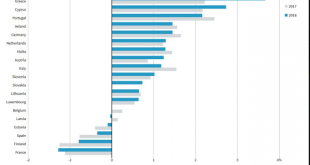

Summary: Greece debt has rallied as a repeat of the 2015 crisis seems less likely. The EC may turn its attention to Italy’s structural deficit. There are several countries, including France that is forecast to have a larger primary deficit in 2018 than 2017. With the official creditors on their way back shortly to Athens, there is a sense that a repeat of 2015 crisis can be avoided. There is a collective sigh...

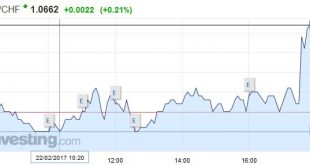

Read More »FX Daily, February 22: Euro Meltdown Continues

Swiss Franc EUR/CHF - Euro Swiss Franc, February 22(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound has made good gains against the Swiss Franc this morning with rates for GBP CHF now sitting at 1.2650 for this pair. The pound seems to have found support as the Brexit bill is still expected to pass through the House of Lords next week when the bill comes under additional scrutiny. There is a...

Read More »FX Daily, February 21: Dollar Bounces Back

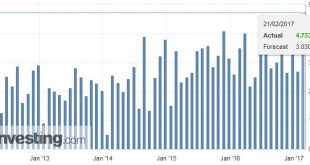

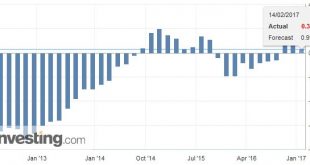

Swiss Franc Switzerland Trade Balance, Jan 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge GBP/CHF The pound to Swiss Franc rate has been in the main driven by sterling weakness which is weighing on the performance of the pound which has been in the main negative but we have lately seen the pound higher. This is mainly due to some clarity over the Brexit and just what...

Read More »Dollar Index: The Chart Everyone is Talking About

Summary: Many are discussing a possible head-and-shoulders pattern in the Dollar Index. We are skeptical as other technical signals do not confirm. We recognize scope for disappointment over the border tax and the next batch of employment data, but European politics is the present driver and may not be alleviated soon. Here is the chart nearly everyone is discussing. The Dollar Index appears to be carving...

Read More »FX Weekly Preview: Number One Rule of the Game is Stay in the Game

Summary: Light economic calendar in the week ahead, but anticipation of US tax reform may underpin dollar and equities. European politics are in flux (France, Italy, Greece) and this may see spreads widen over Germany. Russia’s outlook was upgraded by Moody’s before the weekend, and China has announced no coal imports this year from North Korea. Brazil is expected to cut Selic by 75 bps. The week ahead is...

Read More »The Consensus Narrative does not Appreciate the Resilience of the System

Summary: The system of checks and balances is working. Populism-nationalism is not sweeping across the world. Even in US and UK, populist agenda was appropriated by the main-center right party. The attack on the body politics is activating the immune system in ways that the consensus narrative does not recognize. The high level of anxiety among investors is masked by the rise of equities. As political issues...

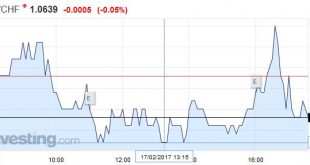

Read More »FX Daily, February 17: Greenback Stabilizes Ahead of the Weekend

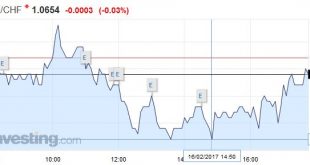

Swiss Franc EUR/CHF - Euro Swiss Franc, February 17(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is finishing the week on a steady to firmer note against the major currencies but the Japanese yen. The softer yields and weaker equity markets often are associated with a stronger yen. For the week as a whole, the dollar is mostly lower, though net-net it has held its own against sterling,...

Read More »FX Daily, February 16: Corrective Forces Emerge, Tempering the Dollar’s Rally

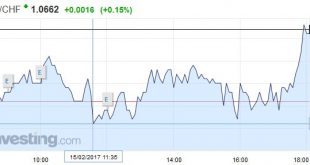

Swiss Franc EUR/CHF - Euro Swiss Franc, February 16(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF At the time of writing the pound is trading much closer to it’s annual low against the Swiss Franc than it’s annual high, and for reason for this can simply be put down to last years Brexit vote. We are now just weeks from the formal initiation of the Brexit process and interestingly the Pound is...

Read More »FX Daily, February 15: Yellen Helps the Dollar Extend Streak

Swiss Franc EUR/CHF - Euro Swiss Franc, February 15(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound to Swiss Franc exchange rate remains in a volatile position susceptible to risks of deterioration from outside global events. The Franc being a safe haven currency leaves it at the mercy of some international events which can cause a flight to safety as investors use the Franc’s stability and...

Read More »Greece and the Return of the Repressed

Summary: Don’t expect a deal between Greece and its official creditors until late spring or early summer. Grexit is still not a particularly likely scenario. It was the European governments not Greece which put other taxpayers’ skin in the game. Freud warned that unresolved psychological conflicts might be repressed but they keep returning. So too with Greece debt problems. A new crisis is at hand. Investor...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org