Swiss Franc The Euro has fallen by 0.19% at 1.1346 EUR/CHF and USD/CHF, March 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Brexit drama continues to play out, and the Withdrawal Bill that has been twice defeated is ironically not dead yet. Today’s vote, in fact, is predicated on another “meaningful vote” before seeking an extension. Sterling remains firm...

Read More »FX Daily, March 13: Still Waiting for Brexit Climax

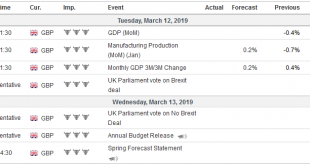

Swiss Franc The Euro has fallen by 0.04% at 1.1368 EUR/CHF and USD/CHF, March 13(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Brexit drama continues to command attention. A vote on leaving without an agreement will be held today, and if that fails, there will be a vote tomorrow on an extension. Meanwhile, the first increase in headline US CPI in four...

Read More »FX Daily, March 12: Wave of Optimism Sweeps through the Capital Markets

Swiss Franc The Euro has fallen by 0.03% at 1.1361 EUR/CHF and USD/CHF, March 12(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Last minutes statements meant to clarify what many MPs find to be the most odious part of the Withdrawal Bill, the backstop for the Irish border is goosed global equity markets even though it does not seem as if the Withdrawal Bill...

Read More »FX Daily, March 11: Greenback Starts New Week Decidedly Mixed, with Brexit Anxiety Weighing on Sterling

Swiss Franc The Euro has risen by 0.19% at 1.1347 EUR/CHF and USD/CHF, March 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asian shares recovered from opening losses to finish mostly higher, with the Shanghai Composite up nearly 2% and India tacking on 1% after the election was called, starting April 11. European markets, led by energy, communication, and...

Read More »FX Weekly Preview: Brexit Comes to a Head, and while Europe and US Data Rebound, the Equity Rally Falters

Brexit comes to a head. By nearly all reckoning, the Withdrawal Bill will be resoundingly defeated in the House of Commons on March 12. The margin of defeat may not match the first rejection, but it will be the death knell to the path that had been negotiated for a year and a half. On March 13, the House of Commons will vote on leaving the EU without a withdrawal agreement. Most, except the most extreme partisans, think...

Read More »FX Daily, March 08: Equities Slump on Growth Concerns ahead of US Jobs

Swiss Franc The Euro has fallen by 0.03% at 1.1313 EUR/CHF and USD/CHF, March 08(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A weak economic assessment in the Beige Book and an ECB that slashed growth forecasts have been followed by news of a nearly 21% slump in China’s exports have marked the end of the dramatic equity rally that was seen in the first...

Read More »FX Daily, March 07: EMU Looks to ECB

Swiss Franc The Euro has fallen by 0.31% at 1.1324 EUR/CHF and USD/CHF, March 07(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The ECB meeting is today’s highlight. A dovish signal is expected. The euro remains pinned near its lows ahead it. The global equity market rally in January and February is faltering this week. Asian equities were mixed, but the...

Read More »FX Daily, March 6: The Dollar Index Extends Gains into the Sixth Consecutive Session

Swiss Franc The Euro has risen by 0.02% at 1.1353 EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are on edge. The week’s big events lie ahead. The Bank of Canada meets today and the ECB tomorrow, followed by US (and Canada) employment data on Friday. The equity markets are mixed. While Japan and Korean equities...

Read More »Thoughts about the ECB and Euro

Mario Draghi’s term at the helm of the ECB is winding down. He will step down in October. It has not been an easy job. The light at the end of the tunnel in 2017 turned out to be another train in 2018. The eurozone enjoyed 0.7% quarterly growth every quarter in 2017. The ECB was able to outline an exit from its asset purchases. The debate began over sequencing and when the first rate hike could be delivered. But alas,...

Read More »FX Daily, March 05: Dollar Remains Firms as China Cuts Growth Target and Taxes, while EMU PMI Surprises on Upside

Swiss Franc The Euro has risen by 0.04% at 1.1328 EUR/CHF and USD/CHF, March 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is an eventful day, but the capital markets are taking it in stride. Equity markets are mixed. Asia may have been weighed down by China’s shaving its growth target and announced around CNY2 trillion (~$300 bln) in tax cuts to support...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org