Swiss Franc The Euro has risen by 0.30% at 1.1115 EUR/CHF and USD/CHF, June 21(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are trading quietly ahead of the weekend. Equity markets are mostly narrowly mixed. Chinese shares extended their run, and the major benchmarks were up 4%+ on the week. Japan, Australia, South Korea, and...

Read More »Europe Comes Apart, And That’s Before #4

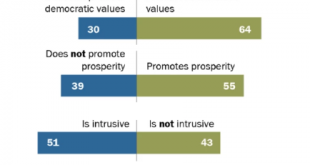

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey. For the first time since 1979, Social Democrats...

Read More »FX Daily, May 28: Risk Appetites Curbed, US Leadership Awaited in FX

Swiss Franc The Euro has risen by 0.20% at 1.1259 EUR/CHF and USD/CHF, May 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The euro initially reacted positively to the EU Parliament elections. The populists did not do quite as well as many expected. The two main groupings failed to secure a majority, but with the help of the Liberals, and possibly the Greens,...

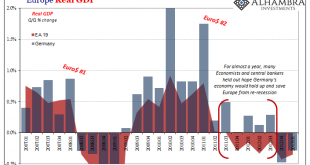

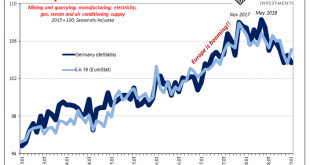

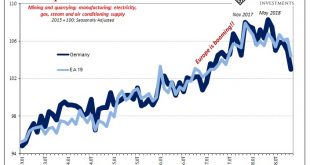

Read More »What’s Germany’s GDP Without Factories

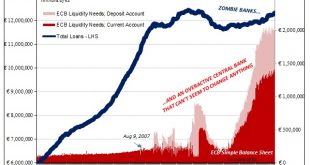

It was a startling statement for the time. Mario Draghi had only been on the job as President of the European Central Bank for a few months by then, taking over for the hapless Jean Claude-Trichet who was unceremoniously retired at the end of October 2011 amidst “unexpected” chaos and turmoil. It was Trichet who contributed much to the tumult, having idiotically raised rates (twice) during 2011 even as warning signs of...

Read More »FX Weekly Preview: Important Steps Away from the Abyss

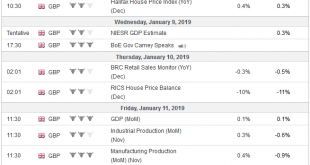

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession. The economy previously contracted when the tech...

Read More »The World Economy’s Industrial Downswing

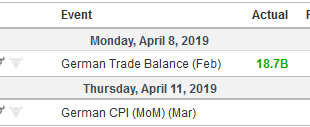

As economic data for 2019 comes in, the numbers continue to suggest more slowing especially in the goods economy. Perhaps what happened during that October-December window was a soft patch. Even if that was the case, we should still expect second and third order effects to follow along from it. Starting with Europe first, Germany’s deStatis had earlier reported factory orders and production levels in January 2019 while...

Read More »It’s Not That There Might Be One, It’s That There Might Be Another One

It was a tense exchange. When even politicians can sense that there’s trouble brewing, there really is trouble brewing. Typically the last to figure these things out, if parliamentarians are up in arms it already isn’t good, to put it mildly. Well, not quite the last to know, there are always central bankers faithfully pulling up the rear of recognizing disappointing reality. At the end of November, Mario Draghi went...

Read More »That’s A Big Minus

Goods require money to finance both their production as well as their movements. They need oil and energy for the same reasons. If oil and money markets were drastically awful for a few months before December, and then purely chaotic during December, Mario Draghi of all people should’ve been paying attention. China put up some bad trade numbers for last month, but Europe’s goods downturn came first. According to...

Read More »FX Weekly Preview: For the Millionth Time, Markets Exaggerate

The S&P 500 fell more than 12% in a few weeks. The 10-year Treasury yield fell nearly 40 bp. There were cries that the sky was falling. A recession is imminent, we are warned by prognosticators. The Fed went ahead and raised interest rates on March 21, 2018, and the S&P 500 proceeded to gap lower the next day and continued to sell-off the following day. Investors did not like the unanimous decision. Yet far from...

Read More »Just In Time For The Circus

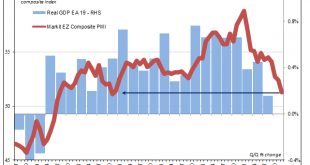

Just in time to follow closely upon yesterday’s European circus, IHS Markit piles on with more of the same forward-looking indications looking forward the wrong way. Mario Draghi says the ECB is ending QE, good for him. The central bank will do this despite balanced risks rebalancing in a different place. The more bad news and numbers stack up the more “they” say it’s nothing just transitory roughness. Globally...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org