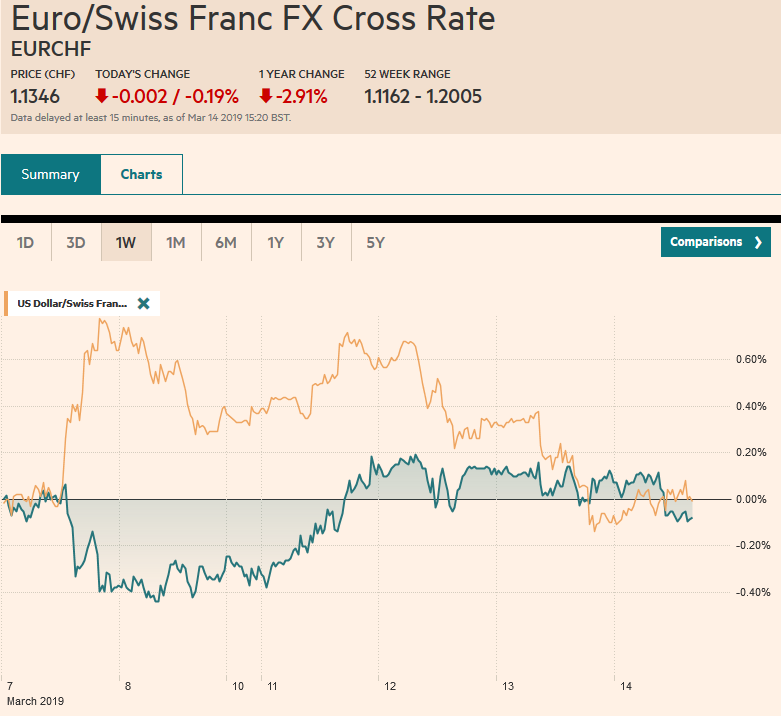

Swiss Franc The Euro has fallen by 0.19% at 1.1346 EUR/CHF and USD/CHF, March 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Brexit drama continues to play out, and the Withdrawal Bill that has been twice defeated is ironically not dead yet. Today’s vote, in fact, is predicated on another “meaningful vote” before seeking an extension. Sterling remains firm near yesterday’s highs, which were the best levels since last June. Poor Chinese data was a drag on Asian equities, where the Shanghai Composite fell by more than 1% for the second consecutive session. European shares are holding in better, with around a 0.25% gain through the morning, led by energy.

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, MXN, newsletter, SPX, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.19% at 1.1346 |

EUR/CHF and USD/CHF, March 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

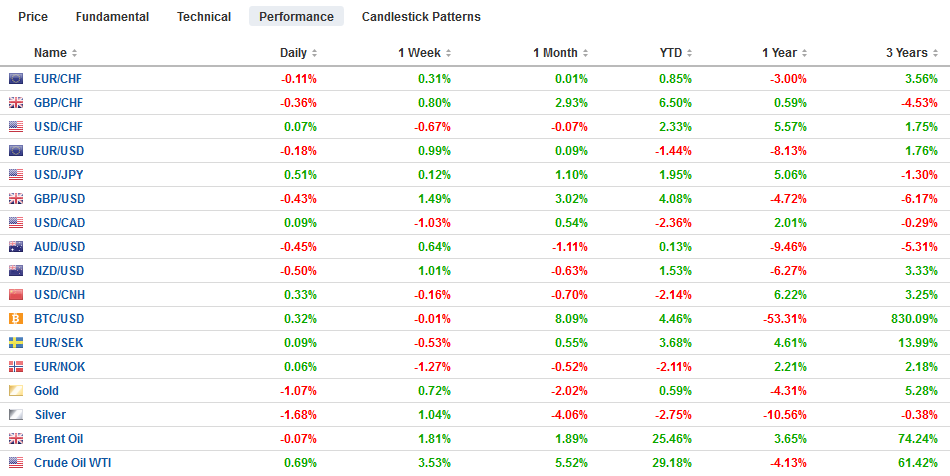

FX RatesOverview: The Brexit drama continues to play out, and the Withdrawal Bill that has been twice defeated is ironically not dead yet. Today’s vote, in fact, is predicated on another “meaningful vote” before seeking an extension. Sterling remains firm near yesterday’s highs, which were the best levels since last June. Poor Chinese data was a drag on Asian equities, where the Shanghai Composite fell by more than 1% for the second consecutive session. European shares are holding in better, with around a 0.25% gain through the morning, led by energy. The disruption of supply from Venezuela, talk OPEC+ may extend output cuts, and a large drawdown in the US inventories have lifted oil prices to new highs for the year (~$68 a barrel for Brent and about $58.5 a barrel of WTI, front-month futures). After falling every day last week, the S&P 500 is taking a three-day rally into today’s session. Core benchmark 10-year yields are a little firmer, though the yield on 10-year Gilts jumped more than four basis points. Peripheral yields are a little softer. The dollar is firmer against all the major currencies near midday in Europe. The yen is experiencing its biggest loss in a couple of weeks (~-0.45%) ahead of what is expected to be a dovish hold by the BOJ tomorrow. The weak Chinese data weighed on the Antipodean currencies. |

FX Performance, March 14 |

Asia Pacific

The weakness of the Chinese economy, which has prompted a government campaign to reverse it, and the distortions caused by the Lunar New Year make it difficult to read too much into the latest data. Industrial output slows to 5.3% from 6.0% in January. Economists expected a 5.6% gain. Retail sales slowed to an 8.2% gain, the slowest since 2012. It was in line with expectations but contrasts with the 9.0% rise in January. Registered unemployment rose to a two-year high of 5.3% from 4.9%. Investment was the exception. It sequentially improved. Fixed asset investment rose to 6.1% from 5.9%, and property investment rose 11.6% after a 9.5% rise in January.

