Swiss Franc As happened very often, traders expected more the SNB monetary assessment. And, as usually, the franc finally appreciated because the SNB did not act. Click to enlarge. FX Rates Looking at the diary, today is the most important day of the week. The Bank of England and the Swiss National Bank meet. The UK reports retail sales. EMU reports CPI figures. The US reports retail sales, industrial output, and...

Read More »FX Daily, September 14: Precarious Stabilization

Swiss Franc Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. Switzerland ZEW Expectations (see more posts on Switzerland ZEW Expectations, )Switzerland ZEW Expectations. Click to enlarge. FX Rates The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that...

Read More »Thoughts on the Price Action

Summary: Global interest rates are rising. Something important is happening. It appears to be dollar positive. Price is Right – click to enlarge. The market has not changed its mind. Following Brainard’s comments yesterday the market had downgraded the chances, which were already modest, of a Fed hike next week. The September Fed funds futures is unchanged on the day. The implied yield of 41 bp matches the...

Read More »FX Daily, September 12: Markets Off to a Wobbly Start

Swiss Franc The EUR/CHF retreated today together with falling stock prices. Later during the European day, U.S. stocks recovered. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure. Click to enlarge. FX Rates Stocks and bonds have begun the new week much like last week ended. Sharp losses...

Read More »Weekly Speculative Postions: CHF net long positions down from 8.2K down to 1.5K

The Swiss Franc depreciated this week again. The euro rose to 1.960. One reason is the reduction in net long CHF speculative position from 8.2K to 1.6K contracts. Given the weak ISM non-manufacturing PMI, it remains unclear. why speculator now move into the dollar. Over the summer, the US dollar was out of favor with the speculators in the futures market. This means that gross long positions increased and gross...

Read More »FX Daily, September 9: Ahead of the Weekend

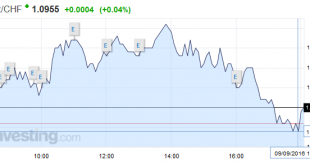

(Dublin business trip is ending, London next week, sporadic posts to continue) Swiss Franc Click to enlarge. FX Rates The US dollar is lower against all the major currencies this week as North American participants close it out. On the day, the dollar is consolidating swings yesterday and is narrowly mixed. Bond yields are higher and equities are mostly lower. The euro has finished lower the last three Fridays....

Read More »FX Daily September 9: Draghi Says Little, Door Still Open for More

[unable to retrieve full-text content]In the last two days, the euro moved upwards against CHF. Given that Swiss GDP was stronger than the one in the euro zone, this is surprising. But we must recognize that Draghi could be the reason. Inflation forecasts of 1.2% in 2017 and 1.8% in the euro zone would mean the ECB hikes rates maybe in 2018 or 2019. I personally do not believe it, given that wage inflation in Italy or Spain is clearly under 1%. This is lower than Swiss wage inflation of 0.8%.

Read More »FX Daily, September 07: Dollar Stabilizes, but Hardly Recovers

[unable to retrieve full-text content]Disappointing industrial output figures from Germany and UK are helping stabilize the US dollar after yesterday's shellacking. Investors have been fickle about the prospects for a rate hike this month, and the unexpected dramatic slide in the service spurred a downgrading of such expectations, and a flight out of the dollar. It was not simply a quest for yields, though that was part of it. Surely the yen and euro's strength is not a function of superior...

Read More »FX Daily, September 6: Dollar Heavy in Quiet Markets

[unable to retrieve full-text content]The US dollar is trading heavily against most of the major and emerging market currencies. However, the losses are modest, and the greenback remains within recent ranges. The Antipodean and Scandi bloc currencies are performing best.

Read More »Services ISM Sends Greenback Reeling

[unable to retrieve full-text content]ISM showed unexpected weakness in Aug non-mfg PMI. Markit measure slipped but not as much as ISM. Odds of a Sept Fed hike slip to about 15%. Watch trendline in Dollar Index near 94.45.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org