Swiss Franc The Euro has fallen by 0.29% to 1.0566 EUR/CHF and USD/CHF, April 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is no reprieve for investors. Equities are falling sharply. Nearly all the Asia Pacific markets slumped but Australia. Chinese markets fared better than most, but the Nikkei was off 4.5%, and India was down almost as much in late dealings. Europe’s Dow Jones Stoxx 600 is off more...

Read More »FX Daily, March 30: Monday Blues

Swiss Franc The Euro has fallen by 0.36% to 1.0553 EUR/CHF and USD/CHF, March 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites remain in check as the spread of the coronavirus is leading to more and longer shutdowns. Asia Pacific equities fell with Australia, the notable exception. Its benchmark rallied a record 7%, encouraged by additional stimulus measures. Led by financials, following new...

Read More »FX Daily, February 21: Covid-19 Contagion Outside China Keeps Investors on the Defensive

Swiss Franc The Euro has risen by 0.02% to 1.061 EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft..com - Click to enlarge FX Rates Overview: The spread of Covid-19 outside of China and early signs of the economic consequences again emerged to weigh on investor sentiment. Poor Japanese and Australian preliminary February PMI reports and some trade indications from South Korea saw most Asia Pacific equities sell-off. ...

Read More »FX Daily, February 7: Dollar Rides High as Eurozone Disappoints, and Caution Sets In

Swiss Franc The Euro has fallen by 0.07% to 1.0692 EUR/CHF and USD/CHF, February 7(see more posts on EUR/CHF, USD/CHF, ) Source: makets.ft.com - Click to enlarge FX Rates Overview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the...

Read More »FX Daily, February 3: Inauspicious Start to the Year of the (Flying) Rat

Overview: The Year of the Rat is off to an inauspicious start as apparently a fly rat (a bat) virus has jumped to humans. China’s markets re-opening amid much fanfare, and the Shanghai Composite dropped 7.7%, which is about what the futures in Singapore had anticipated. Several other markets in the region (Japan’s Nikkei, Australia, Singapore, Taiwan, and Thailand) fell by more than 1%. However, European and US shares are edging higher, and other measures of...

Read More »FX Daily, January 31: Stocks Finishing on Poor Note, while the Dollar and Bonds Firm

Swiss Franc The Euro has fallen by 0.09% to 1.0681 EUR/CHF and USD/CHF, January 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It was as if the World Health Organization’s recognition of that the new coronavirus is an international health emergency was the catalyst that the markets needed. US equities recovered smartly and managed to close higher on the session. However, the coattails were short, and...

Read More »FX Weekly Preview: The Week Ahead and Why the FOMC Meeting may not be the Most Interesting

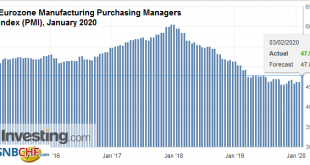

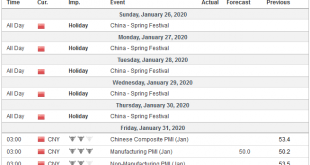

The week ahead is arguably the most important here at the start of 2020. The Federal Reserve and the Bank of England meet. The US and the eurozone report initial estimates of Q4 19 GDP. The eurozone also reports its preliminary estimate of January CPI. China returns from the extended Lunar New Year celebration and reports its official PMI. Japan will report December retail sales and industrial production. These data points will provide insight into the state of the...

Read More »FX Daily, January 24: Coronavirus Hits Asia Hardest, Europe and the US Resilient

Swiss Franc The Euro has fallen by 0.04% to 1.0702 EUR/CHF and USD/CHF, January 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new coronavirus in China has moved into the vacuum left by the US-China trade agreement and clear indications that the Bank of Japan, the European Central Bank, and the Federal Reserve are on hold as investors searched for new drivers. The World Health Organization refrained from...

Read More »FX Daily, January 10: Jobs Friday: Asymmetrical Risks?

Swiss Franc The Euro has risen by 0.06% to 1.0813 EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The first full week of 2020 is ending on a quiet note, pending the often volatile US jobs report. New record highs US equities on the back of easing geopolitical anxiety is a reflection of greater risk appetite that is evident across the capital markets. Asia Pacific equities mostly...

Read More »FX Daily, January 7: Geopolitical Angst Eases, Helps Equities and Underpins the Greenback

Swiss Franc The Euro has fallen by 0.10% to 1.0827 EUR/CHF and USD/CHF, January 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Without fresh escalation, investors cannot maintain a heightened sense of geopolitical anxiety. The recovery of US shares yesterday set the tone for today’s rebound in Asia and Europe. All the equity markets in the Asia Pacific region rallied today, led by a 1.6% rally in Japan and a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org