The Bank of Japan’s meeting concludes tomorrow. The focus has been on the central bank’s economic assessment. Recall that the Japanese economy contracted 0.7% in Q3 and expanded by 0.3% in Q4. The first quarter is off to a weak start. The BOJ may downgrade its assessment of output and exports. However, it is unlikely to announce fresh policy initiatives. The hike in the sales tax set for October 1 and Prime Minister Abe ran his last campaign defending it against an opposition that wanted to postpone it again or cancel it outright. The political hurdles are high.

The Indian rupee is slightly softer today, but it is stronger for the fifth consecutive week. Late yesterday, the central bank announced plans to hold a three-year auction for $5 bln swaps. The ostensible goal is to provide longer-term liquidity to the banks, but some suspect it is also a preemptive move as inflows into India may be expected around the election that begins next month. Inflows into Indian stocks so far here in Q1 are running a little over $4 bln, surpassing both South Korea and Taiwan.

The dollar, which was testing JPY111.00 yesterday is near JPY111.70, session highs near midday in Europe. The intraday technicals are stretched, suggesting that North American dealers may not be inclined to push it much higher. The dollar has traded above JPY112 a couple of times earlier this month but has been unable to close above it since December 19. The Australian dollar is being turned back from $0.7100, which also houses the 20-day moving average. Initial support is seen in the $0.7040-$0.7050 area, but the $0.7000, that was approached last week, and may have benefitted from an option defense, is critical to the medium-term outlook. The US dollar initially tested the CNY6.70 level before bouncing to CNY6.7180, which corresponds to the 20-day moving average. This week and last week’s highs were seen closer to CNY6.7270, which at the time, also matched the 20-day moving average. This area may continue to cap the dollar’s upside.

Europe

There are three numbers from the UK yesterday that may help capture this surreal moment. First, 278 members of the House of Commons voted to leave the EU yesterday without a deal and without assurances of a delay. Second, 164 members voted to Malthouse Amendment that would have sought a two-month delay to prepare for leaving without a deal. Third, despite the mess of things, the latest poll of voter intentions show the main opposition party cannot get out of its own way. The Tories are at 41% and Labour at 31%. The Liberal Democrat support is seen at 8%, and the Greens and UKIP are polling around 6%.

Prime Minister May has argued that only three options: the negotiated plan, no-deal, and no-exit. Her brinkmanship strategy is still playing out. Despite how it may appear after the votes of the past two days, all three options remain. The perceived reduced chance of leaving without an agreement has helped lift sterling. The bill today assumes that there will be at least another vote on the twice-defeated Withdrawal Bill next week. If it passes, May is prepared to ask for a short extension to pass the appropriate legislation. If it does not pass by the eve of the EU summit on (March 20), the EU would determine the length of the delay. EU President Tusk is pressing for a long extension. The idea that a delay can turn into a reversal is being played up, and those like the Mayor of London calling for revoking Article 50 provide fodder for such arguments. May’s brinkmanship tactics are spurring speculation that the Democratic Unionist Party (DUP) and part of the Brexiter’s ERG could be persuaded to endorse the Withdrawl Bill in exchange for some political chit, like the resignation of the Prime Minister.

The euro poked through the 61.8% retracement of this month’s decline yesterday that was found just above $1.1325. The euro held above it for most of the Asian session before easing in the European morning. Narrow ranges persist as the single currency has been confined to a quarter of a cent. There are roughly 740 mln euros struck at $1.1285 that expire today and another 1.1 bln euro option at $1.1250 that rolls off too. The euro’s four-day rally is at risk. In contrast, sterling’s range today is already a cent. It is consolidating within yesterday’s range. Yesterday’s high was set near $1.3380. Today’s low has been $1.3240. There is a nearly GBP300 mln option at $1.3250 that gets cut today. There is another option for closer to GBP200 mln at $1.3200, for which the intraday technicals do no seem to rule out a test.

America

Both the US PPI and CPI reports this week have been soft. Many say that this reinforces the Fed’s patience. Yet the Fed and investors appear to be looking past Q1 data. Yes, it is soft. The combination of the government shutdown, the cold weather, and what seems to be some sort of seasonal pattern since the Great Finance Crisis of weak Q1 growth. Investors still seem to be impressed with the underlying resilience of the economy. Today, the US reports import/export prices, weekly jobless claim, and new home sales. These reports are not what typically moves the foreign exchange market.

When the stock markets were selling off at the end of 2018, President Trump expressed some sense of urgency to strike a deal. Yesterday, he indicated he was not in a hurry. It is not clear whether this is part of the negotiations. Two things do seem clear. First, the two presidents will not be meeting later this month. Next month as the soonest, but it does not sound close to being a lock. Second, the tariffs remain in place. The softer core US inflation readings partly reflect to decline in food prices, which had been targeted by retaliatory tariffs.

The Canadian dollar’s four-day rally may end today. Before the contrasting employment reports last week, the US dollar was near CAD1.3450-CAD1.3460. It dipped a little below CAD1.3290, where bids were found in the European morning. Initial resistance is seen near CAD1.3350 now. Mexico reported stronger than expected January industrial production yesterday (0.6% vs. 0.1% median forecasts). The peso did not draw much comfort. The US dollar continues to trade at the lower end of Tuesday’s range, where the lower end is seen near MXN19.24. Initial resistance is pegged near MXN19.35. The S&P 500 reached a four-month high yesterday. It has advanced for the last three sessions after falling all five last week.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,Featured,MXN,newsletter,SPX