Summary:

The way forward is to replace the entire system of reserve currencies with a transparent free-for-all of all kinds of currencies. Over the years, I’ve endeavored to illuminate the arcane dynamics of global currencies by discussing Triffin’s Paradox, which explains the conflicting dual roles of national currencies that also act as global reserve currencies, i.e. currencies that other nations use for global payments, loans and foreign exchange reserves. The four currencies that are considered global are the US dollar (USD), the euro, the Japanese yen and China’s RMB (yuan). The percentage of use in each of the three categories of demand for the reserve currencies–payments, loans and foreign exchange reserves–are

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

The way forward is to replace the entire system of reserve currencies with a transparent free-for-all of all kinds of currencies. Over the years, I’ve endeavored to illuminate the arcane dynamics of global currencies by discussing Triffin’s Paradox, which explains the conflicting dual roles of national currencies that also act as global reserve currencies, i.e. currencies that other nations use for global payments, loans and foreign exchange reserves. The four currencies that are considered global are the US dollar (USD), the euro, the Japanese yen and China’s RMB (yuan). The percentage of use in each of the three categories of demand for the reserve currencies–payments, loans and foreign exchange reserves–are

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The way forward is to replace the entire system of reserve currencies with a transparent free-for-all of all kinds of currencies.

Over the years, I’ve endeavored to illuminate the arcane dynamics of global currencies by discussing Triffin’s Paradox, which explains the conflicting dual roles of national currencies that also act as global reserve currencies, i.e. currencies that other nations use for global payments, loans and foreign exchange reserves.

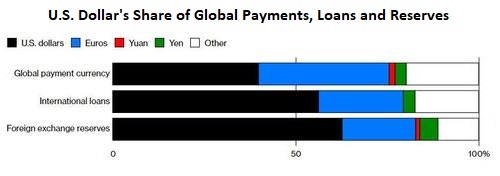

The four currencies that are considered global are the US dollar (USD), the euro, the Japanese yen and China’s RMB (yuan). The percentage of use in each of the three categories of demand for the reserve currencies–payments, loans and foreign exchange reserves–are displayed below.

Many observers don’t seem to grasp that demand for reserve currencies extend beyond payments. Many of those heralding the demise of the USD as a reserve currency note the rise of alternative payment platforms as evidence of the USD’s impending collapse.

But it’s not so simple. Currencies are also in demand because loans were denominated in that currency, so interest and principal payments must also be paid in that currency. There is also demand for the currency to be held as foreign exchange reserves–the equivalent of cash to settle trade imbalances and back the domestic currency.

| Notice the minor role played by the yen and yuan, despite the size of the economies of Japan and China. There’s a reason for this that’s at the core of Triffin’s Paradox: any nation seeking to issue a reserve currency must export its currency in size by running large, permanent trade deficits (or an equivalent mechanism for exporting currency in size).The reason why the yen and yuan are minor players is neither nation runs much of a trade deficit, and neither exports its currency in size via loans or other currency emittance mechanisms. |

US Dollar's Share of Global Payments, Loans and Reserves |

Triffin’s Paradox is the tension between a currency’s domestic role and its global role. The nation’s issuing central bank prioritizes domestic concerns–bolstering employment, tamping down (or generating) inflation, supporting the private banking system, etc.–but the rate of interest, etc. set by the issuing central bank has enormous impacts on nations using the currency for payments, loans and reserves.

No currency can serve two masters at the same time. If the issuing central bank raises interest rates for domestic reasons, the increase in rates may be ruinous to offshore borrowers who must convert weakening home currencies into the strengthening reserve currency to make interest payments.

Higher yields strengthen reserve currencies and weaken emerging market currencies. This increases the costs of servicing loans denominated in reserve currencies.

The question for any wannabe reserve currency is: how do you export enough currency into the global system to support the demand for payments, loans and reserves? If the issuing nation runs a trade surplus or modest deficit, trade doesn’t export enough currency into the global financial system to meet the demands placed on a reserve currency.

The alternative mechanism is debt. If the issuing central bank issues lines of credit to banks, then institutions can make loans denominated in the reserve currency to offshore borrowers.

The EU banks have issued loans in euros, and the fatal consequence of this is now becoming clear. Emerging market borrowers will be forced to default as their currencies weaken against the euro and the USD, driving the costs of servicing their debt denominated in euros and USD higher.

Loans denominated in USD and euros will bring the periphery crisis home to the core’s banking sectors as these loans default. It was all fun and games when the USD was weakening thanks to the Fed’a ZIRP (zero interest rate policy), because it became progressively cheaper to service loans in USD as USD weakened and emerging market currencies strengthened.

Now that dynamic has reversed: every click higher in U.S. yields vis a vis other currencies will only push the USD higher.

The system of reserve currencies is dysfunctional for everyone, creating and incentivizing fatal imbalances in trade, yields and debt. Some look to a basket of currencies (SDRs) as the solution, but all this does is tighten the coherence of a system that’s already dangerously hyper-coherent, i.e. highly susceptible to contagion.

There is no perfect reserve currency. Even gold has its limitations. As a result, the best available solution is a world of multiple currencies, some of which are not borrowed into existence, i.e. gold and bitcoin. Given a transparent range of options, nations, borrowers and lenders could choose whatever mix of currencies best suited them.

Some years ago I proposed using bitcoin as a reserve currency: Could Bitcoin (or equivalent) Become a Global Reserve Currency? (November 7, 2013)

The way forward isn’t to replace the USD with another dysfunctional reserve currency– the way forward is to replace the entire system of reserve currencies with a transparent free-for-all of all kinds of currencies.

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the book's website.

Tags: Featured,newsletter