New In Gold We Trust Report is Here! As announced in our latest gold market update last week, this year’s In Gold We Trust report by our good friends Ronald Stoeferle and Mark Valek has just been released. This is the biggest and most comprehensive gold research report in the world, and as always contains a wealth of interesting new material, as well as the traditional large collection of charts and data that...

Read More »KOF Economic Barometer: Falls Back to its Long-term Average

The KOF Economic Barometer for May fell by 3.3 points to a new standing of exactly 100 points. The last time the Barometer had a similar standing was in December 2015. The current value of 100 points to an average development of the Swiss economy in the coming months. In May, the KOF Economic Barometer fell by 3.3 points to 100 points from revised 103.3 in April (first publication in April: 105.3). Within a...

Read More »Crowdfunding Platforms Boom in Switzerland

This crowd backed a winner: Bernese football fans gather outside parliament on May 20 after their team, Young Boys, won the Swiss league (Keystone) Swiss crowdfunding platforms dealt with CHF375 million ($377 million) in 2017, almost three times as much as the previous year. Some 160,000 people supported a crowdfunding project. Over the past eight years, more than half a billion francs have been collected via the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org