[unable to retrieve full-text content]There were several developments that took place while US markets were closed for its Labor Day holiday. Most of the economic news was favorable. This included a strong snap back in the UK service PMI, more evidence that the moral suasion campaign to lift wages in Japan is yielding some success and a rise in the Caixin's China's service PMI.

Read More »FX Weekly Preview: Parsing Divergence: Focus Shifts from Fed to ECB

[unable to retrieve full-text content]Net-net, the September Fed funds futures contract was little changed on the week. Four high-income central banks meet in the week ahead; the ECB is the only one in play. China accounted for a full three quarters of the US trade deficit in July.

Read More »FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

[unable to retrieve full-text content]The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More »FX Daily, September 01: A Couple of Surprises to Start the New Month

[unable to retrieve full-text content]The new month has begun with a couple of surprises. The biggest surprise has been the record jump in the UK manufacturing PMI to 53.3 from 48.3. A much smaller rebound was expected in August after the Brexit shock drop in July.

Read More »FX Daily, August 23: Broadly Mixed Dollar in a Mostly Quiet Market

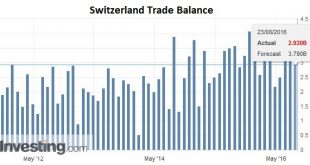

Swiss Franc Switzerland Trade Balance (See more posts for Switzerland Trade Balance) Click to enlarge. Source Investing.com FX Rates The US dollar is mostly little changed against the major, as befits a summer session. There are two exceptions. The first is the New Zealand dollar. Comments by the central bank’s governor played down the need for urgent monetary action and suggested that the bottom of cycle may be...

Read More »Dollar Weakness and Fed Expectations

Summary: Dollar weakness does not line up with increased perceived risk of Fed hiking rates. Frequently the rate differentials lead spot movement. Some now turning divergence on its head, claiming too expensive to hedge dollar-investments so liquidation. TIC data, though, shows central banks not private investors, were the featured sellers in June, the most recent month that data exists. The US dollar has...

Read More »FX Daily, August 22: Fischer Joins Dudley; Waiting for Yellen

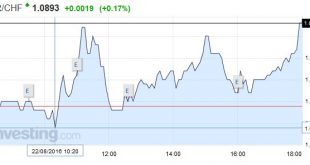

Swiss Franc As usual, when discussions about rate hikes go on, then both the dollar and the euro gain against the Swiss Franc. Click to enlarge. Federal Reserve Last week, some market participants were giving more credence to what seemed like dovish FOMC minutes than to NY Fed President Dudley’s remarks that accused investors of complacency over the outlook for rates. Yesterday, Vice-Chairman of the Federal Reserve...

Read More »FX Daily, August 19: Dollar Recovers into the Weekend

Swiss Franc: In the real effective exchange rate calculation, the PPI plays an important role. The Swiss producer price index fell by 0.8% YoY, while the German one is down 2.0%. Thismeans that in 2016 the CHF overvaluation is rising, when compared to the major Swiss trading partner Germany. The values for 2015 were -6% for the Swiss and -2.5% for Germany, the CHF overvaluation was reduced. Click to enlarge. Source...

Read More »FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

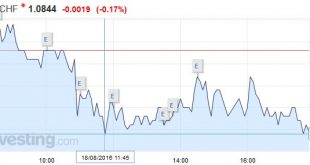

Swiss Franc A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. Click to enlarge. FX Rates It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting. The...

Read More »FX Daily, August 17: Dollar Snaps Back

Swiss Franc Click to enlarge. FX Rates The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley’s comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent. Many...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org