The week ahead is likely to provide some clarification for investors on three fronts that have been a source of uncertainty. The FOMC meeting, with updated forecasts, is center stage. The credit markets are pushing the Fed to be aggressive but can be disappointed. In the eurozone, the preliminary PMI may confirm a modest, even if uneven recovery. The G20 summit is the focus of much attention as many see it as the last...

Read More »FX Daily, May 29: Equity Slump Deepens while Yields Plunge

Swiss Franc The Euro has fallen by 0.20% at 1.1222 EUR/CHF and USD/CHF, May 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The slump in equities continues after the poor showing in the US yesterday. Nearly all bourses in Asia Pacific and Europe are lower. Indonesia is the notable exception as domestic operators re-position after the election. Foreign investors...

Read More »FX Daily, May 23: Trade, Brexit, and Disappointing Flash PMIs Weigh on Global Markets

Swiss Franc The Euro has fallen by 0.43% at 1.121 EUR/CHF and USD/CHF, May 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The deterioration of the investment climate is spurring the sales of stocks and the buying of bonds. The dollar is firm. China and the US appear to be digging as if the trade tensions will remain for some time and the breech is beginning...

Read More »FX Daily, April 30: Dollar Pares more Gains as EMU GDP Surprise

Swiss Franc The Euro has risen by 0.31% at 1.1437 EUR/CHF and USD/CHF, April 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 set a new record high and close yesterday, but the lift to global markets was not strong enough to overcome the disappointing Chinese PMI. Although Chinese equities traded higher on ideas that the news will spur additional...

Read More »FX Daily, April 01: China Reanimates the Animal Spirits, While Europe Finds New Ways to Disappoint

Swiss Franc The Euro has risen by 0.20% at 1.1188 EUR/CHF and USD/CHF, April 01(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Better than expected German retail sales ad employments reports at the end of last week has been followed by gains in China’s official PMI and Caixin’s manufacturing reading. However, the spillover from China was limited in Asia....

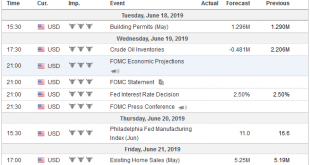

Read More »FX Weekly Preview: Three Highlights in the Week Ahead

Three events next week will shape the investment climate. The Federal Reserve meets and will update its forecasts and guidance. The British House of Commons may vote for a third time on the Withdrawal Bill before Prime Minister May heads of the EU Summit to ask for an extension of the UK leaving the EU. The eurozone sees the flash March PMI, with great hope that the green shoots of spring will be evident. There is...

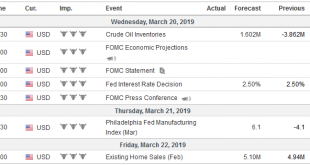

Read More »FX Weekly Preview: Little Resolution in the Week Ahead

According to legend, the person who unraveled the Gordian Knot would rule the world. No one succeeded until Alexandar the Great took his mighty sword and sliced the knot in half. A young boy saw him afterward, crying on the steps of the Temple of Apollo. “Why are you crying?” the boy asked, “you just conquered the world. “Yes'” Alexander wept, ” now there is nothing else for me to do.” Investors are not as cursed as...

Read More »Great Graphic: EMU Inflation Not Making it Easy for ECB

The Reserve Bank of New Zealand is credited with being the first central bank to adopt a formal inflation target. Following last year’s election, the central bank’s mandate has been modified to include full employment. To be sure this was a political decision, and one that initially saw the New Zealand dollar retreat. The dual mandate that originated with the Fed has been questioned in the US, but Congress has shown...

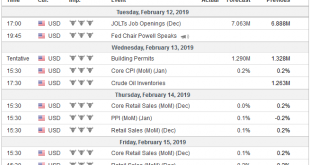

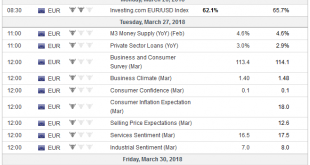

Read More »FX Weekly Preview: The Investment Climate

Eurozone The investment meme of a synchronized global upturn has been undermined by the recent string of US and European economic data. The flash March eurozone composite reading fell to 55.3, the lowest reading since January 2017. Although Q4 17 US GDP may be revised higher (toward 2.8% from 2.5%) mostly due to greater inventory accumulation, the curse of weak Q1 GDP appears to be showing its hand again, with...

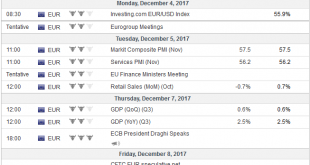

Read More »FX Weekly Preview: Politics may Continue to Overshadow Economics

The new monthly cycle of high frequency economic data has begun. The manufacturing PMI shows the synchronized global recovery is continuing. The service sector and composite PMI will be reported in the week ahead. They are unlikely altering the general expectation for robust growth in Q4. Even the disappointing US auto sales (17.35 mln seasonally-adjusted annual pace vs. expectations for 17.5 mln and 18.0 mln in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org